Is the Permanent Portfolio the Investing Plan For You?

What is the Permanent Portfolio?

The Permanent Portfolio is an asset allocation developed by Harry Browne that consists of:

25% in broad based stock index funds. Browne recommends a basic S&P 500 index fund such as the Vanguard 500 Index Fund (VFINX).

25% in gold. Browne recommends gold bullion coins.

25% in long term treasury bonds. Browne recommends either direct ownership of 30-year US treasuries or a popular fund such as TLT.

25% in cash. Browne recommends liquid cash in an insured bank account, or even better, short term treasury bills.

Harry Browne keeps the portfolio simple using four tried and true asset classes that each perform well in their own economic environment with a pretty high level in confidence. This may be the perfect portfolio for someone looking for reasonable returns and not looking to bet their retirement on traditional stocks and bonds alone. Simply allocate your savings as shown above, and when one asset falls outside of 15-35% range, rebalance with the other assets.

What Could Wipe out my Retirement Savings?

This is a question many investors have likely thought about, but how do we design a portfolio to address it? Harry Browne had a strong understanding of economics that led him to four possible economic scenarios.

1) Economic expansion: Stocks (thrive in boom)

2) Opportunity/Tight money: Cash (a hedge in a recession)

3) Deflation: Long term bonds (do well in a depression)

4) Inflation with slowing growth: Gold (can be depended on in a currency collapse)

If you think about it, these are the only four general economic scenarios we can find ourselves in. Furthermore, there is a strong reason why each asset class performs well in its respective scenario. By owning all four assets at all times, the investor will benefit from the asset class that is outperforming, while remaining hedged against what the future holds.

Why not just Invest in the Asset Classes that are Going to Outperform Going Forward?

One thing that many investors find themselves doing is convincing themselves, for example:

Stocks are cheap now, I should back up the truck and go 100% stocks!

A recession is coming, there will be plenty of opportunities if I go 100% cash right now!

After all this excess in the financial system and growing instability in society, we're bound to be heading into a depression. I better keep all my saving in treasury bonds where I know I'll at least get some yield.

The federal reserve just cut interest rates to zero and we're heading for hyperinflation. Time to go 100% gold!

Maybe you reeeeally think one of these scenarios are going to play out in the future. Harry Browne would urge you, the beginning of investing wisdom is that we never know what the markets will do in the future. In times like these, frankly, we only know a little about the present, and much less about the future. All we can do is diversify in a way so that we meet our investing goals no matter what happens.

How does the Permanent Portfolio Perform?

Adjusted for inflation, the permanent portfolio has an average annual return of 5.0%. This is a little lower than 6.1% you get with the popular 60/40 stocks/bonds portfolio. The historical performance is the drawback of the permanent portfolio to be sure. Even historically speaking, the permanent portfolio may have a somewhat lower return, but it also has significantly lower volatility. See for yourself:

For someone that doesn't want to stomach the larger drawdowns, the permanent portfolio has provided a smoother ride. More importantly, we don't know for sure whether stocks and bonds will outperform cash and gold in the future. There are many rational arguments for why it's likely, but are you willing to bet your life savings on the economy not continuing to be tight on cash, or US dollar staying stable over the long run? Maybe you are, or maybe you're not. Investing is personal.

Adding Some Returns (and Risk) to The Permanent Portfolio

If you're like me, you may like the philosophy of the permanent portfolio, but consider it a little too conservative. Harry Browne would suggest the permanent portfolio be used for the money you cannot afford to lose, and the variable portfolio be used for the money you're willing to lose. Therefore, to add a little risk, and additional return, to the permanent portfolio, keeping some of your savings in a variable portfolio, say 5-20%, may be useful.

The variable portfolio can be used to add stocks to your portfolio, or speculate in other asset classes such as real estate, commodities or cryptocurrencies. Harry Browne would warn you to first set aside money that you're willing to lose, then resist the urge to fund your variable portfolio using your permanent portfolio. This is important to control the risk you're taking.

An interesting take on the variable portfolio is taken in Portfolio Charts' Golden Butterfly portfolio. This is a rational way for an investor to aim for both safety and relatively high returns. The resulting asset allocation is:

20% Total stock market

20% Small cap value

20% Long term treasuries

20% Short term treasuries

20% Gold

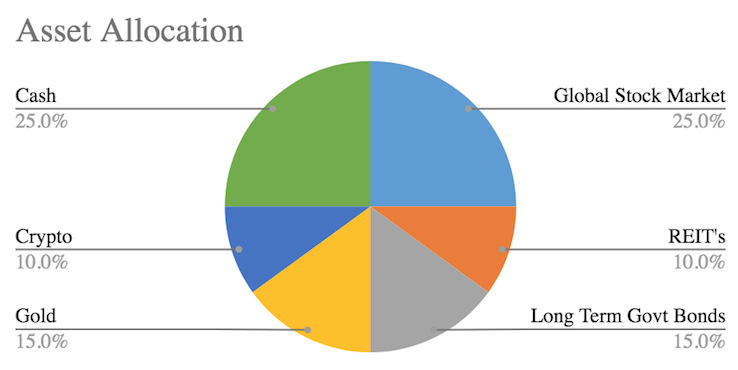

Small Cap Value stocks represent the variable portfolio in this case. The portfolio has had 6.4% inflation-adjusted average annual returns since 1970, slightly higher than the popular 60/40's 6.1%. This shows you the value in thinking outside the box when it comes to your asset allocation. My chosen asset allocation is shown in the main image.

Conclusions

The permanent portfolio is an approach to investing that's very appealing. It provides you with reasonable returns, preparedness for any economic scenario, and most importantly, peace of mind. Here are some resources to learn more about it:

Harry Browne's book Fail-Safe Investing

Some other options on Portfolio Charts