Should I Invest in Bitcoin ?

When I first noticed Bitcoin, it was hovering around $11 in 2012. I tried to start mining but quickly realized my Macbook Pro’s processing power wasn’t sufficient to justify the time and energy it would take to get up and running. I never mined a single Bitcoin, but I did quite a bit of research.

I rapidly read articles on Bitcoin, its past and it's future.

I watched tutorials on how to mine Bitcoin and the mechanics of its payout system.

I browsed all the major forums, for opinions from Bitcoin owners.

This isn’t me trying to brag about my foresight in spotting Bitcoin before it became big. As a technology enthusiast, this was just one of the many tech crazes I explored. Many of these failed quietly or haven’t yet satisfied the hype (3D printing).

If there was one consensus among Bitcoin owners in 2012, it was that they truly believed in Bitcoin. Enthusiasts foresaw the potentially revolutionary impact of a decentralized currency. Libertarians hoped for an end to the monopoly of the dollar. Despite its problems, the future looked bright, and early adopters invested in that premise.

Today, many purchase BTC with no basis other than the gargantuan number beside the ticker and an exponential price chart. With every sharp increase, more and more speculators purchase BTC, with nothing but a hunch as vindication. Answers appear on Quora, where writers ‘guarantee’ BTC will rise to $25,000+.

Yesterday, I talked to someone who purchased 1 BTC, at ~$12,500. He excitedly revealed that he had earned a 25% return within 24 hours, as BTC rose to $16,500. I interrupted to ask what had prompted him to buy BTC in the first place. His only response was that he saw the pattern of BTC’s growth and didn’t believe the profits would end anytime soon.

My friend is normally a rational, intelligent person, whose opinions I seek and respect. As such, I was astounded to hear his speculation was based solely on a hunch.

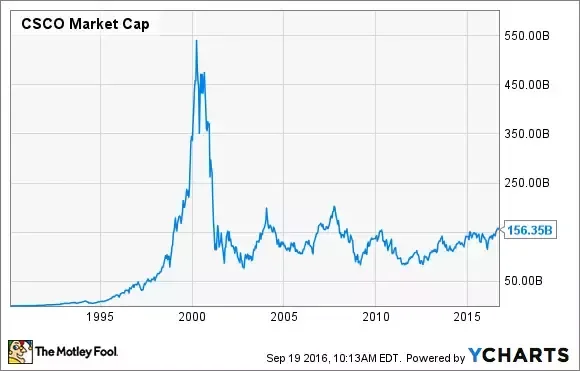

My response was simple. I showed him a chart of an even bigger growth stock than BTC, at the height of the tech bubble in 2000. At the height of its powers, Cisco was the largest company in the world. Like Bitcoin, for over a decade the stock had been exponentially rising, posting a 265,100% return between IPO and peak price.

But then the party stopped and the bubble burst. From 2000–2002, Cisco lost 88% of its value. The stock never fully recovered, and still lingers like a shadow of its former formidable self.

Cisco isn’t an isolated example. History is filled with examples of ‘the next best thing’ with an astounding growth record but without the fundamentals to back up these crazy valuations. Tulipmania, the South Sea Company, and the Mississippi company are just some of these precedents.

I then asked another simple question, to forget about the share price, and to imagine he could never sell the stock on an exchange. If he had to buy BTC at $16,500 and could never sell it on any exchange, would he be happy to hold BTC, as an investment which he could only use as a currency in shops, as he would the Euro or the US dollar? Would he be happy to use BTC for its intended purpose, not just to make a quick profit?

I invite you to ask yourself the same question. BTC is currently worth a collective $267 billion. Do you believe that BTC could buy $267 billion worth of items, either online or in brick and mortar stores?

You may strongly believe BTC will become accepted as a fiat currency, but even then what makes you believe each BTC will be worth more than it is today?

Is it not already priced into the market?

Considering the lack of assets or government guarantor to act as collateral, why is BTC worth more than the paper clip on my desk?

These are all questions you have to ask before purchasing BTC. We’re in the middle of a 9-year bull market, the 2nd longest in history. Markets have been rising so long, they’ve all but forgotten the possibility of a crash. People are buying a ticker, without any consideration for the underlying asset.

Ultimately, BTC is at its current price because no one is certain it will go up or down. I believe it's grossly overvalued, and the underlying asset doesn't deserve a value of $267 billion. That's why I can't recommend investing in BTC.