Is There A Case For HIVE To Appreciate In Value?

First Things First

Many people tend to view Hive as simply a blogging platform, in that it is solely seen as a fork of Steemit. However, Hive is much more than Steemit… and much more than a blogging platform. It needs to be understood that Hive is in many ways an economic construct and that HIVE (the currency) is central as the means and ability to transact and interact on the Hive blockchain. More on this later.

The argument is often made that HIVE is an inflationary asset and that the printing of new HIVE, ultimately devalues HIVE. Furthermore, many believe that much of the newly issued HIVE is offloaded on the market, and in turn, realized in fiat and other Cryptocurrencies. Before I continue, it is important to note that all POS blockchains are inflationary, in nature, when it comes to the issuance of staking rewards.

So, what then has enabled every single POS project to increase in value? Here, we find ourselves back at the “use case” dynamic that is so often brought up when it comes to identifying a potential altcoin gem. Is there a demand for the coin in question? When you consider most POS blockchains, there is little use case outside of acquiring coins for staking purposes. Much of the value being attributed to the project is coming from what is being built on the particular blockchain in question.

The Fundamental Difference Of Hive

The argument can be made that users of a POS blockchain need to hold a small amount of the native currency, in order to transact on the blockchain. It is free to transact on the Hive blockchain. However, something else is required… Resource Credits. In order to obtain RC, a Hive user has to power up (stake) HIVE. In other words, users are not only incentivized to hold and stake HIVE but are unable to interact on-chain without HP.

This is where all dApps built on Hive, not only add value to the project, and subsequently, HIVE but also create a demand for HIVE. In other words, in order to make use of these dApps users have to purchase HIVE, and convert it into HP by powering it up. Furthermore, the powering down process can only be completed over a 13-week period, ultimately protecting the staked HIVE from being sold off in a moment of “market panic”.

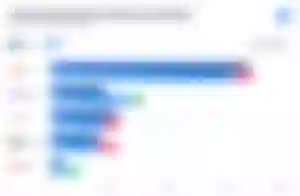

The Hive ecosystem continues to see growth and incorporates a lot more than blogging. Video sharing, sports, DeFi, and gaming are some of the more prevalent sectors. In actual fact, when it comes to gaming, Hive is the third largest blockchain. Only to be outdone by Polygon and WAX. It is interesting to note that in the month of February, Hive actually came in at the number two spot. Remember that each and every single player requires RC (HP) in order to play games. The amount of Resource Credits required will vary from player to player.

Essentially, the more active you are wanting to be on the Hive blockchain, the more Resource Credits you will require. As mentioned, this requires the purchasing and staking of HIVE. There is no other way to gain Resource Credits which places an immediate demand on Hive. Now, when you consider further growth and adoption of the blockchain, you immediately understand that it will by default place a relative demand for HIVE.

In other words, the greater the adoption, the greater the demand for HIVE. The same principle is applicable in regard to an increase of dApps on the blockchain. More dApps means more opportunities, more users, and subsequently a greater demand for HIVE.

Back To Blogging

Let’s just look at blogging again for a moment. Content creators on the Hive blockchain are incentivized to continue powering up their rewards. The greater one’s stake, the greater their influence on the blockchain, and subsequently, their curation rewards. There is also the case of second-layer tokens, such as LEO and others. Some people like the Ad revenue aspect of blogging, which is a key “angle” of Leofinance.

Ad revenue generated via the Leofinance UI is used to buy LEO off the open market and subsequently burned. This reduces the supply and directly addresses the inflationary argument. Even though there are other multiple factors contributing to the appreciation of HIVE, this too is an aspect that is being utilized. Many content creators on Hive also choose to convert their second-layer tokens into HIVE.

This is in the case where they choose not to power up their second-layer earnings. Ultimately, more users on the Hive blockchain playing games, and utilizing DeFi, and other dApps increases the demand for Hive. A significant rise in adoption is likely to push the value of HIVE way beyond the direct effect of inflationary tokenomics.

Final Thoughts

Something that I have mentioned before is that nothing gets priced in during a bear market. In other words, the overwhelming trend is bearish, and so everything gets dragged down in value, regardless of whether it is warranted or not. As a result, even development that takes place during a bear market will only be truly priced in during the next bull market.

There will sometimes be a spike during a bear market. However, it is just a modest assertion against an overwhelming downtrend and therefore doesn’t hold much weight. Patience is required, in order to fully realize price appreciation, in response to positive development and adoption that takes place during a bear market.

I am expecting HIVE to perform relatively well during the course of 2024 and 2025. Remember, HIVE crossed over the billion-dollar market cap valuation mark in 2021. There is a lot that has taken place on the blockchain since then… and there is likely to be a lot more that takes place over the next year or two. Hive is heavily geared and positioned for a WEB3 “awakening”! That’s it for this one, catch you next time!

Disclaimer

First of all, I am not a financial advisor. All information provided on this website is strictly my own opinion and not financial advice. I do make use of affiliate links. Purchasing or interacting with any third-party company could result in me receiving a commission. In some instances, utilizing an affiliate link can also result in a bonus or discount.

This article was first published on Sapphire Crypto.