Many DApps require reliable liquidity pools to support their operation. One of the most interesting innovations in the field of liquidity pools is called Balancer. If you haven’t heard of the Balancer, now is a good time to learn.

What is a Balancer?

Balancer is an unmanaged General Automated Market Maker (AMM) agreement. This introduction is indeed very lengthy, but it is easy to understand once you have analyzed it carefully. You may be familiar with the AMM exchange mode like Uniswap, but the difference of the Balancer is that its generalization makes it suitable for various needs, which will be detailed later.

Balancer pools are like self-balancing index funds.

Anyone can create a Balancer pool and add liquidity to the agreement. However, what makes the Balancer pool so unique is that it is not limited to the typical 50/50 split between two tokens we are used to. The Balancer pool supports up to 8 custom allocations of tokens. For example, one liquidity pool can be 30% WETH, 30% MKR and 30% USDC, 10% LINK, while another liquidity pool is 80% WETH and 20% DAI.

Balancer uses smart order routing to plan users' transactions into a liquidity pool that provides the best interest rate after the combination. In essence, the Balancer pool is like a self-balancing index fund, but it does not charge you, but actually pays you for contributing liquidity.

Different liquidity pools meet different needs

As mentioned earlier, the Balancer liquidity pool is highly flexible and can be optimized for specific use cases. Balancer Labs even released a template designed for the new liquidity pool. For example, Liquidity Bootstrapping Pools, the community can use it to establish deep liquidity for their tokens. Even, establish a stable coin pool with zero impermanent losses.

Governance token (BAL) of the Balancer protocol

When Balancer V1 was launched, there were no native tokens. This latest update of the Balancer introduces the governance token (BAL) of the Balancer protocol. The holder of BAL will decide the future of the Balancer agreement and make decisions similar to the implementation of new functions and potential agreement fees. It even decides on more ambitious plans, such as whether to use layer 2 extensions and whether to deploy contracts on other chains.

Out of a total of 100 million BAL tokens supplied, 25 million were initially allocated to founders, core developers, consultants and investors, and all have unlock periods. The remaining 75 million BAL tokens will be mainly distributed to users who provide liquidity to the Balancer pool. This process is called liquidity mining.

Liquidity mining-earn BAL based on liquidity pool returns

In order to keep protocols like the Balancer decentralized, the governance process also needs to be decentralized. And it only makes sense for those who use the protocol the most to gain the right to speak in the above process. This is precisely the purpose of the Balancer liquidity mining.

Every week, 145,000 BAL will be rewarded to users who have liquidity in the Balancer pool. This part totals 7.5 million BAL every year. The idea is to create a very attractive incentive mechanism for early adopters to increase their liquidity and participate in the governance process.

Earn BAL in addition to fund pool swap fees

Each balancer pool has its own custom pool swap fee; whenever someone uses the liquidity in the pool to execute a transaction, this fee is evenly distributed to the pool's liquidity provider. Therefore, when you provide liquidity, you not only earn this fee, but also BAL.

Liquidity mining encourages lowering the cost of liquidity pools

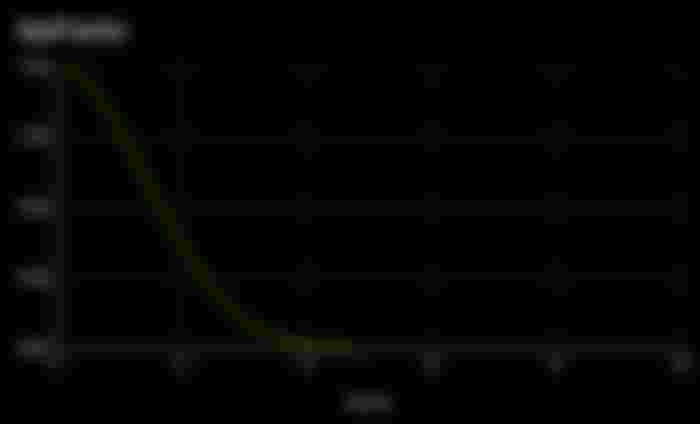

One of the coolest things about liquidity mining is that it is designed to incentivize liquidity pools to reduce transaction fees. According to CoinGecko, the dollar value of the base token of each liquidity pool multiplied by feeFactor will determine how much BAL the liquidity pool is eligible for.

It can be seen from the above figure that the higher the fee and the lower the feeFactor, the less BAL tokens the liquidity provider of the pool can receive each week. The logic is that the lower-cost liquidity pool has attracted more users who are willing to trade on the Balancer, so these liquidity pools should receive more rewards.

This is a serious business template