Myth Debunking: Bitcoin a Commodity?

Bitcoin has been known by many different names over the years, including: Digital currency, digital gold, a phishing currency, an investment asset, and the end of modern capitalism as we know it. However, now that the bitcoin price has reached significant levels, it is time to reconsider Bitcoin and how it is perceived.

We will answer the following question:

Is Bitcoin a currency or a commodity? How is it regarded?

Bitcoin can be used to purchase a variety of items, including art, food, automobiles, and real estate.

One of the earliest proofs of the Bitcoin concept came when Laszlo Hagnac paid 10,000 BTC for two pizzas.

This day is now known as "Bitcoin Pizza Day."

Since then, Bitcoin has been accepted as a payment method by over 100,000 different websites and online stores.

Later, in 2018, Bitcoin ceased to be a currency, as the Ethereum currency surpassed it as the most actively traded currency among traders and users.

The number of Bitcoin holders has increased, as evidenced by an increase in the number of addresses holding bitcoin, as " Grayscale " observed a remarkable increase in the number of Bitcoin holders, particularly those who have kept Bitcoin for more than three years when compared to speculators who transferred Bitcoin in the last 90 days.

Last but not least, a currency's volatility must be low in order for it to be viable.

When a currency fluctuates too much, it is difficult to properly value goods and services.

Particularly when it comes to Bitcoin transaction times.

Where a commodity can be valued in bitcoin, and as the value of bitcoin rises or falls over time, the value of the commodity changes, especially if the purchase process takes time.

The annual volatility of most traditional fiat currencies ranges between 0.5 and 1 percent every 30-60 days.

Bitcoin fluctuates by 4-5 percent at times, and sometimes much more.

At the time of writing, Bitcoin had risen 14.30 percent in the previous seven days, indicating that Bitcoin is still a long way from monetary stability.

Investing in Bitcoin:

What happens if we consider Bitcoin to be an investment asset, as it can be bought and held in the hope that its price will rise?

There are two currents and two camps here:

One person currently believes in Bitcoin, while another doubts it.

Companies such as "MicroStrategy" and "Square" are among those who believe in Bitcoin.

These two companies are considered early bitcoin investors, having invested nearly $600 million in bitcoin.

These firms see Bitcoin as a distinct asset with a cash supply that exceeds the current quantitative easing employed by some of the world's largest economies.

According to Michael Saylor, CEO of MicroStrategy, as central banks increase their printing of money, this money becomes inflated and loses value.

Nobody or nothing, on the other hand, can change that.

Because Bitcoin's total supply is fixed and not inflated. As a result, believers regard Bitcoin as an investment asset. After investing $ 550 million, MicroStrategy saw a $ 133 million return on investment.

The second feature of Bitcoin that is praised by its supporters is its ability to reach those who do not have bank accounts. There are 2.5 billion adults worldwide who do not save or borrow through banks or other financial institutions. Part of this is due to banks' perceptions of this group's profitability in relation to the costs of accessing it.

Another feature that distinguishes Bitcoin is its consistency and high value in many cases, in contrast to collapsing currencies that reflect the state of the economy, such as the Venezuelan Bolivar and the Lebanese Pound.

When domestic monetary currencies fall in value, governments tend to limit citizens' access to foreign currencies in order to prevent further depreciation. Furthermore, banks see banking for citizens of these volatile currencies as risky, so they stay out of those markets.

Others consider Bitcoin a risky investment option, as it does not adhere to and align with structures and institutions.

In an IPE Foundation publication aimed at institutional investors in Europe, explains and recommends avoiding Bitcoin as an investment because it lacks clear regulations on things like credit intermediation and regulation.

The post also argued that there is no reliable market for trading cryptocurrencies that is only available to institutions, and that there are no large banks providing liquidity to traders. risky financial bad investment risky asset risky speculative investment risky business profitable business sound investment risk - seeking financially attractive highly leveraged riskier high return poor investment conservative financial.

Is Bitcoin a commodity?

We discussed Bitcoin as a currency and as an investment in the first part of the article, and we discussed Bitcoin from that perspective.

Consider it from the standpoint of Bitcoin as a commodity.

To refresh your memory, a commodity is a good that can be exchanged for another good of the same type.

A commodity produced by one producer is essentially the same as a commodity produced by another product.

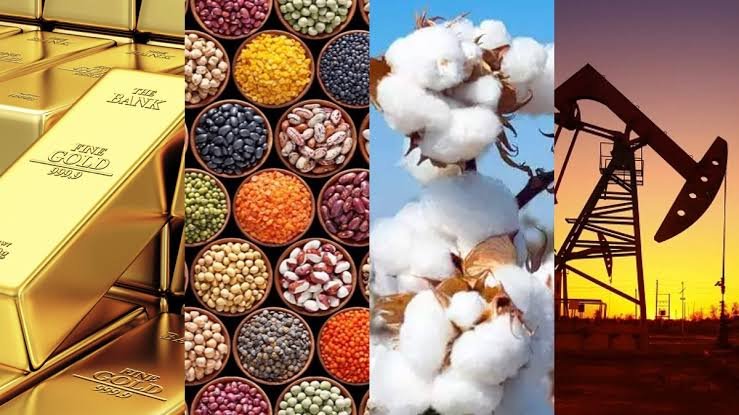

Real-world commodities include: Legumes, beef, oil, natural gas, money in another currency. More financial products, including Bitcoin, have been added to the list of commodities in recent years.

Bitcoin was designated as a commodity by the Commodity Futures Trading Commission in the United States in 2015.

But, in practice, what does this mean?

Commodities have historically had price fluctuations against assets such as real estate or cash supplies such as currencies, making them a fertile environment for speculators attempting to predict the rise and fall of an asset and betting accordingly.

This is where you'll find futures trading, a market in which people try to forecast which way the commodity will swing.

Since the Chicago Stock Exchange launched the first Bitcoin futures contract in December 2017, futures contracts have proliferated and now account for more than 75 percent of Bitcoin's total trading volume.

According to a spokesman for the trading "AAX" platform, which is the world's first platform backed by the London Stock Exchange:

The volatility of bitcoin lends itself well to futures trading.

Some of the most significant growth on our platform has been in Bitcoin futures trading, as investors seek new ways to diversify their portfolios and protect their fortunes from inflation.

Bitcoin, as a commodity, appears to have two investment horizons.

Short-term volatility on a daily basis and long-term speculation. Furthermore, Bitcoin is a regulated commodity rather than a currency or an investment.

The Chicago Stock Exchange established a regulatory standard that affected non-compliant platforms.

Finally:

It can be said that the consideration of Bitcoin varies depending on who gives their opinion.

But, in general, and in light of what has been discussed above, Bitcoin is closer to being a commodity than anything else, as Bitcoin can be compared to oil, which can be invested in, speculated on, or traded as a futures contract.

simpleledger:qpgcw2enx9xrfls6fflqd0mhnf5dpygzgym8ken0qp

SmartBCH:

0xB61CfEf80d6E77DF0856634fbB234B727c61AD62