Is Tesla a Buy Right Now?

The short answer is a simple I don't know. I mean, I should note that my fundamental opinion on Tesla stock in general has not changed. When it comes to the EV space I still prefer Rivian and Ford Motor Company.

In all of my past commentary regarding EV in general, I have always said that Tesla is essentially not a car company, but a technology company, and the market it appeals to is not the driver, but the technology minded eco-friendly crowd.

In other words, the guy who buys a Tesla would more likely have owned a hybrid of some kind than to have owned a pickup truck or a sports car.

That is not the case with someone who may be interested in a Rivian SUV or the Ford F-150 Lightning or Mach-E electric vehicles. These people enjoy utility and enjoy the experience of performance and driving something.

But in evaluating whether or not Tesla is a buy right now, considering that of late its stock is down by more than 50%, I have to set these fundamental considerations aside. Because now I am not evaluating who comes out ahead in the EV space necessarily. I am evaluating the viability of Tesla for the company that it is.

That's the distinction to make. We are not evaluating a stock. We are evaluating a company. We are evaluating Tesla based on, well, Tesla.

What we have to look at is what made Tesla go, and why did it drop? Did anything about the company fundamentally change to justify the 50% of value lost? I think the short answer to that question is no.

Nothing changed.

We are not talking about a change in customer appeal. We're not talking about a change in the Tesla market space. We're not talking about delivery issues of vehicles ordered. We're not talking about a looming strike or employee unrest. We're not talking about anything new regarding the supply chain. We're not talking about not being able to recoup the higher cost of the manufacturing process. We're not talking about any new major concerns over self-driving technology, other developing safety concerns, or the vehicles themselves.

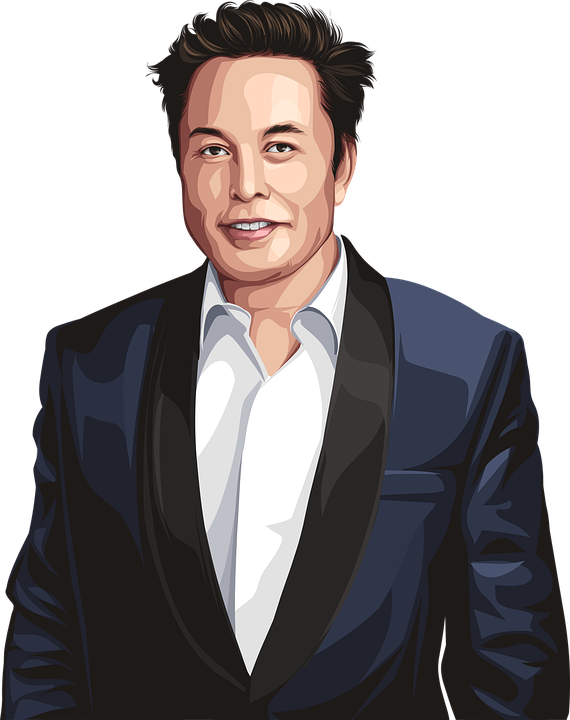

Again, nothing has changed. Tesla is as Tesla was. The only thing that changed was how much someone is willing to pay for the stock. And so, really what we are talking about here is not Tesla. But Twitter. And Elon Musk. Because those are the catalysts behind the 50% drop and nothing else.

Remove Twitter and Elon Musk from the equation and Tesla does what Tesla did, and the stock would not be down 50% right now.

In determining whether or not Tesla is a buy now depends on whether or not you felt Tesla was a buy before the drop. People come and go. Situations and circumstances come and go. But good companies remain. And if fundamentally Tesla was a good company before this drop, one could presume it is a good company still going forward.

There is one other thing to consider though in your evaluation, and that I certainly consider in mine. It's the customer.

Remember that I told you that Tesla's customer is not a driver? I think that's an important thing to keep in mind here. A Tesla customer is driven (pardon the pun) by an ideology. Like I mentioned, they are the eco-friendly crowd and the technology minded person. They are going to tie their interest in Tesla more closely to politics and that ideology they have.

They don't care about the cars, and they don't care about the company if they don't like what the CEO is doing. Inside Tesla, or outside of it. Many of the people who invest in a company like Tesla will have a similar mindset.

Customers and investors will ultimately determine the future value of the company despite how solid the company happens to be. In other words, because of their personal feelings toward the leadership, they can make or break the company regardless of how good the product is or how viable the company is fundamentally.

The company itself is literally being removed from the equation here.

Consider what would happen tomorrow if Elon Musk were to announce he was stepping down from Tesla? The stock would shoot to Mars. I have no doubt about it. Because the stock dropping now is a simple message being sent and again, has nothing to do with Tesla's true valuation.

Would he do it? I don't know. Sure, he is a businessman, and he understands business of course. But he is also Elon Musk, and we know that can sometimes be an interesting part of the bigger picture.

Elon Musk does what Elon Musk wants to do.

The long and short is that if I were evaluating only Tesla right now. Where it was, where I thought it could go, and where it would continue to go absent Twitter and sentiment toward Elon Musk right now, I would find that this drop is a major buying opportunity. Both to perhaps start a new position, but certainly to add to an existing one.

If the focus and attention is on Tesla by investors and customers, the company has long term value. But if the focus and attention is on the politics and antics of the CEO, the long term value is diminished, at least for the short term.

Elon Musk bears a broader image of entrepreneurship, business innovation, and experimentation. Even if he loses one business, he will make many other new moves to build new businesses.

The electric vehicle (EV) business is a big competition where Tesla is an early contender. The magic of EVs is now in the reality checkpoints. The question remains whether EVs are sustainable or not.