Cryptocurrency to reach $20 trillion in value by 2022 after adding $1.5 trillion in value.

In 2021, cryptocurrencies were unrivaled conduits of greed and fear, alternately minting and wiping out fortunes as they swung wildly while adding $1.5 trillion to overall market value.

Bitcoin, which has gained more than 60% this year, has absorbed much of the attention, but has had to share it with the likes of Ether and Binance Coin, as well as meme tokens like Dogecoin and Shiba Inu.

Indeed, Bitcoin's share of the crypto market shrank dramatically over 2021 as other tokens soared, demonstrating how investor interest in digital assets broadened despite — or perhaps because of — enormous volatility.

According to Vijay Ayyar, Asia Pacific head of crypto exchange Luno in Singapore, the decline in Bitcoin's dominance will likely continue next year "given the explosion of assets in the crypto space and the various use cases."

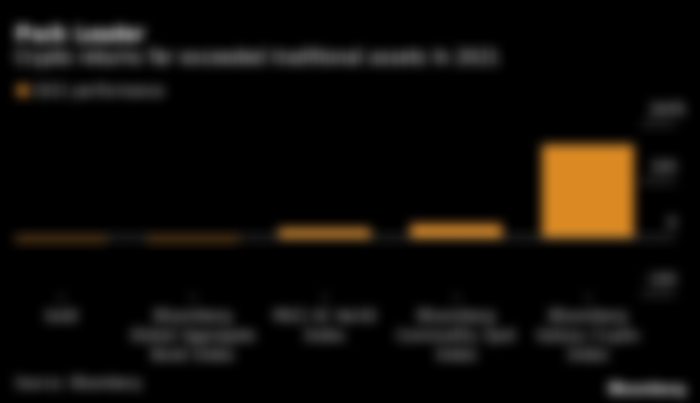

Here are five key charts that tell the story of crypto this year and point to the future:

According to CoinGecko, which tracks nearly 12,000 tokens, the overall market value of cryptocurrencies increased by about $1.5 trillion in 2021 to around $2.3 trillion as of Dec. 17.

Bitcoin, the world's largest cryptocurrency, started the year with a 70 percent market share. This has dropped to less than 40%, owing in part to Ether's growing popularity.

Money has also flowed into other tokens, which some see as a sign of potentially destabilizing speculative froth.

The debate over Bitcoin's potential role in investment portfolios rages on. Proponents argue that it provides a hedge against some of the highest inflation rates seen in a generation. However, in 2021, the token tended to correlate more consistently with risk assets, such as technology stocks, rather than inflation expectations.

The Bloomberg Galaxy Crypto Index has risen more than 160 percent this year, far outpacing the gains in more traditional assets such as commodities and global stocks, which have risen 23 percent and 13 percent, respectively. Of course, given the volatility of cryptocurrency, the old adage "no pain, no gain" also applies.

After a more than 30% drop from a record high just over a month ago, Bitcoin is now testing key technical support levels. One is the 55-week moving average, which has historically served as a floor for selloffs, and another is a level of around $44,100 implied by a Fibonacci study of the rally from the March 2020 trough to the November 2021 peak. The cryptocurrency has already fallen below a trendline drawn from the start of its rise during the pandemic.

Definitely agree, I'm glad you liked it 😊🙂