Genesis Trading COLLAPSES! Grayscale/DCG & Gemini Are Next

With Genesis Bankrupt, the Final Chapter of Custodians Destruction Begins

Another one bites the dust.

The bankruptcy of Genesis Trading (January 19, 2023), a subsidy of Digital Currency Group (DCG), came as no surprise.

For three months, the trading platform was attempting in vain to fund a one billion dollar gap, while the Genesis parent company, DCG (Barry Silbert) is in equal trouble (another billion dollars).

When an empire the size of the DCG crumbles, there’s not much anyone can do to save it.

You cannot fund a two-billion-dollar gap during the bear market either.

The collapse of the DCG empire will also put Gemini Exchange in a similar position and speed up the next bankruptcy.

Gemini Exchange (Winklevoss twins) is now trying to recover just a part of the funds 350,000 individuals trusted after being lured with promises of secure lending with high yield (5–10% depending on the cryptocurrency).

As Genesis’s bankruptcy begins, assets will be liquidated, and the assigned liquidators will repay only a part of it to creditors.

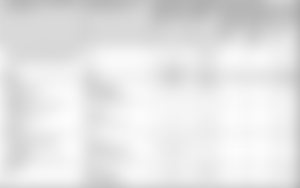

Genesis Files For Bankruptcy Under Chapter 11

Pending Bankruptcy Cases Filed by the Debtor and Affiliates of the Debtor

1. Genesis Global Holdco, LLC is 100% owned by Digital Currency Group, Inc.

2. Genesis Global Capital, LLC is 100% owned by Genesis Global Holdco, LLC.

3. Genesis Asia Pacific Pte. Ltd. is 100% owned by Genesis Global Holdco, LLC.debtor’s estimation of available funds: funds will be available for distribution to unsecured creditors

number of creditors: 50–99

List of Top Creditors:

The file contains the top 50 creditors with Gemini being the top one with $765 million exposure.

Gemini And DCG/Grayscale Are Next In Line

According to Cameron, Gemini is fighting not for the funds and reputation of Gemini but for its customers.

The Winklevoss want to appear as the champions of rightfulness having done nothing wrong, but only fighting to save the customers’ funds from the evil Barry Silbert.

Still, all of this mess was always Gemini’s responsibility.

Not that Barry Silbert is at no fault, but it was Gemini that should have underlined the extreme risk of its “earn” product and how it was possible for all funds to be lost.

It is Gemini going down unless the platform magically manages to recover 90–95% of the assets and appease disgruntled investors that will flock to lawyers and besiege Gemini with lawsuits.

All it takes is one class-action lawsuit.

The majority of investors will accept a 70–90% haircut of their deposits.

DCG will only survive for a few months longer, it can drag this out a while more, but apparently, there’s no future for DCG either.

The Grayscale-DCG empire is over. Gemini is over.

There’s nothing else that can sustain the DCG empire.

Here’s how Grayscale Trust Shares perform on the OTC market:

The SEC will never approve Grayscale Trusts to transform into spot ETFs, and one of the reasons is the custodian mess in what some perceive to be the crypto-industry. An industry that based its operations on fractional reserved re-lending schemes luring unaware investors with high-yield investment plans.

We examined the dire situation regarding Genesis, DCG, and Gemini in December and predicted the collapse of Genesis:

Grayscale - DCG, A Looming Collapse Of Monumental Proportions

Gemini Exchange In Peril: Are The Winklevoss Tweens Going Broke?

Both Gemini and DCG are going down. The surprise would be if one of them escapes the collapse. A DCG bankruptcy will drag with it the rest subsidies, including Grayscale and CoinDesk.

These regulated institutions will face the consequences of their actions. You can not hide behind legal terms when your empires are crumbling.

In Conclusion

Clearly, this market lacks transparency and contains several weak schemes that are bound to fail since their inception.

Yet, we get these individuals (Saylor, CZ, Back, Paolo Ardoino,) acting as demigods in social media, teaching us lessons while exercising their powers.

Egomaniacs and megalomaniacs reach the top with weak foundations.

They extract most of this market, yet they give back nothing but trouble.

We also get all these powerful influencers spouting nonsense, and aggressively attacking anyone with reasonable questions and arguments:

This is how you get attacked by crypto personalities when doing investigative work and mentioning the several red flags and issues of crypto companies.

The same is when exposing weak narratives, as an angry mob of bag-holder maximalists will resort to ad hominem and hateful comments instead of logically recognizing the fallacy of the fairy tales they’ve been fed.

Content published in this article is used for research and educational purposes and falls within the guidelines of fair use. No copyright infringement intended. If you are, or represent, the copyright owner of images used in this article, and have an issue with the use of said material, please notify me.

Platforms:

● read.cash ● noise.cash ● noise.app ● Medium ● Medium (2nd) ●Hive ●Steemit ●Vocal ● Minds ● Publish0x ● Twitter

Don’t forget to Subscribe and Like if you enjoyed this article!