October 2, 2021

Time of writing: 2 pm 10/01/21Hello October! How's your September? Fruitful? Or with huge loss profits?

There were negative things that happened in September, the market dumps, FUDs circulated in the crypto-verse, sudden bugs in readcash, zero heart value on noisecash, and impractical actions that led to BCH losses in SEP20 tokens investments, and abrupt decisions related to crypto stuff.

However, despite having some losses, my passive income in DeFi investment didn't stop adding small amounts to my crypto portfolio. My profits may not be as big as other crypto investors here, but at least I'm gaining small amounts, better than letting my assets sleep in my crypto wallets.

In the world of investing, what we should think about are ways on how to grow our portfolio so it won't be stagnant. Some actions may be risky, but if you aim for higher returns, better take the risks while applying due diligence. Staying in this crypto-verse is risky anyway. So why not take it and make it worth it.

If you want to know my earnings last August, you can check this article below.

Harvesting The Fruits Of Augustus

Another month, another tallying, recording and updating crypto portfolio. Thanks to readcash for allowing us to record our investment and profits so we could easily track our growth.

Nexo Profit

My Nexo profit is not as big as PV 🤭 but it is better than not earning anything. For this month, I only accumulated more than $3 worth of BCH and ETH. If I did not transfer my assets to Fixed Terms last July, I should be receiving more or less $5 per week by now. But no worries, I just need to hold my assets longer on Nexo so I could accumulate more.

Probably many of you here are already compounding on Nexo. For those who are still looking for a platform where you can compound your Bitcoin Cash, Nexo is a good one. You can check the link given above to check on Nexo. By holding your assets in a compounding wallet, your assets are eligible to accrue 5-12% daily interest. And the longer you hold, the higher the returns.

But this isn't financial advice. You are accountable for your actions. So better conduct due diligence and DYOR before investing on any platform. If you want to know more about Nexo compounding, you can check this article below.

Earn While You Sleep With Crypto Compounding

PancakeSwap Auto Staking

The Auto Cake staking on PancakeSwap is giving me 74% APY, thus, earning 0.15% daily interest from it. That is equivalent to more or less $0.50 daily or $15 monthly.

Since it is auto compounding, I just let my interest earn more interest and I am not harvesting them. From 3.34343 CAKE profit in the last day of August, it became 4.12668 as of October 1. So this month's profit is 0.78325 CAKE or $14.8+ based on the $19.18 current price of CAKE

You can check these articles for more info about PancakeSwap Staking/Farming and the risks in DeFi Yield Farming.

Adding Assets To Liquidity Pool Again And Trying The CAKE Auto Pool

My First Time Yield Farming On PancakeSwap And Things You Should Know About Yield Farming

CubFinance

CubFinance offers its users to earn more CUB on staking on the Dens, Farming, and the new Kingdom compounding.

CUBFinance Farming

The old V1 liquidity on CubFinance farming ended on September 21 and I wasn't aware of it. Only last 26th of September when I checked my CubFi account. And I was surprised to see that my LP for CUB/BUSD has already ended. My LP tokens gained 12.922 CUB from September 1-21.

However, upon checking the CubFi Farm, I saw the LP pool for CUB/BUSD and I got confused at first. I thought I needed to remove my LP and restake them in the pool, so I did it, and it cost me almost $1 BNB for the fee for removing, adding, and supplying LP. Unfortunately, it was a useless move. Because when I was about to restake my new LP tokens, it was recommending to get LP tokens using the new V2 liquidity which can be found on PancakeSwap, not CubFinance itself.

After adding 63.228 LP on PancakeSwap, I stake it back on CubFinance which cost me another dollar for the fee. And from September 26-30, I accumulated 2.87 profit from it.

So the total CUB I earned in CubFinance Farming is 15.791 CUB or $6+. Better than nothing.

Only this Friday when I learned about an easy way on how to migrate from V1 to V2 liquidity without spending too much on the fee. You can check this link below.

https://docs.cubdefi.com/how-to-migrate

CubFinance Kingdom

The kingdom of CubFinance is giving me 0.14% daily interest on the CUB I staked on it and its auto compounding. From 80.52 CUB last month, it became 102.22, thus giving me 21.7 CUB profit from it, or $8+ based on its current price which is $0.41.

For more info about earning passive income amid the market crash, you can check these articles below.

Ways You Can Do To Grow Your Bitcoin Cash

Earn Passive Income Amid Market Crash

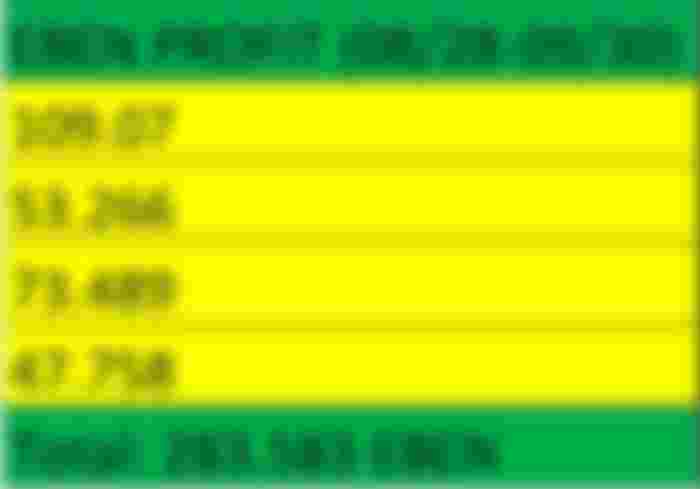

BenSwap (SmartBCH) Staking and Trading

This new DEX of SmartBCH is giving me a passive income in EBEN and WBCH staking on the pool.

I mentioned in my previous article that I accumulated 283.583 EBEN on staking, excluding the ones I lost (92 EBEN) due to abrupt decisions caused by some FUDs. It should be more or less 400 EBEN by now if I did not lose some.

Currently, I am staking 0.6 WBCH with 5.91% APR or 0.02% daily interest.

And 1,414 327 staked EBEN with 185.34% APR or 0.51% daily interest.

BenSwap trading also gave me some profit.

I was able to buy 30K+ CATS during the dump (2.9 BCH per 1M CATS) and I already gained profit from it because, at the time of writing, the price went up to 3+BCH per 1M CATS.

From 10K AXIEBCH, I was able to accumulate 1871.96 AXIEBCH in trading (sell high/buy low).

The creator of the KTH token has conducted a drop for LP providers. I took the chance to get some KTH from it so I added KTH/BCH LP on the BenSwap pool and because of that, I have 0.40% shares from the pool that will be distributed weekly.

From 20K KTH, I now have 23,121.50 KTH and I am still eligible for weekly rewards even though I pulled out my LP tokens already because I don't want my BCH to decrease due to impermanent loss.

To know more about SmartBCH and BenSwap, you can check this article below.

Diving Into The Sphere Of SmartBCH, Trying The Benswap Pool

For the SEP20 Tokens, you can check this article.

SmartBCH SEP20 Tokens You Shouldn't Miss

Binance

Earning some crypto on Binance through putting my assets on Savings account, BNB Vault, Staking, and Trading.

So currently, this is my total balance on Binance. It is fluctuating of course due to the volatility of the market.

Publishox

I became inactive on Publish0x due to busyness at work and too many things to deal with in the crypto world. But still posting though if I have spare time. Unfortunately, the tipping pool of P0x decreases and I barely earn more than $0.50 per article.

For this month, I only got $4+ earnings on P0x. So I better be active on readcash and noisecash. The earnings are way too different.

LeoFinance and Hive have been eliminated from my list since I can't handle too much stuff anymore. But I didn't touch my earnings there as I didn't know how to withdraw them. And the last time I tried to log in to my account, it said my password was incorrect and I don't have time to retrieve it.

Readcash and Noisecash

And of course, readcash and noisecash earnings this month were higher than last month and it was unexpected since I had zero heart value for a few days and some readcash upvotes decreased as well.

All in all, it was a fruitful September despite the negative things that happened in the crypto-verse. And let's all hope that October would be better.

Thanks for reading 😘.

Fue un excelente mes para ti.

Estas en varias plataformas y haciendo varias inversiones. Se nota que algo sabes de todo eso y has sabido sacarle provecho. todo esfuerzo merece su recompensa.

Felicidades y que tengas un excelente octubre.