Is Polkadot better than Bitcoin and Ethereum?

Polkadot is often dubbed the “killer of Ethereum”, although it does not intend to rival Ethereum. It is easy to see why the Polkadot blockchain is considered by many to be an improvement on the existing Ethereum infrastructure, even after the infamous Ethereum 2.0 upgrade. This is because both Ethereum and Polkadot use the sharding technique to avoid scalability and transaction issues. But it is quite difficult to compare with Bitcoin, since the Polkadot and Bitcoin blockchains project very different designs, functionalities and objectives.

Many experts consider cross-chain networks to be key in the development of DeFi development and decentralized applications. In this sense, Polkadot's structure, which consists of a relay chain and an unlimited number of parachains, is superior to Bitcoin's relatively rigid model, which consists of proof-of-work (PoW) consensus and immovable decentralization.

There is another difference that comes from the way both networks compensate users to encourage engagement and adoption. Traditionally, Bitcoin has always rewarded miners despite the increasing difficulty of computing tasks. In fact, in recent years, Bitcoin mining (and, consequently, obtaining the rewards) has been monopolized by large industrial-scale mining operations of very wealthy companies or individuals who can afford the costs of machinery, bills of services and bandwidth.

However, since Polkadot is decentralized DeFi Development Company, there are validators where users can stake Polkadot coins and perform different functions. Depending on the amount of DOT tokens wagered, users can receive more DOT tokens as a reward and can also influence the development of the project. Instead, this possibility does not exist with Bitcoin holders.

In terms of transaction processing times, Polkadot shows significant progress by being able to process transactions in a linear fashion and being able to reach transaction volumes of up to 1,000 transactions per second. If the data flows through the Polkadot parachains and is sent back to the mainchain through the bridge, this figure increases exponentially. Once again, the scalability and technical superiority of the project is highlighted.

How is the value of Polkadot perceived?

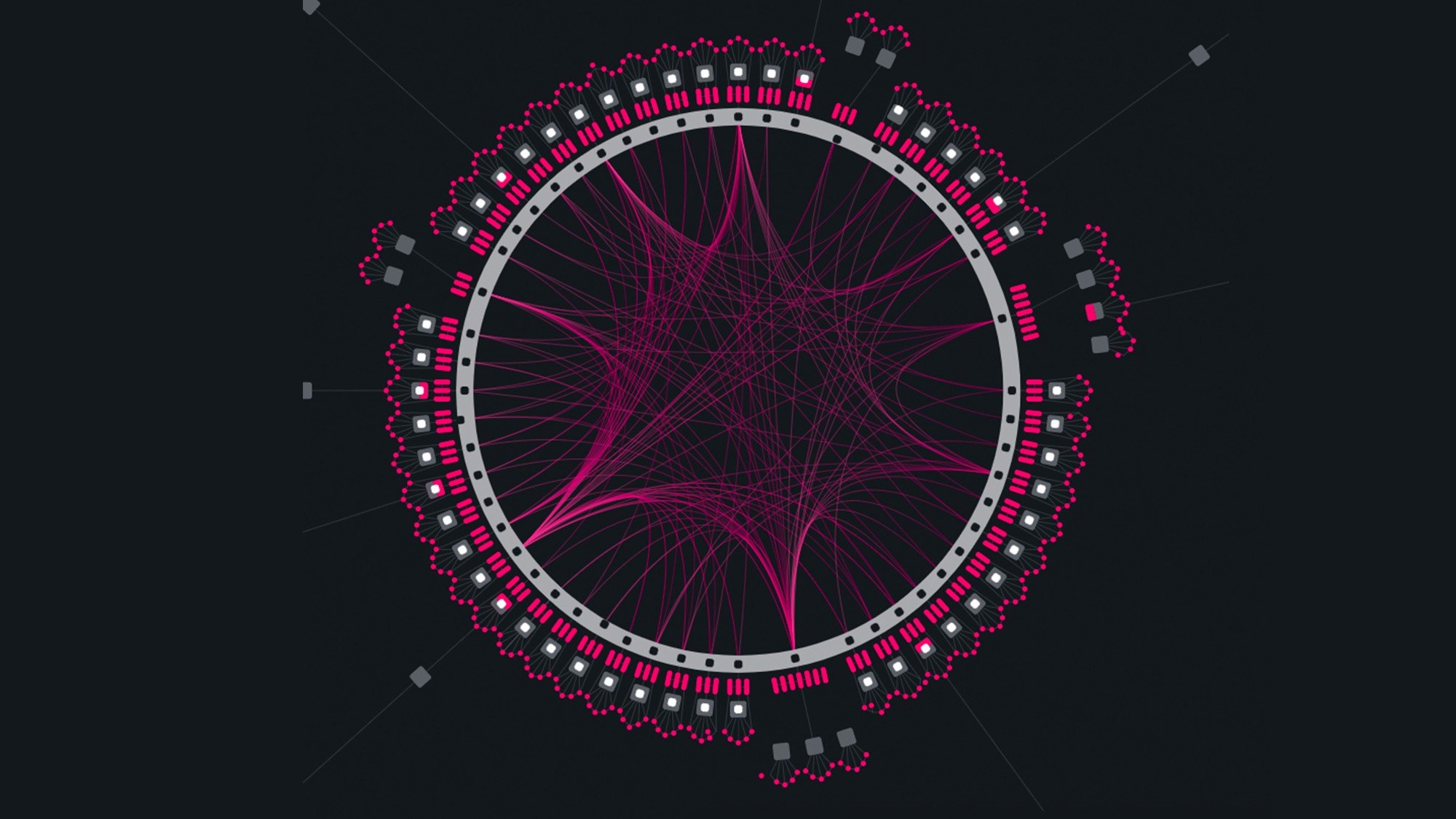

Polkadot has many advantages over many of the existing blockchains. It already has Ethereum 2.0 functionality built in and a unique framework that implements parachains – a blockchain within a blockchain, also known as shards. On the Polkadot blockchain, shards send asynchronous messages between shards, with each shard having a unique state transition function (STF).

These parachains collect and process data and "feed" it into relay chains, which transmit the processed data to other chains. A fourth component, known as a 'bridge', relays the data back to the main chain, such as Ethereum, Bitcoin, Tron or any other platform.

The value is huge, as Polkadot essentially creates what is known as a heterogeneous blockchain. It connects several chains in a single network and allows them to process transactions in parallel and exchange data between chains with guarantees of security.

This allows any arbitrary data to traverse Polkadot's multi-chain application environment, such as real-world assets and tokens. Any blockchain can join the Polkadot infrastructure, which is basically a set of aggregate validators that take advantage of heterogeneous shards.

In this way, the use cases of Polkadot are much more important than those of any other blockchain. Included are transaction chains, oracle chains, identity chains, file storage chains, data curation chains, loT chains, financial chains, and privacy chains.

The risks and limitations of Polkadot

Polkadot is a very safe project that has managed to overcome important challenges in its short life. This overcoming is a true testament to the team and community behind it.

Still, there are some risks associated with Polkadot Coin. Like for example, the learning curve, which is already very steep for cryptocurrencies. The Polkadot blockchain seems to put less emphasis on user experience and has become quite complex for its benefit.

Community-governed hybrid consensus is another potential weakness. Despite their best intentions, Polkadot cryptocurrency holders don't always know what's best for the network as a whole.

The second risk has to do with money and in particular the allocation of Polkadot's DOT tokens. A substantial part of the investment in the project comes from China, specifically from non-specialized farmers. Many cryptocurrency enthusiasts are wondering what this approach means for the future of Polkadot and how it affects dormant DOT holders with incredibly high inflation.

Polkadot (DOT) Coin Price Analysis

The Polkadot Coin (DOT) hits its all-time high of $368.05 in August 2020, shortly after the project started. However, the price of DOT suffered a drastic drop to reach the lowest price of $2.69 at the end of August. Since then, the price of DOT has hovered between $3 and $8 on average throughout the year. However, Polkadot attempted to resume the uptrend on January 7, 2021 and subsequently outperformed the average listing price to $10.63. However, the bears start a correction, but the DOT rebounds to $8.78 a week later.

When analyzed based on the moving average and RSI (Relative Strength Index) indication, a possible uptrend is suggested. Also, DOTUSD can go back up and break above $30 again if it breaks above the resistance level. On the contrary, if the DOT price breaks the resistance showing a downward trend, it could indicate a stronger correction. With BTC rising, DOT is trading at $36.6, almost reaching its all-time high again.

The Polkadot Forecast

Many experts are looking at the rise in Polkadot trading volumes to determine the future of the Polkadot coin. At the same time, many established projects are working to integrate as parachains into Polkadot.

In 2020, we saw the Polkadot blockchain reach a major milestone with the launch of Kusama, a multi-chain network for early-stage Polkadot implementation. The new network increased the number of validators from 700 to 900. Many expect Polkadot to follow the same path, which requires the network to be managed by a minimum of 1,000 validators,

because a large number of validators is likely to attract new users to the platform. Consequently, it is understandable that Polkadot intends to create bridges between other blockchains in the coming months and years.

As one of the most promising projects integrated into Polkadot, it is believed that Edgeware will provide a sustainable ecosystem, in particular by relying on just a few codes by hand across the separate modules within the different parts of the blockchain. As a WASM smart contract, it can adopt different architectures with more flexible and smooth execution. In 2021, Edgeware looks like a breakthrough, and since it's already turning heads, the future looks bright.

Conclusions

Polkadot is an ecosystem with potential yet to be discovered. Although there may be drawbacks, only in the future will the full story be known. However, in terms of competition, the Polkadot coin is currently only rivaled by Cosmos, with which it shares similar concepts but with a simpler protocol. Although other projects are also working on inter-blockchain communication, Polkadot is still ahead in many ways.