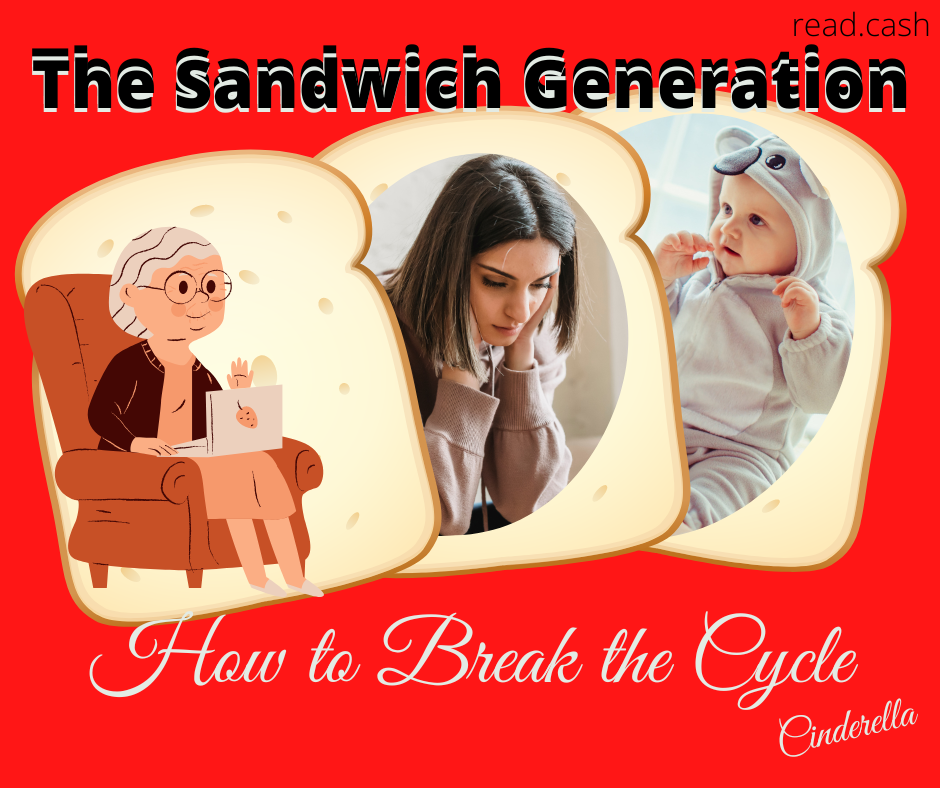

Sandwich Generation: How to Stop the Cycle?

We, Filipinos are known for having a strong and close family ties. This traditional Filipino value which has been handed down to us by our ancestors is what made us distinct from others. We regarded our families as the most essential part of our lives and we put it in the high pedestal above all other things. Looking at it, we can say that this family value should not be disregarded and must be handed down to our children and the generation to come.

Video Courtesy of YouTube

Your Children Are Not Your Investment

Though there is another practice among Filipino families that we need to reconsider. It is the belief of some parents that their children will lead them out of poverty and they will instill this at the mind of their children. This is one of the reasons why there are some individuals who would bear many children with a belief that they will take care of them when they grow old.

This is also the reason why parents would no longer think of saving for their retirement. Maybe not all but there are still a high number who are even coming to the point of obliging their children to support their subsistence.

If this will be the case, the children won’t be able to save for their future considering that they were tied up on an obligation. So the history repeats itself. We will then become part of…

The Sandwich Generation

Sandwich generation is a situation where a middle aged individual was caught between the two generations such as the generation of the parents and the children. When it has become obligatory on your part to support your family and siblings while trying to build your own finances and supporting your children, you belong to the sandwich generation.

Though there is no questioning the fact that without our parents, we won’t be where we are now. We don’t blame them for not being able to save enough amount for their old age. No, we don’t blame anybody here. What we want to imply is that while we have time, we need to do something for us to stop the same thing from happening.

I am from Gen X and I belong to the Sandwich generation. What could be more stressful than having to take care of your parents while trying to build your career and managing your own family?

I am an independent individual and at a young age I learned how to depend on myself alone in order to make a living. I finished my studies behind the expected age of graduation. This is because I can’t take a full load subjects since I need to support my studies.

I worked with several private companies before I was able to enter the government service. Perhaps due to hard work and dedication to my job, I got promoted twice in 2021. Ever since I started working in the government, I am already supporting my parents and siblings.

Oftentimes, I need to give up my own wants because I have to prioritize their needs. My children are still dependent on me and though they are already of legal age, they are still under my care.

My salary would be more than enough for me but because I have to support my parents and siblings, I need to do extra work. This is the reason why I spent the time I supposed to devote to resting to my online writing activities. I don’t want to waste my time. Every single second is important.

What Can We Do to Stop the Cycle

If this will be the situation in most families, the children won’t be able to save for their retirement and will soon rely on their children when they get old. The cycle will never end. This is one thing that I don’t want to happen. So this early I am doing everything to prepare for my old age.

With the new technology, it has never been easier for me to learn various ways of earning money apart from my salary. I make sure to allot my free time to find methods that will increase my current income.

Here are various ways that can help us in one way or another to help us become the last sandwich generation, if we are.

Insurance

While it may not be of help at current time, insurance can cushion the impact of any misfortune that might happen such as accident and sickness.

As government employee, we are required to have deduct mandatory contributions for retirement from our monthly salary. The good thing with having an employer is that you have the counterpart to your contributions. As of now the Government Service Insurance System is requiring the employees to have 6% of the salary and the employer, 9%. However, as I observed the current situation and the increasing inflation rate, I am not sure if the amount I would be receiving in the future would suffice to my needs. That is why it is imperative that we start establishing our retirement fund separate from the one mandated by the law.

There are many types of insurance that we can avail of but we can prioritize our health and start with having a health insurance. There are also life insurance plans for your retirement needs such as pension plans. We will discuss this topic in detail in my upcoming articles.

Live Frugally

Many people have a habit of spending on things we don’t really need. We usually get deceived by some marketing strategies which lead us to buying things that aren’t important. Learn to identify our priorities, our needs over wants.

Make Saving a Habit

In my previous article, I have pointed out the importance of savings even if we have a low income and the reason why we need to force ourselves to save. Saving is the first step to establishing a business and investment. We know that we need funds in order to implement these two.

Establish a Business While Still Young

Establishing a business is something that we should start while we are still actively employed. The common mistake with some is that they are starting to establish their business after retirement. It would be good if the business succeeded. But what if not and you invested your retirement fund?

Start Investing

Just like having a business, we should start investing while we have a regular source of income. We should slowly build our investment portfolio. This way, we are setting aside smaller funds which would lead to attaining a huge investment portfolio over time without hurting our current financial situation.

Train Your Children to be Independent

It’s not bad to spoil our children from time to time. As parent, we want the best for our children. But we should instill in their mind the importance of being independent and not relying on others.

Stop the Cycle

We can’t do anymore of what already happened. But we can do something with our future. We need to stop the cycle of sandwich generation.

Be the Last Sandwich Generation

Our current situation may have been because our previous generation has a few knowledge of what will happen in the future. But on our part, we all have the resources to learn and to avoid the same mistake from happening again.

How about you, do you belong to the sandwich generation?

Disclaimer:

The content of this post are not for promotional intent rather for informational purposes only and should not be considered as a financial advice. Similarly, the opinions I have shared are of my own and does not in any way represent the organization I am currently connected with.

Special Thanks:

I would like to extend my thanks to my sponsors. I wish you more success with read.cash and with other projects you currently have.

Lead Image Edited via Canva

Written for read.cash by Sharon S. Lopez (cinderella) June 16, 2022.

All rights reserved.

You provided a new and fresh concept like sandwich generation we should give equal rights to each member of family