June 1, 2022

May was down, but I am still UP, and trying to be optimistic even though I got huge losses in my investments due to this recent sudden market crash, lack of time in monitoring my investments, and wrong decision makings. The alarming bear has shaken me up and made me worry if my investment will still be recovered. Yet, I just let it pass like how the market trends continue, albeit volatile because it will only stress me out.

As usual, the opportunities in the Cryptoverse that keeps adding digits to my portfolio include:

Trading/NFT

DeFi Staking/Farming

Blogging

TRADING

After trading some $JOY last April, it wasn't followed by other trades anymore as I got demotivated by the market. It was actually a wrong move again as I should have sold my assets before the crash and then buy more at very low prices. Again, regrets always happen in the end. But recently, after seeing the CLY price crashing, I opted to sell all my CLY tokens in my wallet to avoid further losses. The profit may be small, but better than getting nothing at all or losing my initial investment in this token.

Yet, I was still able to get a small profit from selling NFTs and it was already a good one. It wasn't that big, but better than nothing, especially since it's quite tough to sell NFTs nowadays. Some of my NFTs listed on Oasis are still unsold and it's still uncertain if they will be sold or not because people seem to avoid NFT trading nowadays. So I probably need to lower the selling prices to be able to sell them.

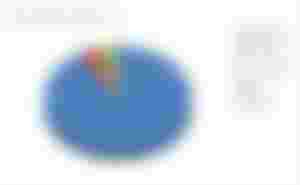

So for this month of May, the 4% shares came from my trading profit.

SMARTBCH

Out of 11 DeFi platforms I invested in SmartBCH, I only harvested some profit from 3 platforms since the majority are considered loss of investment due to drastic drops in tokens' prices. And even if I sell all my rewards, they are still not enough to compensate for the losses. And for others like MistSwap, CELERY, and TangoSwap, I opted to just hold my staked tokens on these DEXs until the time that I want to pull them out for trading. Tropical Finance, DexSmart, MuesliSwap, 1BCH, and EmberSwap are all investment losses.

So my profits in SmartBCH came from Benswap, BlockNG, and BCHPAD. The highest percentage came from BlockNG, followed by BenSwap and BCHPAD and I'm keeping tokens of these platforms for the long term. Overall, my SmartBCH investments added 4% profit to my May portfolio.

BSC/NEXO

My staked $CAKE on PancakeSwap was moved to the CubDefi Kingdom as the Auto CAKE Pool Staking ended and it was replaced by Flexible and Lock APY Pool with lower APYs. Meanwhile, the CubDefi Kingdom CAKE Pool has an enormous APY of 8760% and I'm earning 1.23% shares from my staked tokens daily. My $CUB tokens, on the other hand, are earning decent APYs from both Farm and Kingdom CUB Pool.

Meanwhile, on NEXO, my BCH and ETH are earning a small profit monthly. So this month, Nexo and BSC added 2% shares to my May portfolio.

For GameFi, I stopped playing Pandaland and I just opted to list my Panda NFTs on Oasis and one of them was already sold. The more than 3000 PDA rewards I got from playing Pandaland are still unsold and I'm waiting for the price to rise a little bit higher since it is volatile and I'm seeing an upward trend at the time of writing. Meanwhile, on Pegaxy, I just let my scholars race my pegaxies and I don't care about the rewards from this game anymore.

BLOGGING

My side hustles in blogging always got the highest percentage in my monthly profit. The crypto market crash was still a blessing in disguise as I accumulated higher rewards from both noise/readcash compared to the previous month. Unexpectedly, my profit on readcash alone crossed over one BCH and if added with my noisecash rewards, it will be worth around seventy-five percent of two BCH. So no matter what happens to the market, we are still gainers here. Let's just hope for BCH to pump higher and cross over two hundred dollars again or even higher.

Meanwhile, on the Hive platform, the HIVE price dropped as well to more than 50% from its ATH. Albeit, my rewards were higher compared to the previous month. I was lucky as well to win some prizes from different challenges which added some amount to my monthly profit. Luckily, almost half of my rewards are paid in HBD stablecoin so it was not been affected by the crash and I also earned a little interest from putting my HBD into my savings account. Some HBD were converted to HIVE so I could participate in the Power Up challenge this first day of the month and earn interest from it as well. The rest will be withdrawn for trading purposes as I am planning to put them into something profitable and hoping to earn more profit from it so I could buy a DSLR camera soon🙂.

So 91% of my May portfolio came from my blogging income. The 58.9% came from readcash and noisecash, and the remaining from Hive.

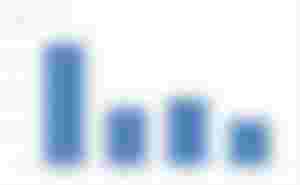

To sum up, my profit compared to the previous month has a 33% drop because of the sudden market crash. All prices of my investments dropped and so as the value of my monthly revenue.

My monthly income graph is as volatile as the crypto market, lol. Nonetheless, profit is still profit and I'll keep them until the market recovers.

Let's just hope for a better June and more green market to come.

Follow me on:

First of all? Ateeeee! Ang ganda ng pa-banner mo uy. Bet ba bet ko~ minimalist pero ah basta! 😍

Next? Well, di na ako shock sa earning mo sa crypto-verse. Sanay na iz me pero nakakabilib and inspire pa din. Well, di na yata mawawala sa'ken yan. Hihi