It is not new knowledge that many people in this world experience financial incapacity. Poverty, inadequate income sources, insifficient food served on the table, inability to answer to the needs and wants. This holds true, especially to my fellow Filipinos.

I do not mean to offend my fellow kababayans here. I just want to spit some facts, and attempt to confirm, that, yes, something is wrong with poeple, that is why poverty enjoys its vacation here. This doesn't apply only to Filipinos, however. In all races, or nations, there is always gotta be some root cause for poverty. I think we can agree for one of the main reasons.

Lack of Financial Literacy

Investopedia defines Financial Literacy as:

"..the confluence of financial, credit, and debt management knowledge that is necessary to make financially responsible decisions—choices that are integral to our everyday lives. Financial literacy includes understanding how a checking account works, what using a credit card really means, and how to avoid debt."

In layman's terms, it is about responsible money management, making effective financial decisions, and finding ways that will strengthen wealth for long term benefits. Yes, you know how to read. In a general sense you are considered literate. However, in finance, how literate are you?

Financial literacy is just as important as the life lessons we hear from Mom ever since we are children. Sadly, this topic is rarely talked about. It is either stuff about financial literacy are:

Too boring;

Uses too many technical terms that only finance people could understand;

Induces anxiety when talked about;

Other reasons.

In school, financial management is not even a topic for general student classes. It is only for those who have finance or accounting related courses, etc. The result is this. People are not aware of possible ways to manage their finances, or some tips to increase their portfolio. They are not aware of some terms commonly used in the field. Diversification. Risks. Interest. Principal. Inflation. Time Deposits. Those words may not be still clear for some.

I do not intend to come up as a financial adviser here, okay? In fact, I am a whole noob in this thing, too. But I always try my best to research, so the knowledge I accumulated while I was still studying will be applied and put to good use. It is not until I came across this amazing book that I realized, I have been wasting my years, not even finding ways to earn, and save more. I am 21, but I can't still say confidently that I have achieved a massive financial freedom.

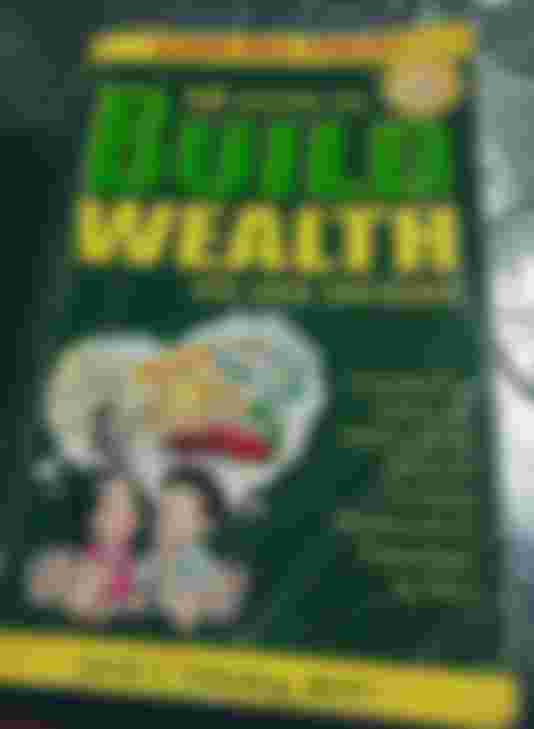

12 Steps to Build Wealth on Any Income

That is the title of this section. Just kidding. The heading above is the title of a book I recently read.

It is a Filipino book written by Alvin T. Tabañag, a personal money management coach and an RFP (or Registered Financial Planner). His book tackles about the wonders of financial freedom. Of what being rich really means. I learned a lot when I read this book. Who does not want to be rich? This question got into me, so I went straight into binge-reading the whole thing. It has some really good tips on saving. Encouraging words to keep. The best for starters like me. It is not yet too late to start working on our financial knowledge. In my next articles, I may talk about my learnings from this book.

To anyone out there who finds interest to work out his/her financial literacy, this is something I learned. Don't just lean on yourself. Experience is the best teacher, but it does entirely mean YOUR experiences all the time. Learn from others' mistakes. Be inspired by others' success.

Reading books like these is a great start. Invest with these kinds of books and continue sharpening your mind about the world of finance.

Benefits of Financial Literacy

Instead of talking about the disadvantages of lacking financial literacy, why don't we talk about the opposite's benefits? Reading across different sources helped me gather nice results that I will show to you.

It makes us alert and adept in dealing with unexpected financial setbacks. Let us take this pandemic for example. No one has predicted that we will experience the New Normal. No one expected the sudden outbreak that impacted the economy so much. So many businesses had to shut down. So many people had to guve up their jobs. What is that one thing that kept financially literate people afloat despite this? Savings. Investments. People like them know how to manage amidst trying times because they have knowledge about situations affecting finance.

It makes people become more aware and plan for their future. Financial literate people know how to think long term. How could I live comfortably when I grow old? Will I still be working at 60? With the fiat money decreasing value over time, is my $500 savings today still enough to sustain me when I retire? They ask these questions a lot. They make sure to answer these ones with solutions, organized execution as planned and analyzed.

It helps us achieve our goals. Do you have a dream vacation?A dream concert? Or practical things such as own house, or own car? We know we gotta have money to have those major goals. A financially-literate person lists these goals and saves up accordingly for this purpose. No more spending for unplanned expenditures, nor tempting online shopping deals.

Financial knowledge should be taught in schools as early as possible

I believe that it is a good thing to teach financial matters to children as soon as they gain awareness about handling money. The earlier the person is aquainted with financial knowledge, the better will be his/her preparedness for a future with absolute financial freedom.

I could attest to it, because I feel kinda sad I just discovered its importance recently. Maybe if I had gained some substantial financial literacy since then, I would have saved quite a lot today. I am still thankful though, it's not yet too late for me.

As for me, when I become a parent in the future, I would make it a goal to teach my child how to save as early as he/she can, and encourage him/her to achieve financial literacy that could help him/her have a secured future. It would be nice to teach the child not just how to read and write, but also to be more responsible even at a young age.

“I think if people truly understand the way that financial systems work at an early age, or even later on in life—if they’ve made poor decisions but learn how they can go back and fix them and start planning for the future—they can then encompass that and take the steps to make a better life for themselves.”

- Cherry Dale, Director of Financial Education, Virginia Credit Union

“Financial literacy is just as important in life as the other basics.” – John W. Rogers, Jr., CEO Ariel Capital Management

What is your take on financial literacy? Are you one of those lucky persons who had an understanding of it from a young age, or are you like me who is just starting to explore it? Feel free to discuss it with me in the comment section. I would love to know what your tips for me would be.

Until next time!

External Source/s:

❄️ Read next:

❄️ Surprise! My Article Promotion Segment is back! Please check out my recommended reads for today, I learned a lot from these articles. Will add more on my next articles, let me just catch up more on my unattended reads. :)

What are your daily routines? Something changed my life. by @Princessbusayo

Writing Prompt #6: Cheating by @JonicaBradley (Join this now!)

I earn BCH playing Rising Star! - Become a rock star, be famous!, I'll explain everything to you by @MicroReylatos

❄️ Thank you in advance for supporting me in my humble journey. My sponsor block is always welcoming of new people to fill it!

Come start writing and earning here, if you haven't yet!

I am also on noise.cash. Same username, let me know and let's talk there!

To God be all the glory.

Click photos for sources.

Lead Image Source.

...and you will also help the author collect more tips.

Since I started my job here in Manila, my boss is always teaching me how to plan long term, and having savings is the most important. She taught me how to manage my money so that I could still save even though I had many bills to pay. She said when you receive your salary, you should separate your savings immediately and the portion is 80-20. 80% is yours and 20% would be your savings. To keep it safe, deposit it directly to the bank. To avoid the temptation of withdrawing your savings, don't apply for an ATM card as much as possible, just put it all in a bank book.

She also told me a quote to remeber: "Don't let your lifestyle adjust your budget. Let your budget adjust your lifestyle".