What are "Gas Fees" and why are Wars being fought over them?

If you have remotely stepped foot onto the NFT side of any Blog, posting forum, or even the NFT side of Twitter, you most certainly have come across the term "Gas" and its' fees. Everyone rants and raves, about how "Gas is low" or that its exuberantly high, to the point you start to question; What is Gas and why do people have such problems with it?

Gwei, our best friend and worst enemy.

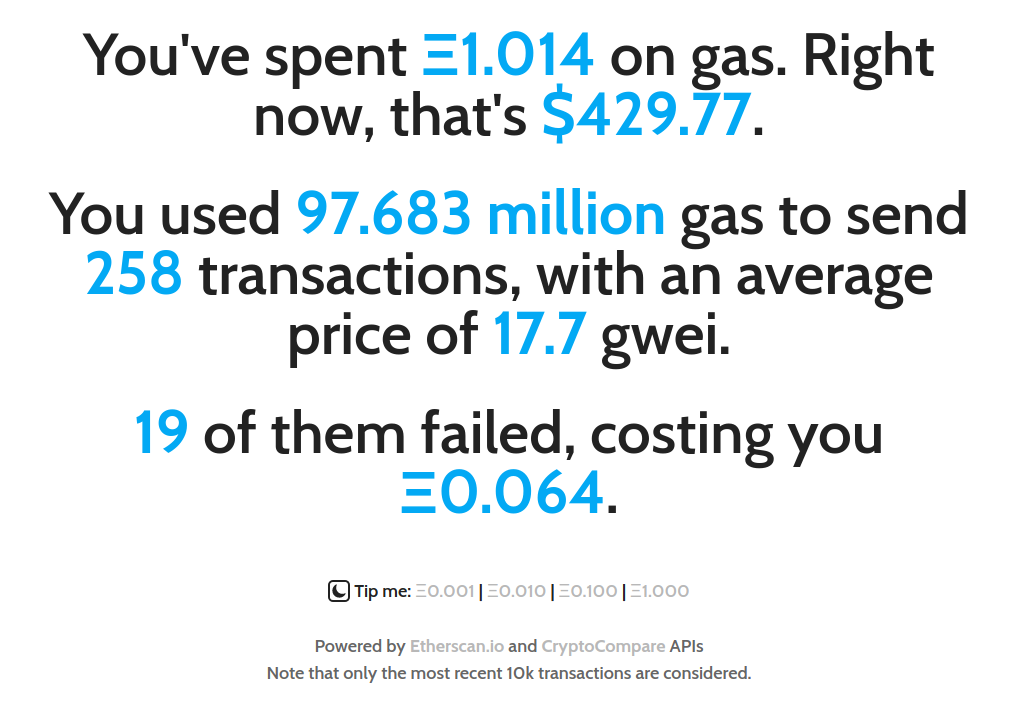

When you put aside almost the social slang term "Gas Fee", This fee boils down to a Utility Fee for the network to process your immediate transaction which you must "Sign" for through your browser. This transaction happens through most of the functions on Ethereum (ETH) platforms: Creating NFTs, listing one of your Assets for sale on one of the Marketplaces, etc.

Each of these Transactions use what is commonly called "Gwei" or "Gas".

Gwei in essence, is the "...denomination of the cryptocurrency ether (ETH), which is used on the Ethereum network." This denomination, fluctuates in Amount depending on the activity of the Network at the time you submit your transaction. If the ETH network finds itself more congested, the amount of Gwei to complete your "order" will be substantially higher. As well on the flip side, if you submit your transaction at a time where there happens to be very little activity, you may pay little to nothing.

(Folks that were trading NFTs back a little before the start of this summer, remember when Gas fees on the ETH network Opensea, were at an all time high. At times reaching hundreds to thousands of dollars per transaction!)

What makes Gwei so volatile?

When you are trading in the larger than life volumes of ETH that some of these projects that truly blew up are, A fee of $300 in Gwei doesn't make you blink. Though on the opposite end, think of the smaller start up collections, or even ones that just haven't hit that level. They charge maybe $100 in ETH or less at times. Individuals who may try and support these smaller artists and collectives, at times will face a transaction fee 3 times their investment.

The thing to keep in mind, is that though these fees reach the heights they have over these past few months, this is all fairly new in the world of Growing Pains for the expanding ETH Blockchain. Members of the community fondly recall on times, not too distant in the past, where Gwei never stepped foot past $10! Artists and collectors just hitting the scene over the Summer couldn't possibly fathom Gas hitting below $30 nowadays, which would be considered extremely cheap.

What does this mean, moving forward?

Considering how the developers behind Ethereum have even acknowledged that the Blockchain is in need of an "Upgrade" so to speak; ETH2 is going to be a Vital turning point that will make or break Ethereum as one of the true "Bitcoin Killers" and "King of NFTs". Why I say this: Ethereum's domination of the NFT market, through outlets such as Rarible and Opensea, give them momentum and the ability to propel like none other. Though, all of this is heavily resting upon Ethereum's ability to catch up in the ease of transactions within ETH2, similar to their Carbon-Neutral Rivals like Tezos XTZ, Wax WAXP, Cardano ADA, and even Solana SOL. Ethereum moving into a more advanced transaction system with Ethereum2, one that is more energy efficient will be both better for the planet and better for business.

Thankfully, ETH2 before its launch is being held to match the costs of its predecessor ETH. This means that ETH holders will suffer no penalty, and be able to swap over for the exact value once ETH2 launches. The expected launch time frame will be around Spring - Early Summer 2022. Currently you are able to stake your ETH towards the ETH2 project, earning passive rewards as you wait for the launch.

Are there Alternatives?

As Ethereum has had to go and rework their Network as to compensate for the sheer volume of people that have flocked; Carbon Neutral platforms such as the listed above are starting to show their prowess. WAXP is holding down the throne for King of Blockchain Gaming, while platforms like XTZ, ADA, SOL, have entered the market offering faster, cheaper transaction fees.

Speaking of WAXP, instead of having a fluctuating variable for the price of each transaction, you reserve RAM and CPU for you account by Staking WAXP on one of their internal sites such as https://wax.bloks.io/. (Though truthfully, CPU won't be entirely necessary for the casual Collector, as it's more if you are uploading your own works as NFTs and similar functions.)

I plan on writing more in depth articles upon each of these Platforms, for now this is just to highlight specifically the Platforms handling of mass transactions, and the fees of doing business on these markets. It isn't as if these Carbon-Neutral platforms have come without their fair share of issues.

Solana's NFT marketplace had complete market blackouts for about a 24 hour period, while one of Tezos' marketplaces had a complete market shutdown for a few days as well. What is for certain amidst the mass hype for NFTs as a whole, these networks are just being bogged down and stressed out.

Final thoughts

Slightly off topic, but the fact that there are tons of claim bots just existing in these spaces and clogging the networks during any big name/hype drops is the big culprit of discomfort for the casual collector/anyone trying to get their foot in the door.

Nothing great comes without its' hardships. All in all, I am truly excited to be a part of these communities, and look forward to seeing how these Markets compete with one another. Healthy competition in this space is the lead driving force in innovation.

If you enjoyed my Ramblings, Catch me on:

Publish0x (Coming soon)