Introduction

In this article, I would like to share some strategic reflections about the state of our beloved P2P Electronic Cash system that is Bitcoin Cash, and why and how we should aim at building novel tools to signal value with real-life merchant adoption as opposed to crypto-fiat speculative markets only.

This should be, in my opinion, one of the key aspects of our strategy in order to contrast with the BTC roadmap which solely focuses on fiat counter-valuation as an attention-seeking tactic, with the adverse effect of hiding away the true and original purpose of the bitcoin revolution: to act and function as a financial and monetary paradigm-shifting invention.

With that in mind, I propose the new idea of On-Chain Markets: using the Bitcoin Cash Blockchain as a qualitative and quantitative registry for goods and services exchanged against BCH in the real economy, one that could be monitored in a real-time fashion through the use of specifically built blockchain explorers.

On the problem of fiat counter-value and controlled opposition tactics in the crypto ecosystem

In the Art of War, the famous Chinese general, strategist, and philosopher Sun Tzu explains

‘’ Whoever is first in the field and awaits the coming of the enemy, will be fresh for the fight; whoever is second in the field and has to hasten to battle will arrive exhausted. Therefore the clever combatant imposes his will on the enemy, but does not allow the enemy's will to be imposed on him.’’

Let’s reflect on how this wise advice transposes to advancing the goals of true P2P electronic cash for all.

At inception, Bitcoin was meant to bring a challenge to the domineering legacy financial system (the enemy), which is certainly very powerful, and until then fairly uncontested and unchallenged in its own field of power: the issuance and control of the currency supply in the form of debt-based fiat money and its distribution circuits in the form of legacy payment networks (Visa, Mastercard, Sepa, Swift, T2, Fedwire, etc...).

The great mistake of Bitcoin, bitcoiners, and coiners in general, is to seek validation and approval almost exclusively through counter-valuation on fiat markets, the field where the enemy was always, and still is, at its strongest.

How can possibly, to paraphrase Sun Tzu’s own words, a second in the field defeat a first in the field?

It is common knowledge that classical, regulated financial markets are already pretty manipulated and overvalued due to accommodating monetary policies of the likes of Quantitative Easing (QE) and the ability for investment banks to bet with huge leverage. As long as everything goes well, the banks accumulate profits, but when everything turns out sour, a financial crisis is triggered with the daunting consequences we all know:

‘’Chancellor on brink of second bailout for banks’’

What about crypto-fiat markets? The situation there is obviously much, much worse...

As a reminder, crypto-fiat markets are unregulated which means that a lot of forbidden cheating processes are allowed to occur: spoofing, front running, wash trading to name but a few.

All of these tricks are banned from regulated financial markets since the Securities act of 1933 was implemented just after the 1929 financial crisis.

Even worse, not 100% backed so-called stable coins, such as Tether, account for the vast majority of traded volumes for BTC and are widely used by traders as a convenient way to move « stable » fiat counter-value accross exchanges and to avoid capital gain taxes. This allows crypto companies complicit with Tether to accumulate coins on exchange for an effective cost of 0 when traded against Tether and thus manipulate prices.

With all that in mind, a legitimate question arises: can we trust the crytpo-fiat markets as a valid, reliable value signaling mechanism for assets which intrinsic function and purpose is to bypass fiat currencies and build a new financial paradigm? This sounds uber paradoxical, doesnt’it?

Answering: Yes! would be equivalent to giving all of the voting ballots to our adversaries and say:

‘’ Hey! You have all the ballots (fiat) now, you can even create new ballots out of thin air, now please, cast your vote on which crypto is going to succeed!’’

This is obviously a recipe for failure: we can’t solely trust the crypto-fiat markets as legit value signaling tools for truly paradigm-changing crypto-assets. The price, and hence the « perceived » value of the latter will be suppressed by market manipulations and the value of the one destined to serve as a controlled opposition of sorts will be enhanced and greatly overvalued by the same means.

This will have the effect to focus the larger public attention on the pseudo-« best performing » assets and rank them in an artificial way, by market capitalization for example, so as to suit TPTB’s agenda and propaganda.

And we are pretty much already witnessing that strategic phase playing out in the BTC vs BCH issue: All BTC Maximalists (*) now rely almost exclusively on the price aspect as a shaming tactic against BCH:

‘’Look where the BCH/BTC pair is! All Time Low! Have Fun Staying Poor!’’

With the financial powers that be now protecting BTC (**), and BTC Maxis even acknowledging it as recently heard on the Clubhouse hosted debate with Kim Dotcom (in the video below at around 56:50), I think the time has come to wisen up and to improve our game of offense and defense.

In fact, I strongly believe that powerful speculative attacks could be used against BCH in the near future if we allow crypto-fiat markets to be the only type of markets where BCH value is decided without any contingency plan. Such attacks, short of killing BCH, could still have very bad consequences and settle us back a great deal, hindering our purpose at being P2P e-cash for everyone.

To rephrase the philosophy behind Sun Tzu’s quote, we are basically trying to fight the enemy on its own field, where he is always fresh (with fiat or Tether), and where we are already quite exhausted (despite all its technical superiority, it is a fact that BCH is terribly undervalued...). We need to get clever and impose to our enemy our own battlefield where he can more easily be outmaneuvered: the broad merchant and user adoption as an every day Mean Of Exchange (MoE).

This must be our primary battleground. To think we can beat FED agents and the likes on fiat markets could definitely put us in a very precarious situation in a not- so-distant future. This is not me being over pessimistic. This is me assessing the situation the best I can to protect the project I love, and to do that the right way, it is of the essence to be conscious of our weaknesses and of our enemy’s strengths.

And yes, I do not weigh my words here: contrarily to Kim Dotcom’s very gentle and diplomatic take towards BTC (which I greatly respect, even if I hope it is a ‘’keep your friends close; keep your enemies closer’’ sort of approach coming from him), I do consider BTC as an adversary as it is now without any doubt under the spell of the legacy financial system, of their agents, and being maneuvered as a controlled opposition tool in order to further obfuscate the path to real financial freedom for all.

The true nature of the endgame: spend and replace

I remember this meme as being an all out superstar around the 2014 bear market.

It tells it all:

Fiat counter-value is obviously the blue pill the financial establishment, who managed to subvert the nature of bitcoin through the BTC chain, is making all of the BTC Maximalists, naive supporters and larger public swallow to great effect:

« Hodl! Numbers go Up! Have Fun Staying Poor! » are all blue pill mottos.

The other approach, the red pill strategy, consist in giving everything at being an effective Mean Of Exchange (MoE). By spreading merchant and consumer’s adoption, cryptos are effectively being used, spent and progressively replacing fiat as viable currencies for everyday life:

« Spend and replace! » is the red pill motto.

With its exorbitant high fees, its crowded mempool resulting in unbearable transaction delays and the infamous Replace by Fees feature (RBF), which allows to increase network fees to pay different transaction outputs, BTC is completely unfunctionnal as a fast, cheap, and reliable mean of exchange for the world.

For instance, at time of writing, BTC average and median transactions fees are at around $US 20 and $US 10 per transaction respectively!

Now let’s compare that to the world income distribution:

Source: https://www.pewresearch.org/global/interactives/global-population-by-income/

According to the Pew Research Center, 93% of the world’s population lives with less than $US 50 per day, 84% with less than 20, 71% with less than 10!

To make things worse, research done by the Swift Institute about payment size distributions, that is the frequency of payments of a given amount or size, has found it obeys a Log-normal distribution (see opposite figure). More importantly, it shows that half of all cash payments are less than $US 15 , with an average of 25, and half of all debit card payments less than $US 43, with an average of 65.

The main results are summarized in the table below:

(Source: https://swiftinstitute.org/wp-content/uploads/2012/10/The-Statistics-of-Payments_v15.pdf , Ch. 10.)

This results can be completed by other studies like the one made by the FED (https://www.frbsf.org/our-district/about/sf-fed-blog/cash-preferred-consumer-payments-under-ten-dollars/) which produced an histogram of payments methods frequencies for different amounts and where it is found that cash payments are used half of the time for tickets of value less than $US 10.

Hence, it can’t be more clear that the fees on the Bitcoin BTC network in light of the frequency of payments’s sizes, which are in average on the order of BTC’s average fees, leaves behind most of the world’s population as an everyday payment method: Bitcoin BTC can’t operate anymore as P2P electronic cash for everyone.

This is where Bitcoin Cash BCH with its near zero network fees and instant cash-like payments through 0 conf can come ahead by filling in the gap and being first in the field!

Know the enemy and know yourself

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.” Sun Tzu, The Art of War

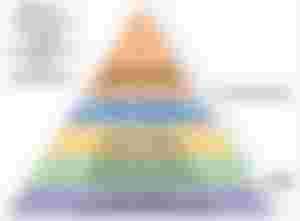

In a recently published article titled: ‘’ Bitcoin’s Hierarchy of Needs’’, BTC’s proponents reflect on the effective roadmap BTC will be taking until what they call ‘’Hyperbitcoinization’’ (HB) (https://bitcoinmagazine.com/culture/bitcoins-hierarchy-of-needs). This is their delusional objective of an all out domination of BTC in all compartments of monetary function, a pretty dystopian future they can certainly achieve with the help of their recently found powerful backers in big finance, if we don’t outsmart them.

Unsurprisingly, they put mass adoption of their fetish coin as a MoE at the lowest priority level and only second to the pyramid HB apex. Why so?

Because BTC thought leaders know all too well BTC is cripled by design in that department and that their chances of reaching that goal in a truly trustless, permissionless and decentralized way is just out of the table: their financial masters want control and they won’t allow that to happen.

This is why the Lightning Network (LN) is the solution BTC proponents put forward as a MoE. I’ll now highlight how bad and how far from bitcoin grassroot fundational values LN is if used as a main transactional layer system build on top of the BTC blockchain as it is intended by BTC maximalism:

Off-chain scaling solutions by means of secondary layers like the LN are no scaling solutions at all: only on-chain scaling can be considered authentic scaling of a POW blockchain technology. One does not scale an existing consensus layer L1 by jumping to another consensus layer L2.

LN is made at the image of the legacy financial architecture : it is an IOU exchange system through bidirectional payment channels. As BTC maxis falsely pretend, no sats are ever exchanged on LN, only promises to be able to redeem sats on chain at a latter time, which will we see next is obviously impossible because of the current main chain fee structure and the lack of willingness to scale it properly.

The IOU guarantee model, that is the way it is guaranteed to every LN users that they will be able to redeem their LN tokens for BTC on the main chain, is extremely weak, not to say straight out non-existent. This can be mathematically formalized in one simple equation, which I call the fundamental LN guarantee equation.

Let’s call K the on-chain capacity of BTC blockchain (in transactions per year for example), f the average frequency at which users wish to close/open channels (in number of times per year) and N the total number of users. The 3 parameters K, f and N are linked by the following relationship:K/2fN=1

with the current BTC blocksize limit and maximum capacity of about 400k transactions per day, or about 150 M a year, the equation says that, as an example, a maximum of 75M users could be able to open/close 1 channel a year, or 150 M users 1 channel every 2 years and so on... It is trivial to demonstrate that the greater the userbase, the weaker and the less guaranteed LN IOUs become, and this completely disregards the constraints in terms of fees that incur while opening/closing channels and which considerably worsens the LN guarantee model. LN guarantee model doesn’t scale without scaling the main chain capacity. Hyperbitcoinization on LN with no blocksize increase is meant to lock world population in another unguaranteed IOU financial system.

LN relies on bidirectional payment channels and on hop routing to pay recipient with whom one’s node is not directly connected to. As it happens, it is not proven yet that hop routing works for arbitrary number of users and for transferring arbitrary amounts: this is the infamous liquidity problem of the LN network. On the contrary all evidence points towards the fact that liquidity hubs will arise and that it is through them that the vast majority of payments will be routed, recreating a facsimile of checking bank accounts. Hence, custodial LN liquidity solutions and routing hubs are currently the only way LN can give the illusion ‘’it works’’... by taking the self-soveireign, trustless and permissionless aspects the blockchain tech was meant to deliver away from its userbase.

Now let’s dive into what I would call the enemy’s specialty: the Store of Value narrative (SoV).

Because BTC can’t function properly as P2P cash anymore, that is as a MoE, its proponents now shift the focus on what is in my opinion the less fundamental property of money: its function as a Store of Value.

What sort of value does money usually stores?

Well, when money acts as a MoE, its monetary base stores the value of the whole economy it accomodates! In that sense, there is no value that a digital currency can ever store which is idependent of the value of the economy it accommodates. This is why the real Store of Value is in the real economy, not in the currency!

This means that no matter how hard and scarce and sound your currency is, it will never ever be able to act as a true universal and intemporal store of value for all goods and services produced within an economy. Why? Because price are always prone to fluctuations which can, in some not so rare circumstances, be pretty violent.

For short, achieving the function of Store Of Value for a currency is equivalent to achieving price stability within an economy. While sound monetary policies that limits the quantity of money available can greatly help, they will always be powerless when it comes to price discovery of goods and services through supply and demand in free markets, unless of course, one wants to live in a planned economy.

The Store of Value narrative is thus a fallacy: the most fundamental function of money is to be a MoE first, and to signal price or value as an unit of account next.

What BTC proponents are really doing here is confusing the elusive Store of Value function of a currency with the speculative value of an asset such as BTC, which has no value other than the one signaled in fiat markets.

And regardless of all bad things one can say about fiat currencies, they do work as a MoE and hence get value from the huge economies they accomodates as legal tenders.

This is why Maxis are so obsessed about price: not because it signals BTC function as a Store of Value, but because fiat is still the real deal as MoE to acquire all goods and services produced in our economies.

But the goal of Bitcoin was to drift away from fiat as MoE, not to stick to it. BTC Maxis should rewrite the White Paper as :

‘’ BTC: An Electronic Store of Near Colapsing House of Cards Fiat Value System.’’

Because BTC will never be a BCH competitor in the MoE department anytime soon, because BTC proponents are busy folding the knee to the banking cartels and waiting for them to give ‘’value’’ to their corrupted coin project through fiat markets pumponomics, the way is free for BCH to show the world how true P2P cash can get real economic value by being a MoE first and above anything else! Now please welcome On-Chain Markets!

On-Chain Markets: A novel tool to signal value through BCH spending in the real economy

All markets share a common function: to share and signal value, that is convey information about trade opportunities and characteristics.

As of now, crypto assets are mostly traded against fiat currencies and/or against each others in speculative, unregulated markets or so-called exchanges. I have already explained why this all out domination of crypto-fiat markets as sole value signaling places for cryptos put real paradigm-shifting assets in the precarious situation where they could fall victim to price suppression at best or even violent speculative attacks at worst, with dire consequences.

This is why we need to invent new ways to signal value away from crypto fiat markets. As the Bitcoin Cash ecosystem should thrive from the ability of BCH to function as a Mean of Exchange, so should its value! This is in substance the main idea behind On-Chain Markets: each time a merchant transaction happens against BCH, we publish it on the blockchain with all sold/bought good and services details altogether with their respective prices: we’ve just built an On-Chain Market!

We can now use an online BCH Market Explorer to retrieve the econometrics of the BCH merchant ecosystem and chart it nicely to see how the real BCH economy thrives! This can obviously have multiple benefits:

The merchants can now be publicly tracked as effective, crypto-fiat market independent BCH market makers: they sovereignly decide how much they value Bitcoin Cash and how much of it they are willing to trade in exchange for their good and services. .

This mean they are free to offer discounts against fiat value if their customers pay in BCH, which corresponds to buying BCH at a premium vs current fiat-countervalue. This empowers merchants at signaling real economic BCH value as merchant adoption grows (as opposed to the purely speculative value on fiat markets). And this very closely translates into BCH being effectively used as an Unit of Account.

This can help as some sort of BCH arbitrage system and help BCH reach fair prices on exchanges through real everyday usage. If merchant adoption grows and if they collectively decide that they’ll buy BCH at premium by offering discounts for their good and services against BCH, they can now signal it with On-Chain Markets: people will find out and will want to buy BCH to benefit from those discounts, eventually helping price increase on crypto-fiat markets.

The real objective of On-Chain Markets is not so much to help arbitrage BCH prices on exchanges but to make sure that even if crypto-fiat markets crashes or disappear into oblivion or whatever, the BCH ecosystem has an alternative way to signal value through real economic usage as MoE. Instead of Hodling! like maxitards, we give value to BCH by spending it and replacing fiat in our everyday lives as much as we can! The more we spend and replace, the more value BCH gets from merchant value signaling through On-Chain Markets!

This gives another layer of resilience to Bitcoin Cash by allowing its value to be discovered independently from the all too manipulated crypto-fiat exchanges.

Let’s now talk a wee bit about how this could be done on a more technical perspective. What we want to do is basically give the option to merchants to be able to print the receipt of each BCH transaction they do against good and services on the BCH blockchain.

The first step would be to build an app, which could be stand alone or an add-on to existing and popular BCH wallets, which will allow merchants to register their inventory with pricing: let’s call this app the cart.cash app. Once the inventory is built, they can use it as a Point Of Sale system: they add items to the customers’s cart, apply the eventual discounts and the app will generate an invoice with a QR code. This QR code contains the BCH amount due to the merchant BCH public address plus the transactions needed to write the cart details to the BCH blockchain. The latter will most likely be some OP_RETURN transactions as we can use this OP code to write up to 220 bytes of info to the blockchain and that corresponds to 220 characters. If the cart data is greater than 220 bytes, we can perfectly split it into multiple OP_RETURN transactions.

The second part will consist in developing the Blockchain Explorers that will allow us to monitor these newly built On-Chain Markets. Ideally the infos we’d like to be able to retrieve would be: what kind of good and services are currently being exchanged with Bitcoin Cash? At what prices ? Where can I find the merchants which are publicizing such great deals? And pretty much anything else that could come to mind.

Unlike crypto exchanges, we will be building real economy exchanges for BCH and we will be able to chart this new markets in various ways: the only limit is our imagination!

Conclusion

I really hope this article will help readers and BCH lovers get deeper strategic insights about how I think this crypto, and more particularly Bitcoin (BCH vs BTC), game should really be played in order for us to achieve success and economic prosperity as originally intended: by being P2P electronic Cash for all. I’m convinced that we can greatly outsmart the BTC narrative and its all fiat-based value strategy by bringing real economic purpose to the BCH ecosystem and inventing new ways of signaling value away from the crypto-fiat speculative markets. My idea of On-Chain Markets is one of them. I think it can be quite easily and quickly developed and implemented (ideally in < 18 months) so as to be readily usable by merchants in the very near future. I hope for the On-Chain Markets idea to be favorably received by the larger BCH community so that we can start building and using it as soon as possible!

Thank you very much for the time spent reading me!

Side notes:

(*): BTC Maximalism: The doctrine that claims BTC will dominate the crypto ecosystem in a not so distant dystopian future by absorbing all world economic value as a single currency to ‘’rule them all’’. LN IOUs would then replace fiat as legal tender for the 99% who will have to KYC themselves to the now state regulated money transmitters called LN Liquidity Hubs (the new Bitbanks’s checking accounts). Meanwhile, the ultra wealthy 1% would be able to afford the astronomic fees on the main 1Mb chain to move value between themselves. BTC Maximalism is thus the crypto equivalent of the status quo, packaged in the fallacious narrative of ‘’financial revolution’’

(**): As it has now become common knowledge, the founding of the Blockstream company, whose co-founders and developers lead the narrative to limit the bitcoin blocksize to 1Mb during the scaling debate, was done in part with VC funds coming from Axa Strategic Ventures (https://www.axavp.com/avp/blockstream/) whom CEO was at the time no other than Henri de Castries, president of the Bilderberg group, one of the most connected person one could possibly find within the legacy financial power structure. Other round of funding came from Mastercard, who funded the Digital Currency Group (https://dcg.co/who-we-are/#board-members), who in turn also funded Blockstream. Quite interestingly, you can find another powerful insider in its board in Glenn Hutchins, a former board member of the Federal Reserve Bank of New York and member of the Council on Foreign Relations. And its registered senior advisor is Lawrence Summers, former Secretary of Treasury under Clinton with links to all corners of the US banking sector.

...and you will also help the author collect more tips.

Now this is some serious strategic thought and I agree 100%. Kudos.

MoE alone is probably not enough. We also need investment.

The privacy issues present a challenge here.

Too many ifs here but might be viable down the road. Not to get started tho.

Interesting thoughts and thanks for sharing them