Holding DEC vs SPS pancake pool comparison

Clash of profit titans, with math!

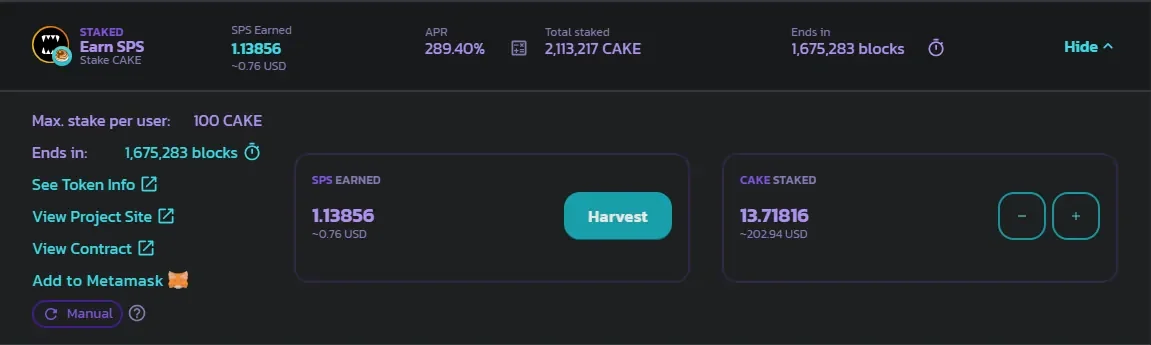

Pancakeswap.finance, a DEFI tool that's caught my attention recently. I've finally decided to learn how to use it for one reason alone: there's an SPS pool with 300~400% APR going for two months. That sounds great! It averages over 20% profit a month. So I sold my SPS to get some cake, the token you need in case you want to stake in that SPS pool.

Right now, I've got 13.7 cake staked in the SPS pool, which is around 200 USD. I'm getting approximately 1.5 dollars a day. But then I thought about it - is that any good, compared to the 32 SPS (~25 dollars) I'm getting daily on my Splinterlands crypto game account? After doing the math, it turns out it isn't any better.

If I get 25 dollars for 176k points, that's around 0.14 USD for every 1k points. Buying 200 dollars worth of DEC equals 25k DEC/points, increasing my SPS airdrop by 3.5 USD - over twice as much as in the pancake SPS farm pool! That's why, as I publish this post, I'm trading my cake back to DEC. It seems holding DEC and playing ranked are the best options. Wait... Wait...!

EDIT: I had written another paragraph about transferring back and forth between the two options, but DEC is accounted over a span of 24 hours, so moving DEC back just in time for the airdrop is a really bad strategy.