Thinking red?

I know this is probably the first thought that comes to mind when you wake up to a bloodbath taking the cryptocurrency market cap below the $900 billion mark in an instant: time to sell, save what's left and buy back at a later point in time. I can understand that most investors are in the crypto game for a relatively quick buck and not because they are long-term believers or firm supporters of the revolutionary peer to peer transaction systems we are blessed to have these days and the technology behind it all, but I would still advise them to avoid hitting the panic sell button and think twice.

With BTC reaching new all-time highs, dragging altcoins upwards with it and exploring the grounds above the $30k mark, it was more than obvious that we were probably going to witness such massive swings in the token's USD value, because well, this is the market and this is exactly how it has been moving all along. The only difference is that the cryptocurrency game is now on a different, much bigger scale, and therefore fluctuations of 5%-10% now translate into massive gains or losses, because most of us still tend to compare our favourite cryptocurrency projects to fiat money and measure their worth based on their USD value.

Misconception

In my humble point of view this is a mistake, because if we keep thinking this way then we openly admit that we'll never have the chance to rid ourselves from the centralized financial systems that print paper money out of thin air. Governments around the world now even have the audacity to express the intention to digitize their rigged fiat currencies, in an effort to convince the people that they have come up with a product that is much different to the obsolete transaction systems they currently have in place, and which deserves to keep pace with the best performing cryptocurrency assets. Of course that is laughable and only aims to convince the ignorant.

And even though they pretend to have it all figured out, believe me when I say that they are luriking in the shadows when there is blood in the streets, buying up everything they can get their hands on and looking to take advantage of your fear, uncertainty and doubt. This is the main reason why you have to think twice before you hit that sell button when there is blood in the streets, because not only are you giving up the opportunity to make much bigger profits down the road, but also giving the banks and financial institutions the much desired chance to improve their positions and claim a much bigger piece of the pie at a discount.

Follow the news

Recently Mt. Gox announced that they were looking to compensate for the BTC stolen in what was the biggest BTC heist of all time, by giving their customers BTC tokens that exceed the value of the assets lost in USD. For those who don't know, Mt. Gox announced in February 2014 that approximately 850,000 BTC were stolen in a hack, valued at more than $450 million at the time. Now there is a proposal by a trustee for Mt. Gox to return 140,000 BTC to customers who lost their assets. And yes, even though we are talking about a much smaller amount of BTC tokens, they are actually worth a lot more due to the recent price surge, and therefore, I expect many of those BTC tokens to be dumped, applying further downward pressure and driving the crypto market cap even lower.

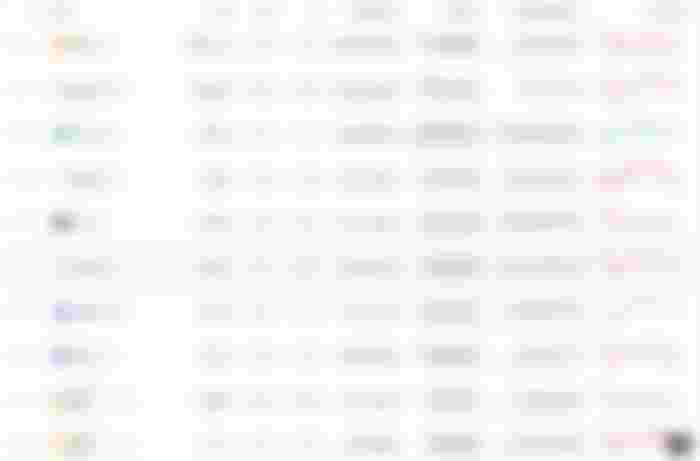

If the Tokyo court system approves this proposal that is. And guess what? I would enjoy that. Driving the price of BTC downwards would certainly have the same effect on alts, and those of us looking for a sweet opportunity to fill up our bags may actually get it. I could be wrong, but I really do believe that the next bull run will make the previous peaks and dips look like flat lines. If you think that's an exaggeration, have a look at the following charts.

The market has always been correcting itself, so I tend to only think about the bigger picture and look at charts on a much smaller scale. Weekly performances and monthly indices are not my cup of tea, because I am in for the long haul and know for a fact that the cryptocurrency ecosystem is here to stay and change the world for the better. Today we lost a battle, but in the long run we will win this war. I've got plenty of time and patience.

Seen it all before

To be honest I've just been around since 2017, so you cannot say that I am one of the very early adopters, but I do believe we all are way ahead of our time given that the whole cryptocurrency industry is still in its infancy stage.

I actually got very lucky and witnessed the massive bull run that started taking place in August 2017 and drove prices upwards in spectacular fashion, but I also remember the bear market that followed and lasted for years. I am used to seeing red, and I know it's just how the market works. If you are one of those in for the long haul who believe that cryptos will eventually replace FIAT currencies, then you shouldn't worry about those red signs at all, because we all know they are temporary.

People tend to only see the recent price activity and forget about the bigger picture. Even if their favourite project goes up by 800%, they will still worry and panic when they witness a 10% decrease a few months later. It's human nature, and I am no better at all, but the fact that I have seen this all before enables me to remain calm and have patience. I also resort to a simple technique I am about to share with you, which works wonders and allows me to see the truth for what it really is.

Do I really need to explain?

In the charts above you can see the total cryptocurrency market cap fluctuations on different time periods; 7 days and 7 years, respectively. As you can see, the daily ups and downs are barely noticeable on the second chart, but big enough to give you a headache on the first one. The second one allows you to see the bigger picture, and even though I do agree that the past is not always a credible indicator of what the future holds, I must admit that I can see a clear trend line, which is even more obvious on a log scale. Of course I don't have a crystal ball, but my money is on that.

Thankfully I don't have to sell my crypto assets to cover life expenses and pay bills, so I am in accumulation mode and couldn't care less about the USD I can get in exchange for my holdings for the time being. What I do care about though is the amount of crypto I can get in exchange for my USD, and since I am convinced that the red signs are only temporary, I have found a way to enjoy the red days as well. Of course this is just my personal take on the matter, and I could be wrong. Always do your own research, and never take my word for your investment choices.

That's it for now, hope this read will inspire you to stay positive during the red times. It's part of the game, and only means the space is healthy. If you can't take advantage of the situation, just sit back and give it some time. It also helps to just stop checking the market for a couple days. If you made it this far you rock, and I'm thankful you took the time to read those lines. Have a good one!

I appreciate your attention,

As a newbie in this field, I really appreciate your effort sharing it with us. I really find it helpful. By the way po @Lordneroo , can I ask a permission if I can quote a few sentence of yours in the article that I am writing? Specifically, this one: