I think we’ve gone over how the fiat currency system works in some of our previous articles. Today, let’s focus on mining. What is its purpose? What do miners do and why does mining consume so much energy?

I think it’s beautiful and important for us to have a somewhat clear understanding of the mechanics behind the things we are working with. You surely don’t need to know everything about how bitcoin cash mining works, but I think a good overview of the topic is somewhat essential. I think if we understand this, it will clear a lot of the mystery and ambiguity that surrounds bitcoin cash and other popular cryptocurrencies. It will help us understand the market better and what this new and very promising asset class can do for our financial future.

What is bitcoin cash mining?

The Bitcoin Cash protocol keeps a ledger of all transactions within the network in a series of blocks, with each block recording a collection of transactions. These transactions can contain more than just money moving from place to place – it can also contain data of different types that help us build decentralized systems within many domains. For example, you could create a decentralized ride hailing or food ordering app. You could also hold fool proof elections and let citizens vote directly on a variety of issues.

Since the bitcoin cash system doesn’t have a central authority to declare which blocks are valid and which ones aren’t, it runs a type of lottery instead. This lottery ensures that miners have accurately listed all the transactions in the block and have successfully solved an extremely complex cryptographic calculation. The person or group who solves this puzzle first gets to add their block to blockchain and gets rewarded for it. This process repeats roughly every 10 minutes.

As there is no central authority to control the distribution of money, mining was chosen to be the way for money to be created and transferred. The cryptographic problem that is being solved with each new block is a proof that someone went through the effort of mining that block. The process of legitimately creating Bitcoin cash takes both time and computing power and counterfeiting Bitcoin Cash takes roughly the same amount of work, encouraging people to be fair.

The purpose of mining

Bitcoin Cash mining is often thought of as the way to create new BCH. But that's just a by-product of the primary reason why mining is so important. Mining helps to secure a global currency. This is not just the national fiat currency of one country – it is a currency that can be used by anyone in any part of the world. It is the world’s first permissionless and censorship resistant money. The supply of bitcoin cash is designed to decrease over time, thus making it deflationary – as time goes by, the supply of new coins to miners decreases. Using currencies like Bitcoin cash, you can send money to any part of the world for an incredibly low fee.

Because Bitcoin cash is a decentralized peer-to-peer system, there is no central database, authority or office that keeps track of who owns BCH. Instead, the log of all transactions is distributed across the network. Without mining we would either need a central authority to manage the amount of created BCH and how they are transferred (which defeats the purpose of a decentralised cryptocurrency), or we would be stuck with worthless bits that anyone could make in any amount.

The main problem with a distributed transaction log is how to avoid inconsistencies that could allow someone to spend the same bitcoins twice. This is similar to the purpose of banks in our current financial system – they make sure that we don’t spend money that we don’t have. The solution in Bitcoin Cash is to mine the outstanding transactions into a block of transactions approximately every 10 minutes, which makes them official. Conflicting or invalid transactions aren't allowed into a block, so the double spend problem is avoided.

Although mining transactions into blocks avoid double-spending, it raises new problems: What stops people from randomly mining blocks? How do you decide who gets to mine a block? How does the network agree on which blocks are valid?

Solving those problems is the key innovation of Bitcoin: mining is made exceedingly difficult by a technique called proof-of-work. This means that it takes an insanely huge amount of computational effort to mine a block, but it is easy for peers on the network to verify that a block has been successfully mined. This keeps single entities like governments or corporations from controlling a majority stake of the global mining operations. Miners can block any transaction they wish. They can also create empty blocks with no transactions at all. If an entity controlled more than 51% of the global mining operation then they could potentially render the whole system unusable. This is why the proof of work method uses so much energy and hardware. It would be financially stupid to mine without the chance of receiving the block reward.

Each mined block references the previous block, forming an unbroken chain back to the first Bitcoin block. This blockchain ensures that everyone agrees on the transaction record. It also ensures that nobody can tamper with blocks in the chain since re-mining all the following blocks would be computationally infeasible. If nobody has more than half the computational resources, mining remains competitive, and nobody can control the blockchain.

The creator of Bitcoin realized that there would have to be some way to get Bitcoins into circulation. Since it is decentralized, he did not want to issue coins from a central authority. So, he enticed others to "mine" for Bitcoins by exchanging computation power for Bitcoins. The mining process is quite similar to a lottery, where you buy "tickets" by computing hashes; the more hashes you compute, the more likely you are to win 6.25 Bitcoins.

This scheme has the economic benefit that value is not created out of thin air - Bitcoin Cash miners must trade one valuable resource (their computing time and energy), in exchange for another (BCH). This helps establish a correlation between a "real world" value, and the value of a Bitcoin Cash.

It just so happens that mining also is used to establish a well-defined ordering of Bitcoin Cash transactions; so we kill two birds with one stone, and provide incentives for people to contribute resources to keep the Bitcoin Cash network operating.

As a side-effect, mining adds new BCH to the system. For each block mined, miners currently get 6.25 new BCH (currently worth about $ 3764), which encourages miners to do the hard work of mining blocks. Nowadays, it’s not common to mine alone. Miners organize themselves in pools to increase the chance that a particular pool may find the next block. These mining pools can predict their estimated earning by looking at what percentage of the total mining market they hold. The money earned by the mining pool is divided amongst all its members. This money helps individual miners pay for their hardware and the electricity used for mining and cooling their equipment. Mining is funded mostly by the block reward of 6.25 BCH per block, and slightly by the transaction fees (about 0.1 BCH per block).

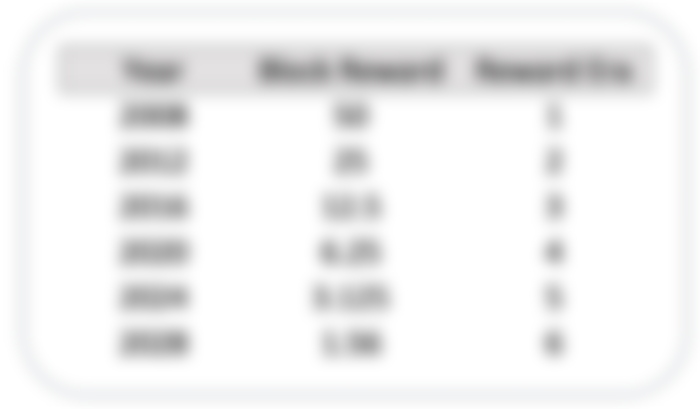

Block reward Halving

After every 210,000 blocks mined, or roughly every four years, the block reward given to bitcoin Cash miners for processing transactions is cut in half. This cuts in half the rate at which new bitcoin Cash is released into circulation. This is bitcoin Cash's way of using a synthetic form of inflation that halves every four years until all bitcoin cash is released and is in circulation.

This system will continue until around the year 2140. At that point, miners will be rewarded with fees for processing transactions that network users will pay. These fees ensure that miners still have the incentive to mine and keep the network going. The idea is that competition for these fees will cause the network fees to remain low after all the 21 million blocks have been mined. 89% of all BCH have already been mined.

In 2009, the reward for each block in the chain mined was 50 bitcoins. After the first halving it was 25, then 12.5, and it became 6.25 bitcoins per block as of May 11th, 2020. The next halving will occur in 2024.

Equipment used to mine

Originally, Bitcoin’s creator intended for Bitcoin to be mined on CPUs (your laptop or desktop computer). However, Bitcoin miners discovered they could get more hashing power from graphic cards. Graphic cards were then surpassed by ASICs (Application Specific Integrated Circuits). You can think of a Bitcoin ASIC as specialized Bitcoin mining computers.

Nowadays all serious Bitcoin mining is performed on dedicated Bitcoin mining hardware ASICs, usually in thermally regulated data-centres with low-cost electricity.

Mining is ridiculously difficult

The difficulty of mining a block is astounding. Finding a successful hash is harder than finding a particular grain of sand from all the grains of sand on Earth. To find a hash every ten minutes, the Bitcoin hash rate needs to be insanely large. Currently, the miners on the Bitcoin network are doing about 154.75 million Terahashes per second.

Miners are incentivized to use the cheapest form of electricity they can find which naturally pushes them towards renewables. We will talk more about energy in our next article.