What is Bitcoin Cash?

Bitcoin first appeared almost exactly nine years ago and it’s now as strong as ever. These days, it’s not only the world’s first but also the most expensive, stable and popular cryptocurrency.

That being said, it isn’t perfect. One of the most pressing issues for the cryptocurrency has always been its scalability. More specifically, it’s been the size of a block of transactions, which upon the creation of Bitcoin was limited to one MB. This limit causes substantial delays in transaction processing times and limits the number of transactions the network can process.

Bitcoin Cash was a different story. It differs from the other versions in that in enabled the increase of the block size from one MB to eight MB. It’s overall goal is to increase the number of transactions that can be processed by the network, hoping that Bitcoin Cash will be able to compete with the volume of transactions that industry giants like PayPal and Visa can currently process.

Bitcoin Cash was launched in August 2017 and has since become Bitcoin’s most successful offshoot.

Story of the hard fork

The one MB limit for the size of every block was originally implemented to lower the possibility of potential spam and DDoS-attacks. While there were not that many transactions happening in the network, the limit wasn’t affecting anything at all.

As Bitcoin grew more and more popular, the limit started causing blocks to pile up, which unnecessarily extended the transition times. The situation got out of hand around May 2017, when some users reported having to wait for confirmation for up to four days.

Users had a chance to pay higher transaction fees to speed up the confirmation, but this approach basically rendered Bitcoin useless as a payment method, especially when it came to smaller transactions. For instance, paying for a sandwich or a cup of coffee with BTC just simply wasn’t viable, as a $3 cup of coffee will incur a transaction fee of more than $15. Otherwise, the seller will receive an unspeakable dust amount.

The Bitcoin community came up with two possible solutions to this situation: Bitcoin Unlimited and Segregated Witness (SegWit).

Bitcoin Unlimited would scrap the block size limit altogether. Many miners were in favor of this solution, as the lack of block size limit would not only prevent blocks from piling up but also raise the overall miner’s fee for every block.

However, a lot of developers were against this proposal, thinking that its implementation will lead to small miners going out of business, which, in turn, could lead to a centralization of the entire network by massive mining corporations.

A Segregated Witness solution implied storing some of the information in separate files outside of the Blockchain. Developers claimed that it would free up a lot of storage space, the blocks will fit in more transactions and the confirmation time will significantly decrease. But, many people believed it was just a more complicated temporary stopgap when compared to the Bitcoin Unlimited approach.

As a result, a compromise protocol called SegWit2x was developed. Launching this protocol meant storing some of the information outside of the Blockchain as well as increasing the block size limit to two MB. The protocol was implemented on Aug. 1, 2017, after 95 percent of miners voted for the proposal. However, the network didn’t see the immediate increase in the block size limit. To a lot of people, this meant postponing a problem instead of solving it.

Moreover, this decision seemed to cater for those who treat Bitcoin as an investment opportunity and not a payment system it was created to be.

Then, during the Future of Bitcoin conference in Arnhem, Netherlands, the first implementation of the Bitcoin Cash protocol called Bitcoin ABC was announced by Amaury Séchet, a former engineer at Facebook.

Séchet and his team of developers decided to abandon the SegWit2x protocol and increase the block size limit to eight MB. As such drastic changes required their creation to split from the original Bitcoin network, it was announced that a hard fork will take place on Aug. 1, 2017.

For those that don’t know, a hard fork is the only currently known method for developers to update Bitcoin software. Developers split the network and essentially create a new Blockchain with altered rules. The original and the forked version of the cryptocurrency have identical Blockchains all the way up to the block when the split occurred. From there on, the two networks exist independently.

After the split happened, everyone who held Bitcoins before the hard fork received the same amount of Bitcoin Cash tokens.

The new cryptocurrency was quickly adopted by investors, as by the end of the first day of its existence Bitcoin Cash became the third cryptocurrency behind Bitcoin and Ethereum in terms of market capitalization.

Bitcoin Cash cheaper to use than Bitcoin Core?

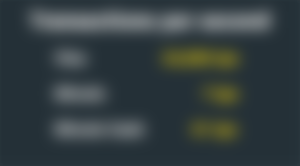

In short: yes. The ever-rising fees associated with Bitcoin transactions were one of the main reasons for the inception of Bitcoin Cash. A very hands-on test, conducted in December 2017, showed that a Bitcoin Cash transaction was 99.56 percent cheaper than the equivalent transaction on the original Bitcoin network.

At the very end of 2017, people were paying $28 on average in transaction fees to move their Bitcoin tokens. Someone has even claimed that they had to pay a $16 fee to send $25 worth of Bitcoin, which is a 40 percent commission.

Hard fork critics

In a cryptocurrency world, a hard fork is always quite a troubling event. Many people believe that it goes against the very principle of the immutability of Blockchain and contradicts the ‘code is law’ principle.

When it comes to this particular hard fork, many critics are worried that the computer power required to process larger blocks will price out smaller miners, which might lead to the decision-making power being concentrated in the hands of large corporations that can afford more and better equipment.

Finally, as everyone who held Bitcoins before the split received an equal amount of Bitcoin Cash tokens, some people voiced their concerns that the split was nothing but a money-making scheme. In fact, the hard fork did create a situation similar to a double-spending problem, as it made conducting two transactions from a single wallet using the same set of keys possible.