I would like to start this article by saying that I do like Avalanche (AVAX), and the community has been loads of fun and inspiration. A little about myself, I am a peer to peer electronic cash enthusiast, occasional critic, and voluntaryist. I was a well known participant in AvalancheHub and even hold 1st place in reputation, I've done three community airdrops including a 250 AVAX airdrop, a 100 AVAX airdrop, and a 25 AVAX airdrop. I also created and maintain the second most popular Avalanche subreddit on reddit, r/Avalanche_. In the time I've been involved with Avalanche, I went from having under 150 followers on Twitter to having over 850, most of them being Avalanche fans, and this has been massively beneficial to my self-image and mental health. I value Avalanche both as a technology and a platform, and envision a future in which it earns a spot in the top 10 or even top 5 of all cryptocurrencies.

All that being said, there have been a few small shortcomings and disappointments in the platform for me, and they are sizable enough that I've reconsidered my place as being an Avalanche-only supporter, and now prioritize my time with Bitcoin Cash. I will discuss what I think these shortcomings are, and what would be necessary to change my mind. This isn't a goodbye to Avalanche, I still love Avalanche and plan on building on it (along with Bitcoin Cash), but it is me returning the majority of my efforts and energy to my home cryptocurrency, Bitcoin Cash. My mind can be changed, but there are objective requirements I perceive to be necessary in a cryptocurrency that I decided I will not compromise on. I hope that this post signals for the things that would be needed to improve Avalanche and make it something I could fully have faith in again, including having significantly lower fees, better decentralization, and more transparency on certain things.

What I Like About Avalanche

Avalanche is hands-down the best blockchain 3.0 platform, and is best fit as a competitor and/or a successor to Ethereum, being a robust DEFI platform. I don't think any of the other attempts at a robust blockchain 3.0 cryptocurrency come anywhere close. In my opinion it's better than Cardano, EOS, Polkadot, Cosmos, Solana, Near, and just about everything else. Its even a better design than Ethereum.

My favorite features would probably include subsecond finality as fast as 400 milliseconds, subnetworking capabilities with custom blockchains and virtual machines, and its ability to scale node count to what seems near-infinite levels. Its transactional throughput is also good. And of course its DEFI adoption is accelerating rapidly and making huge strides.

If I ever wanted to launch my own blockchain, it would probably be easiest to do on Avalanche as a subnetwork. In the unlikely event that I do, there's also tooling on Avalanche that allows for bridges to be created between two networks, opening many different possibilities.

I will briefly go over the different things I am excited for on Avalanche and why I joined in the first place.

A New Consensus Algorithm That Can Power Both High Scaling and High Decentralization

Avalanche consensus is a very creative solution to the double spend problem. It manages high efficiency by leveraging locally random subsampling, instead of every node trying to communicate directly with every node, or instead of nodes individually producing and broadcasting giant blocks. At 4500 tps per second and with almost 1000 validators, Avalanche is highly impressive from a technological point of view.

Avalanche is efficient enough that there is no technical ceiling as to how many fully-validating nodes there can be, and as long as the transaction figures aren't surpassed then small scale hardware like raspberry pies can participate in consensus. The former is a significant improvement upon the decentralization that can exist within a classical consensus protocol, and the latter appears to be a significant improvement on the scalability that can exist on a nakamoto consensus protocol.

Scaling and Innovation Through Subnets

Subnetworks are a novel concept that have been partially emulated on other platforms, but are only being brought fully to life on Avalanche. They essentially allow anyone to launch their own blockchain, with customizable features such as custom virtual machines, and utilize either the AVAX token, a custom token, or both.

Subnets offer an interesting solution to scalability, as there is no hard limit as to how many subnetworks there can be. Anyone can launch their own subnet for relatively cheap and without asking permission first, and this can easily offload transactional throughput. Its hard to say AVAX will ever have a true scaling ceiling if you can just always launch another subnet, which shares the characteristics of the parent chain. My only concern is these subnetworks struggling to achieve adoption fast enough to be useful for scaling, and not introduce too much complexity into the system that could cause bugs or problems.

Finally, its worth noting that subnetworks allow for a new precedent of interoperable experimentation and idea competition. For example, there can be multiple subnets implementing different and competing forms of sharding, or different privacy protocols, or different types of turing complete virtual machines. You don't have to own multiple coins with differing experimental values if you can have one coin that is usable across many different experimental chains.

Onboarding Mainstream Finance and Creating Better DEFI

Due to the high customizability of subnetworks, industry leaders with different kinds of usecases are able to launch both permissioned and partially federated subnetworks. This allows for regulatory-compliance as well as retaining control over a chain where your control is needed. This allows for many different kinds of assets in the mainstream finance universe to be onboarded to Avalanche.

Avalanche has also taken a strong approach to creating and onboarding decentralized finance protocols, such as decentralized exchanges with automated market makers, prediction markets, and other things utilizing Ethereum smart contracts natively on the Avalanche C-Chain.

Both onboarding mainstream finance and DEFI protocols in my view can act as a catalyst for adoption. However I will iterate that without some kind of a focus on usage of Avalanche as peer to peer electronic cash, there isn't really anything to adopt, aside from a speculative asset that can just easily decrease in price as it can increase. So while these are amazing catalysts, I do think there needs to be more of a shift into usage of peer to peer cash in order to retain the adoption it achieves.

What I Have Mixed Feelings About On Avalanche

There are some things that I will not claim to wholly like or dislike, because there's advantages and disadvantages to each one. But they are worth noting since they do feed into my overall thought process and interact with other points to be made.

Details Surrounding the Double Mint

The first thing that comes to mind is the unusual double-mint incident that occured. On one hand its really bad this occured because it means that in the event of another bug-triggered double mint, a much larger and potentially catastrophic one might be able to occur. It also makes a philosophically unsettling statement about how cryptographic verification works on Avalanche, which is to say that its a lot more subjective than it is objective, which has theoretical negative side effects. On the other hand however, it is interesting to note how Avalanche is a truly immutable platform, so much so that not even bugged mints can be reversed, which gives pretty much perfect confidence to all sent transactions.

Possibly Too Much Staking and Not Enough Liquidity

Another thing I have mixed feelings about is how the Proof of Stake economics are playing out. Originally I had thought it would greatly democratize control of the blockchain, but I am not so confident about that anymore. Avalanche, from inception to now, has had a ratio of about 70%-80% of all coins being staked. This means that earlycomers have a very strong hold on the project, and its at the expense of liquidity and chain-democracy. Without proof of work to distribute any coins, I fear that we will have a stagnant and deeply-seated pool of wealth enriching earlycomers at the expense of the retail market. I did not expect this number would be this high, and honestly thought it would flatten out, not get more extreme. On the other hand, this could also mean greater blockchain security and a greater deflation of the supply if it keeps it up. I am undecided how I feel about this in particular.

AvaLabs Creating New Tokens

Something else I have mixed feelings on is the focus on launching "official" new tokens on Avalanche, both for DEFI speculation and as a security model for subnets. The first instance of this that I criticised was the planned launch of Athereum, which I feared would either compete with AVAX or leak value from AVAX holders to Etherean holders. Then PNG was launched, without governance live or any plans for real usecases, which resulted in a bunch of AVAX holders buying it and losing 90% of their AVAX to Uniswap holders who got PNG airdropped on them. Now there is a plan to fork Bitcoin and Bitcoin Cash, further diluting AVAX and creating things AVAX holders might buy and lose value on. From what I can see, having a token seems to be the planned security model of almost all new subnets, which is a model that may work security-wise, but would result in more speculation at the expense of safer decentralized finance, and of course dilutes value. Those are the reasons that I think I dislike the rapid creation of new cryptocurrencies by AvaLabs, but I am open-minded to the possibility that the increase of speculation may increase adoption, and that the security benefits of using these tokens might be significant. I personally would never invest in any of these though.

Things That I Dislike About Avalanche

There are a couple of things that I strongly and distinctly dislike about Avalanche, which did not concern me in the beginning when I originally joined Avalanche, but now are a source of significant concern to me. I will go through them in detail one-by-one.

Relatively High and Unpredictable Transaction Fees

The first thing that really bothered me about Avalanche in 2021, was the significant increase in transaction fees. In the beginning, the transaction fees were very cheap, and were less than a tenth of a penny in parity with other cheap cryptocurrencies like Bitcoin Cash. But as of recently, price has increased over 10x (30x if you start at the ICO price) and the fees have been not reduced down to match the increase in price. In the recent phase-one Apricot upgrade, they decided to only decrease the C-Chain transaction fees by 50%, and they decided not to decrease the X-Chain or P-Chain transaction fees at all. They say they want to lower fees incrementally, but it begs the questions of why they are only decreasing fees on one of the three primary chains, why it is seen by AvaLabs as necessary to do it incrementally, and at what point did AvaLabs decide that its their role to centrally manage fee levels using a corporate top-down approach based on their arbitrary and subjective beliefs about what they ought to be?

It was my understanding that it is not the role of AvaLabs to centrally decide governance parameters, and that was exclusively the role of validators. I was also under the impression that lower fees would be wrapped up with an upgrade in how fees are calculated (going from flat to based on size) as opposed to just hard forking the chain multiple times and changing parameters whenever they want, which has a completely different image and creates different social precedents.

The way I think the Apricot upgrade should have been released, and the way I honestly thought it would be released, was to decrease the fees of all three chains by approximately a factor of 10, and simultaneously release a new standard that calculates fees based on size. That should have been phase 1 of Apricot. Then phase 2 could be pruning and dynamic fees, and phase 3 could have been onchain governance and anything else. There is nothing arbitrary about decreasing fees by a clean factor proportional to how price approximately increased, but there is something disturbingly arbitrary about changing fees around every upgrade, keeping fees high and neglecting a opportunity to reduce them meaningfully, changing their relative cost ratios, and doing it in such a way that is disconnected from how expensive they have become.

Fees on the X-Chain are approximately 3 cents, and peaked out at about 6 cents on the run-up to $60/AVAX. And this is by far the cheapest transaction fees that Avalanche has to offer. The C-Chain currently have transaction fees upward of $2, will be reduced to upward of $1 after phase one is released, and I expect them to still be at least $0.25-$0.50 by the time Apricot is fully rolled out. Many in the Avalanche community have also shifted their focus away from "having the cheapest fees" or even "having cheap fees" at all, and many now defend the more expensive transaction fees, pushing fear of onchain spam and "abusive" or "pointless" low-value transactions. It is my fear that greed for burned transactions and the value it creates for holders and stakers is driving a desire not to decrease transaction fees as much as they should be.

Miscommunication and Failure To Keep Up To Date With Various Promises

There are many things in this category that I can think of where something was promised or expected, and theres either been no word about it since or the thoughts behind it has quietly changed. AvaLabs very well may follow through on every single one of these things, but my concerns stem from the things people say changing or them not providing information to keep us up to date with them.

The first thing that comes to mind was the discussion around the foundation burning its staking rewards to help preserve decentralization. It was a popular proposal that was reverberated by AvaLabs people, but as far as I know there's been no updates as to whether it will actually happen or not. Without discussion of it, the idea is probably dead in the water, which is bad for decentralization in this case. Theres also other things from AvaLabs that I thought would get discussed again, such as a more in-depth explanation of the double mint incident.

The second biggest thing I can think of is the mention of feeless transactions using micro-POW, detailed in their whitepaper. I had assumed this would be experimented with before governance came online, but governance is about to come online and not only has there been zero mention of this, but from what I can personally see there are many people who actively oppose it. I had wrote an article a few months back detailing these feeless transactions alluding to them coming soon, but its been a while and now I am unsure if it will even happen at all. There was also talk of using micro-POW as a supplementary measure to transactions in order to allow reduced fees.

Another thing I heard about was integration of Avalanche into point-of-sale systems, and maybe funding this with some of AvaLabs coins. I don't remember where I heard this, but I havent heard of it since, and Avalanche-X didn't do a grant to anything like this (to my knowledge). I also had thought the foundation was connected to Avalanche-X and that the coins in the foundation would be used to continously fund Avalanche projects, but it seems to me that this is not the case and that most of Avalanche-X was completed last year using exclusively coins from the community and developer endowment pool.

One thing that has annoyed me in this area is poor communication around how Avalanche fee burning really works. Avalanche fee burning is advertised as a one-and-done deal where all fees are burned and the value is therefore distributed equally to tokenholders. However, this is not actually how it works. Theres also a reminting mechanism where validators will earn from fees in the future, contradicting a claim that "100% of all coins are burned". If intentional this is false advertising, if unintentional its poor communication. The way I understand it, is that fees are burned for now, but get reminted after the staking rewards end. What I dont understand is whether or not reminting has a limit on how fast it could go (allowing deflation from rate of change), or if any fees will be intentionally permanently burned in the process.

All in all, I wish AvaLabs would be clearer on a lot of these things, and not commit to things they aren't able to follow through with or keep us up to date with. I believe in announcing results, not announcing announcements. Disappointment from things not happening or getting fit into a schedule is inevitable if they promise too much at once.

Fears of Centralization

When Avalanche mainnet was first announced and the details of the public sale were finalized, there was a lot of controversy about the coin distribution. Initially, I defended it, and steelmanned it as having purpose, desirability, and gave it the benefit of the doubt as to not causing centralization. However upon further examination, pondering new possible situations, hearing updates from AvaLabs employees, and fearing worst case scenarios, I think I've found that I've been a lot too graceful in my previous analysis. I am going to re-examine it, compare my past and present thought process, and explain why I think it's too centralized.

The main things that I used as arguments to defend Avalanche distribution was that 1) Staking Rewards will probably be burned, 2) the foundation will be distributing its coins to fund projects, 3) The foundation was located in Singapore and is not unilaterally controlled by AvaLabs, 4) the endowment and airdrop would begin to be distributed fairly and quickly, and 5) team coins would be divided amongst the team members. It seems that it very well may be the case that none of these will turn out to be true, and instead will die as hopeful assumptions. There is no evidence AvaLabs plans to burn staking rewards, no evidence the foundation is going to distribute all the coins its allotted to projects every year, no evidence that control of the foundation is decentralized enough not to give unilateral power to AvaLabs, no evidence that the endowment or airdrop will be close to finished any time soon, and no evidence that control over team coins are decentralized or already split up. This implies that AvaLabs may have control over all of those coins, and may be staking with it.

Furthermore based on a reddit comment by an AvaLabs employee, it seems that there is evidence that AvaLabs is in fact staking both the team coins as well as the foundation coins themselves. The way this was described, it seems the staking is a corporate top-down centrally controlled processed, and not in any way well distributed like I had previously hoped.

The crux of my previous argument was that because of the 80% (now changed to 60%) safety threshold, Avalabs would have to own almost all the coins to attack it or unilaterally control it, which I proved that they didn't have that much. However, I did not explore other possibilities, such as what if AvaLabs manipulated the liveness threshold (40%) to do things such as block governance proposals they don't like? I tried to ask someone from AvaLabs about this, but got no response.

If AvaLabs even had 40% of the supply under their control, I would argue that's too much because then they essentially could have veto power over all future governance proposals, where if they don't like something, they can block it onchain from happening. Anything more than 20% of the supply is way too much to be decentralized in my opinion, it doesn't matter if you have 900 full validating nodes when AvaLabs controls half the online stake.

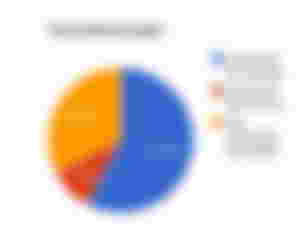

However the problem is, I dont think AvaLabs has 40% of the online stake. I think they might have a lot more than that. Based on data from Avascan, it seems to me that they could potentially have up to 57.7% of online stake, which is only 2.3% away from being able to perform a safety attack on the chain. I compiled this data directly into a pie graph, and separated it into all the individual components, and also into how I interpret the data in terms of whether or not AvaLabs most likely has control of a share of coins (those allocations include team, foundation, endowment, and airdrop). I inputted the coins listed on Avascan and the percentages and images were auto-generated by the pie graph algorithm.

This of course would be a refutation that Avalanche is decentralized if AvaLabs really did control this many of the coins. And as far as what the evidence says, it looks like it very well may be the case. Cross-examining it with the graph that AvaLabs publicly posted, this version is definitely a lot less appealing, but all the same information is there, as you can see:

This is not good in terms of decentralization. It may not be obvious to the casual reader just how bad this is, so let me reframe it. If I am correct that the staking rewards will not be burned, then I can just remove that from the graph because everyone receives that equally and proportionally. If I do that, then this is what the graph now looks like:

I would be disappointed to hear from AvaLabs that they control over half of the online stake and have been essentially lying about Avalanche being decentralized and onchain governance be something other than them arbitrarily changing random parameters whenever they want, so I hope they clear this up. And let me be perfectly clear, the answer should not be "trust us" or "have faith in the team". In cryptocurrency we are supposed to Not Trust, and Verify. Therefore there needs to be proof that Avalanche can't be centralized, not a promise that they won't act centralized.

Unless theres something I'm missing, or there is some logically sound reason as to how this doesnt equate to them having a centralized and enormous control over the online staking power, I'd say the only real way to fix this would be to burn 80-90% of these coins permanently. Use and donate some of them, sure, but they need to be burned because a supply of coins this large released suddenly would crash the price of Avalanche violently.

Conclusion

I don't feel comfortable with the direction Avalanche is taking, which is why I plan on diversifying away. How much I diversify away and whether or not I keep any AVAX at all depends entirely on what happens over the next few months, as I am waiting for September for my staking period to end. If nothing changes, then I may not leave a foot in the project at all. But as it stands, I have confidence that Avalanche will most likely make some improvements in some of these areas, in which I will stay involved. Either way, my current plans are to build on both Bitcoin Cash and Avalanche, because I still like the community and some of the usecases that can be powered by the platform, even if I don't fully agree on the direction of the project.

In order to improve Avalanche, fees need to be lowered a lot. I think that fees on the X-Chain should be lowered to about one tenth of a penny, as this is how expensive other UTXO chains loke Bitcoin Cash are. The C-Chain is fine to be more expensive since the EVM is less scalable, but I am not going to take it seriously as a "low fee solution" unless its less than five cents, since that's the amount that the inventor of the EVM, Vitalik Buterin, thinks is too expensive.

As an absolute necessity, decentralization needs to be improved. Its not acceptable for AvaLabs to have 40% of the online stake, as this gives them veto power over governance proposals, making governance centralized. Much less 58% online stake, which is the actual figure my surface-level research came up with. Having half of all the staking power or more is essentially a federated network no less centralized than something like Binance Smart Chain. If its not the case that AvaLabs has anywhere near this voting power, then that needs some explanation and transparency. Otherwise, there needs to be a massive supply burn. Edit: Alternatively, instead of a massive supply burn, some of those funds could be secured in a DAO where validators can then vote on what to do with them, and ensuring AvaLabs doesn't have too much power.

Between high and unpredictable fees, uncertainty surrounding promises made, and centralization, I think Avalanche has some real work to do. I dont think these concerns should be framed or dismissed as "noise," as was done in the last clubhouse developer meeting. They also shouldn't be ignored.

As for my personal plans, I will spend more time in Bitcoin Cash. It may not be perfect, its far from it. But its got low fees, a proven track record, transaction throughput that rivals Bitcoin, robust adoption as peer to peer cash, and the best promise for intelligent onchain scaling in the industry. The combined power of 100s (or maybe eventually 1000s) of tps via onchain scaling, as well as the relatively new niche-oriented sidechains such as SmartBCH, along with market-driven and determined transaction fees that keep them low (and not hardcoded fees or a parameter thats bureaucratically voted on), I think BCH has a powerful and practical scaling recipe. I also have my hopes high that Avalanche will straighten some of these issues and create utility for itself as a platform.

Thanks for the community insight into AVA. Some questions and comments on your article