Zimbabwe is a country locked in the crossroads of a geostrategic position in Africa in a region containing vast resources with various forces trying to exploit them.

Zimbabwe’s economy suffers from multiple years of hyperinflation that led to the devastation of its economy.

It is a similar situation with Venezuela, another nation with extensive supplies of mineral wealth and oil. The geopolitical concerns in these countries are identical, and they both experience the same issues for more than a decade.

Lately, we read in the news that the government of Zimbabwe is seeking the crypto field and, in discussion with the private sector, is actively looking into the possibility of accepting cryptocurrencies.

The Zimbabwe government officially denounced such claims, though.

Source: Twitter

Zimbabwe is also planning to create a CBDC, a Central Bank-issued and controlled digital currency that will represent the digital form of the Zimbabwean dollar.

Of course, any denial doesn’t mean there is no consideration at all.

With this article, we are examining Bitcoin Cash as an alternative method of exchange, especially for an economy with the issues Zimbabwe has to face.

There are valid reasons that could significantly improve financial conditions in this devastated economy and create terms for stable and robust growth and an improvement of overall living conditions.

Catastrophic HyperInflation

This was the first google result when I search for the inflation level in Zimbabwe’s economy in 2008. I am not sure if the number of sextillions is ever used before and as human beings; I don’t think we can comprehend its magnitude.

We are incapable of understanding the magnitude of quadrillion or trillion either and 89 sextillion percent as inflation. Apparently, it means that money was completely worthless in this nation during that time.

This also explains the 100 trillion dollar bill introduced at the beginning of the century by the Zimbabwean Central Bank.

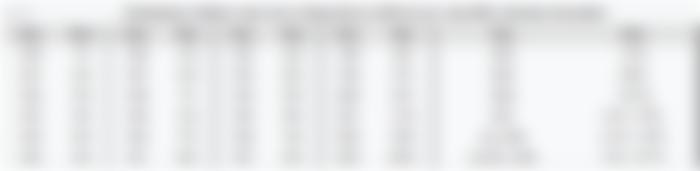

A table of inflation levels of Zimbabwe explains the excessive mismanagement, corruption, and violent redistribution of land tactics the Mugabe government forced and destroyed the economy of a previously economically flourishing nation.(Wikipedia).

At the peak of inflation in 2008, the prices were rising by 98% daily! And since these are the official numbers, probably the banknotes were valueless as the black market rates would be more realistic. Nobody wants to hold such fiat money.

Recent data from Zimbabwe inflation appear to give a lower inflation level than the issues we used to learn in the news, even so, the official announcements contain extremely high numbers.

Inflation rate compared to previous year

2021 99.25%

2020 557.21%

2019 255.29%

Source: Statista

There are fears of repeating this vicious cycle and entering hyperinflation zone once again despite the relative decreased inflation in 2021.

Why Bitcoin Cash?

Source: WhyBitcoinCash

Bitcoin Cash is possibly the only cryptocurrency that can serve commerce in this nation and create a barrier against corrupt forces that manipulate the national currency and hyper-inflate the economy.

The Zimbabwean dollar is volatile on its own, but only to the downside.

As we read from Statista, the population of Zimbabwe is trying to hold foreign fiat banknotes like the euro and dollar, but the most available one is the South African Rand. However, this currency also faces issues and keeps devaluing versus the dollar and the euro.

Euro and the dollar are not available to accommodate the needs of an economy outside their reach. There is limited trade that can’t create enough influx of these two most stable currencies and the government cannot trade Zimbabwean dollars at forex markets.

There is a need for a currency outside the bounds of the Zimbabwean economy. One currency that is not subject to government manipulation and corruption of officials.

Sound money is mandatory to fix the ailing economy and the financial issues of this government.

Bitcoin Cash is money for the world. It doesn’t have to take over completely the Zimbabwean fiat, but can be used in parallel and ease the inflation fears with its limited supply.

As we’ve seen, the population of Zimbabwe needs a currency that won’t lose value to the dollar and euro. Adopting Bitcoin Cash will be the answer.

It is easy to use and can create better terms for commerce and international trade. Bitcoin Cash scales to reach millions and later on billions of users.

Bitcoin Cash has all the positive features of cash and can become an integral currency, at least running in parallel to the Zimbabwean dollar for some of these reasons:

Extremely fast with 0-conf transactions. Takes only one second to transact.

Fees are less than one penny for each transaction.

Easy to use and adapt. Download a bitcoin cash wallet, preferably bitcoin.com, and scan a QR code for payment. User-friendly and simple, like a cash transaction with a cashless network.

Immune to inflation and geopolitical risks. Nothing can touch Bitcoin Cash, it is a universal decentralized network with a limited supply of 21m coins.

Can help combat inflation. Prices of goods may rise to a certain point depending on supply and demand, but with Bitcoin Cash, there are no hyperinflation fears since the money supply will always be fixed.

Bitcoin Cash will probably increase in price if it gets adopted massively inside any economy. This, in turn, will reduce further inflation in local currency terms, increase the wealth of the public and help increase spending and commerce nationwide.

Major trading partners can accept it as its value has been relatively stable, even for a cryptocurrency since its release.

It offers all the critical aspects of Bitcoin (decentralized, permissionless, and secure network) and adds scalability to accommodate millions of users.

Can achieve much-needed stability that would create favorable terms for robust economic growth. As Bitcoin Cash price keeps increasing, the wealth of the nation will do as well.

The GDP of Zimbabwe at $16,7Billion today and with a 14.8million population, the stats represent a poor country. 74% of the population lives with less than $5 daily, and mostly lives in rural areas.

If monetary stability is secured, Zimbabwe can begin rebuilding the fundamentals of its economy, increase infrastructure, and attract foreign capital. Zimbabwe could achieve this within a few years with a relatively lower inflation level that would not damage the economy and with fears of hyperinflation extinct.

This economy has potential for decades of growth and increase in GDP, with a reduction in poverty level and infrastructure growth that will promote industrialization.

In Conclusion

Source: Wikimedia Commons

This is also a situation that was frequently discussed with Bitcoin in the early days (until 2015) when it was still a P2P electronic cash network and looking forward to scaling and meeting mass adoption.

Bitcoin Cash is the upgrade that scaled Bitcoin and should be identified as a potential replacement or parallel solution to hyper-inflating economies such as Zimbabwe, Venezuela, Lebanon, and Turkey.

Bitcoin Cash is voluntarily in nature, it doesn’t represent a forceful monetary system. It should be taken into consideration together with the population of a country after educating the public and after finding overwhelming support. Because of its voluntary nature, individual merchants and consumers can adopt it with no government interference. Just an announcement that Bitcoin Cash is allowed is not enough, since the public is uneducated on the matter. There is a need for initiatives that will proceed with seminars that could just take one hour to explain what Bitcoin Cash is and how to use a mobile wallet.

Bitcoin Cash is a consensus-driven network with a common goal to be adopted as a global currency. It can also serve as an escape to diverse devastative economic effects. It will be up to the people of Zimbabwe, after a certain education on cryptocurrencies to acknowledge the positive effects and adopt it as a monetary network.

Bitcoin Cash has all the required features to stabilize an economy in need, but this can’t happen with force or coercion. The concept is about escaping the fiat currency calamities and entering a new world of economic independence that will reduce poverty and increase the wealth of the nations.

Lead Image Source: Wikimedia Commons (modified, cut), Licence

Follow me on: ● ReadCash ● NoiseCash ● Medium ● Hive ● Steemit ●Vocal ● Minds ● Twitter ● LinkedIn ● email

Don't forget to Subscribe and Like if you enjoyed this article!

My gosh. I knew Zimbabwe's economy was in the tank, but did not realize by how much. As for Venezuela, it still flabbergasts me that one person I talk to was in a professional job that paid just over $16 a month. Unheard of.

I do think that crypto has a great opportunity to offer more to certain economies. Sites like this can help in that way as it affords a means to earn something outside of traditional work.

I still think that it seems confusing to me how a simple currency necessarily changes the problem behind the poverty. One must still earn a currency in some way (aside from growth of the price of currency) in order to have it to conduct commerce.

I am not sure a currency alone can fix the problems that are the root cause of the economy or its performance. It's just money, regardless of what we call it, and like all money it must be earned in order to be traded for goods and services.

Perhaps I am simply confused.