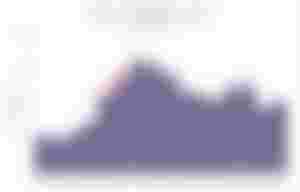

Bitcoin miners received $ 412.5 million in April, surpassing the March figure by 8%

The income of bitcoin miners in April increased by 8% compared to the previous month, largely due to the recovery in the price of the cryptocurrency, The Block draws attention.

In April, miners managed to extract $ 412.5 million worth of cryptocurrency against $ 380.1 million in March. The calculations were based on the assumption that miners immediately sell bitcoins after they are mined.

Analyst Larry Cermak notes that the vast majority of miners' income came from rewards for adding blocks, which are still 12.5 BTC, but will be halved next week. The fees paid by users for processing transactions amounted to only 1.5% of the total income of miners in April.

Chermak also states that the trading volume of cryptocurrencies in the spot market in April fell by 25.2%. The decline occurred for the first time in five months. In addition, he is confident that the current growth is not driven by the interest of retail investors.

“This is the retail investor FOMO,” Chermak writes, pointing to low new subscribers at Coinbase and Binance on Twitter, which is at odds with late 2017. - For illustration, I used Twitter followers. The same is true for exchanges' web traffic, Google queries, and so on. "

Singapore Startup Raises $ 1 Million to Develop Bitcoin Cash DeFi Products

General Protocols, a Singapore-based startup that develops Bitcoin Cash (BCH) -based products for the DeFi industry, has raised over $ 1 million in its initial round of funding.

The investors were the players of the BCH ecosystem.

According to the company, the raised funding will expand the engineering team working on the AnyHedge derivative for decentralized finance and "expand operations around the world."

The startup calls AnyHedge the first DeFi derivative to use Bitcoin Cash smart contract technology.

ErisX Received New York State Cryptocurrency License

The New York State Department of Financial Services (NYDFS) has issued a permit to cryptocurrency exchange ErisX to work with digital assets. The company announced yesterday evening that ErisX Clearing, the clearing and settlement division of the exchange, received a so-called BitLicense from the regulator.

Thus, ErisX became the latest member of a group of well-known cryptocurrency firms that meet the NYDFS standards. Coinbase, Robinhood, Bitstamp, Tagomi and others received BitLicense.

“We are delighted that NYDFS has recognized our commitment to high standards that we have borrowed from the traditional market and applied to the cryptocurrency market,” said ErisX CEO Thomas Chippas.

Importantly, ErisX already holds two licenses issued to it by the Commodity Futures Trading Commission (CFTC). In 2011, the regulator issued a contract market license (Designated Contract Markets, DCM) to ErisX Clearing, and in 2019 the exchange received a clearing organization license (DCO).

Chippas said at the time that the company decided to “separate trading and settlement functions using traditional models: DCM - exchange; DCO - Clearing ”. This is exactly what institutional investors expect to see, he said.

Why does ErisX need a BitLicense

New York State regulators are wary of the cryptocurrency business. NYDFS requires that any company providing services related to Bitcoin and other digital currencies to residents of the state must be properly licensed, even if registered in another jurisdiction.

BitLicense was developed in 2014 and officially launched in 2015. This license was New York's answer to the hacking of the largest cryptocurrency exchange at that time - Mt. Gox.

It's worth noting that getting a license from NYDFS is not an easy task. In addition to the fact that the license itself costs $ 5 thousand, companies applying for it must conduct an audit of financial and security systems, as well as prepare all the necessary documents. A Bitstamp representative told Coindesk reporters that in 2019 the exchange spent more than $ 100 thousand for these purposes.

At the end of last year, ErisX was screened by NYDFS Superintendent Linda Lacewell. According to Coindesk, Chippas emphasizes that his company has always maintained an "open and transparent" relationship with regulators.

Billionaire Paul Tudor Jones Hedges Inflation Risks With Bitcoin

Macroinvestor Paul Tudor Jones has decided to buy bitcoin as a hedge against inflation, which he fears as a result of central bank money printing policies. Jones told his clients that Bitcoin could play the same role as gold in the 1970s. Bloomberg writes about it.

“The best strategy for maximizing profits is to keep the fastest horse,” Jones said. "If I had to predict, I would bet on bitcoin."

At the same time, he clarified that his Tudor BVI fund may mark up "a percentage at the bottom of the range of single-digit numbers in Bitcoin futures."

Jones' fortune is estimated at $ 5.1 billion. He became famous for his ability to predict "black" Mondays and Tuesdays, in particular "Black Monday" in 1987, when there was the largest drop in the Dow Jones Industrial Average.

The investor said that he decided to take a closer look at Bitcoin after assessing the consequences of the fiscal policy of the largest countries in the world and the redemption of bonds by central banks amid the coronavirus pandemic. He estimates that $ 3.9 trillion in money supply has been issued since February, which corresponds to 6.6% of the global economy's productivity.

“Events on the global stage are moving so fast that even veterans like me are speechless,” Jones said. "We are witnessing Great Monetary Inflation - an unprecedented expansion of every form of money that has never been seen in developed countries."

Jones admitted that he considered various options for hedging against inflation, such as gold, US government bonds, some stocks, currencies and commodities. He first invested in bitcoin in 2017, doubling the amount before exiting a position at a high of about $ 20,000. This time, when evaluating bitcoin, he focused on its characteristics as a store of value and evaluated the cryptocurrency according to four parameters: purchasing power, trust, liquidity and the ability to move.

“I'm not chasing hard money or cryptocurrencies,” he wrote. "The most compelling argument for owning bitcoin was the upcoming ubiquitous digitalization of currencies, accelerated by COVID-19."

One good thing about history is that it never changes no matter what it is already stated and in the nicest way better ever