You have probably heard of the financial crisis of 2008. It started in 2007 of course with a so called liquidity crisis but exploded with the Lehman Brothers collapse in 2008.

Lately there has been a lot of discussion about short-sellers and how much shorting is unethical or you are just a bad person that is betting against the rest, trying to make money with the misfortune of others and other ridiculous arguments I am reading.

Manipulation comes both ways. Yes, some hedge funds had a strategy to short stocks that matched certain criteria and then announce their short to the public, while starting FUD campaign against the so called overvalued stock. It is not ethical and often it may not be allowed, however the market doesn't work one way only. Shorting is a guarantee for most investors and helps in times when things go wrong. I will not go into details about that a lot. It isn't the point of this article, as the point is mostly how to spot a bubble.

The movie "The Big Short" is a movie adaptation of real life events and the story of a how a few investment funds spoted the 2008 bubble in the housing market and decided to bet against the market when everyone was in a state of euphoria and any discussion of things going wrong was ridiculed by the media and financial news.

Yet, it was some that dug deeper into a chaotic economy that resembled a jungle and managed to make an amazing trade, betting that everyone else was wrong and the whole economy was about to enter a very bad state.

There are always signs when we are in a bubble. I suggest you to watch this movie if you haven't done already. It was trending a year ago, and I remember how it helped me re-evaluate some ideas I had about markets.

The stock market today is in a bubble. And so is the cryptocurrency market. Two trillion dollar market cap exceeds our expectations, it is just too much and based on unreal expectations. There are always signs out there, but the problem comes when identifying the important ones from the fake signs.

A huge sign of a bubble is this . The crypto market cap is now more than what the whole US banking system is worth. The total market cap of two trillion dollars that crypto market reached yesterday is exceeding the cumulative market cap of the stock value of all american banks together. Meanwhile, last year it wasn't higher than the capitulisation of only one bank "JPMorgan".

Yes, I know that there is still room to go and everything can keep pumping for months. But the risk is also growing and buying at the top of the bubble is not a game I am enjoying. If someone wants to be part of the decentralized financial future, be my guest, I just don't think it is the right time.

Jim Bianco takes this even further with his next thought:

So sticking with this idea, what's next?

Another double and cryptos becomes larger than US Financial Companies (Banks + brokers, insurance, exch, fin cos, asset managers, etc.)

4x rise and Cryptos surpass the value of all global financial companies.

The explosive growth of cryptocurrencies is just repeating the previous one from 2017. The end will be investors having lost 95% of their money. Not there yet but we are getting closer. Terms like "diamond hands", "hodl", and more are created to support prices at very high levels, push as much higher as possible and enable the big holders sell when the time is right. The crypto markets have very low liquidity and the latest price jump has been an outcome of a long marketing process to convince institutions about the value of cryptocurrencies. Everyone did their part quite well and the results are what we have today.

Watch the movie "The Big Short". And then watch it again and pay attention to everything. Write down what you are missing and you don't understand. Subprime MBSs, Synthetic CDOs, anything the banks were offering having a cool name and offered with a triple A rating from Fitch, Moody's, and Standard & Poor's. It is a banking mess that works until it stops working, until greed takes over and a feeling of growing too big to fail is established.

As in 2017, today there is the same feeling in the crypto market, however the stock market isn't going any different. It is an everything bubble, with a spending frenzy that is a repeat of the previous financial cycle that led to a total collapse of the world economy, and a recovery that lasted 10 years.

Keynes puts it like this:

"the markets can stay irrational longer than you can stay solvent."

We see irrational behaviour and often the signs are there, however the market can be as irrational as it is today for a very long time that is very hard to predict.

However today the stock market in the USA is nowhere near to events in the real economy. American government debt has exploded, we see only speculation with money pouring in stocks and crypto and a failed system that will require increased taxing for everything. Expect to pay taxes for the air we breath. An economy is not run by trading bots. While it lasts exploit the markets but it won't last for too long, it is close to the peak. Cryptocurrencies are rising once again and just like the previous bubble, we have historic events that can helps us find an exit, with better terms from the stock markets.

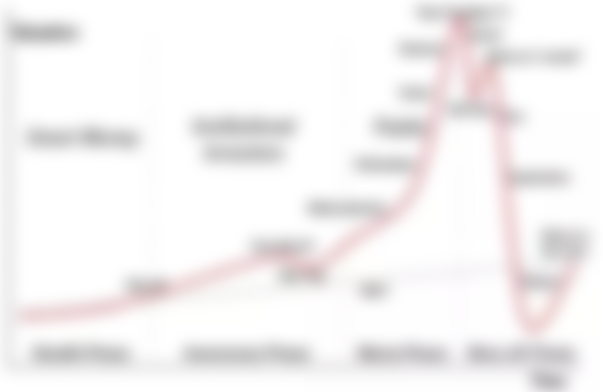

This is how bubbles work:

Looking at the current charts of the crypto market, which state do you think we are currently in? Can it be the smart money is today? Of course not. The institutions? They bought this summer and are now probably thinking of taking profit.

This is certainly the state of the public entering, or the so called retail investors. This is where the smart money are off-loading their investments. Media attention has been attracted since months ago, we have passed this phase, and of course it intensifies as the market keeps growing and the bubble is increasing.

The enthusiasm of the public is very easily transformed in greed, and this is also a notable level we have reached. I think we are at the final phase, which is delusion. At this level, the bubble is almost completely formed and the tipping point can be anything. Maybe we have passed the new paradigm phase already. Let's see what investopedia has to say about this:

A new paradigm is a new way of thinking or doing things that replaces the old. New paradigms in the stock world can mean great profit potential as investors pile into revolutionary new ideas. Investors in new paradigm ideas should tread cautiously as prices can become too inflated based on hype.

When reality sets in, the real value of the company or companies may be significantly lower than its peak stock price.

This is the peak of the bubble. We don't know exactly when everybody will come into realization of a market having being inflated and hyped, it can last for a while, but not for too long, when this level has been reached.