This is just for comparison purposes based on APY, Product availability and ease of access.

I started staking ADA token on Hotbit.io exchange on February 23, 2021 at 13% APY.

I was earning 0.75 ADA everyday with my 2001 ADA through their ADA-7 Lock up fund with Fixed income. For 2 weeks I was earning 5ADA every week.

Then they stop offering ADA-7 Lock up fund with Fixed income. But they have 2 new products

· ADA DeFi Smart Pool the APY is dynamic, meaning it changes depending on market demands and other factors Currently the APY is at 8%. The quantitative hedging fund focuses on the cross-exchange hedging arbitrage.

· ADA Fund With Flexible Deposits And Withdrawals the APY is also dynamic, currently at 2.69%. The quantitative hedging fund focuses on the cross-exchange hedging arbitrage

Right now my funds are invested on ADA DeFi Smart Pool the good thing is I do not need to re-enroll every week. The downside is its lower APY.

As they say do not put all your eggs in 1 basket. So, some of my ADA are staked on BNB exchange.

Initially this is what they offer. I was not able to avail of this because of their minimum requirements.

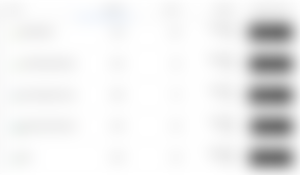

Their current offer is as follows. I am currently avail the 30 days locked up staking.

The best thing to stake is to either run a Stake Pool or delegate to stake pool highest, this way you are also supporting the network.

As of the moment I am just gonna leave my ADA on the exchanges and take the risk.

I will also continue to use both Binance and Hotbit for Staking just to split the risk.

Do you know of a better way to stake Cardano ADA. Please let me know in the comments below. I will really appreciate it.

If you find this information useful. Please use my referral link below for both exchange.

Hotbit.io https://www.hotbit.io/register?ref=94838

Binance.com https://www.binance.com/en/register?ref=13870310