If you are curious about liquidity pool and how this thing works I would recommend you to ready your math skills in here and a 2 or 3-Dimensional imagination. Because this article is a whole lot of numbers and technical words coming from the world of decentralized exchanges. Char. Just basic math is all you need yo!

These are my questions on the first launched of smartbch, what is Liquidity pool and what was its function?

What I found,

Liquidity Pools allows investors to put and locked two different coin and token, and stake them to earn rewards. Basically this pool allows everyone-- any small and big time investors to trades both those token or coin on any decentralized exchanges under similar network. And while doing so, the trading fees are being paid for the investor who contributed to the pool.

Me when I heard of it : Ah wow so, this is fun! I am putting two tokens and being rewarded! So I tried farming and LP.

And after I pulled out one of my Liquidity Pool I was amazed because one of the unstable token and coin I put on the liquidity has lower quantity than of my initial pooled token. But with a higher price value.

For example, the photo below is my screen shot of my before and after liquidity pool of kitten-bch. The price of kitten drives almost 50% and bch price then goes up a little higher than what I initially input so the photo below is the result.

Ah so this is a lot riskier than I thought. So I studied the mechanics of pooling.

To tell you more what had happened let me get you an illustration regarding on what is happening inside the pool when both the token increases in price or decreases in price right after days or weeks you initially put it on the pool.

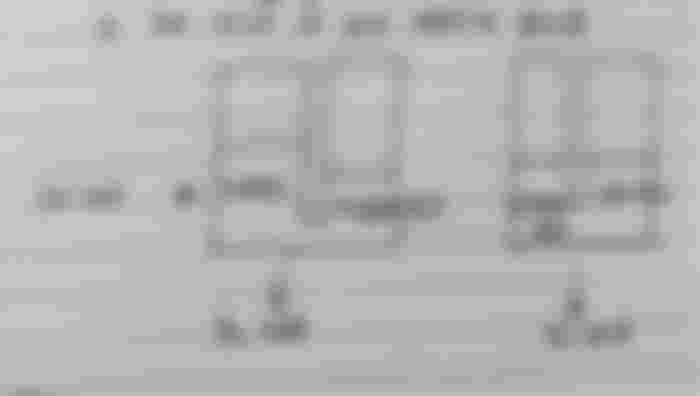

To emphasize and give clarity on how the pool works let us used first the stable coin and bch as a sample before diving into token-coin LP. So the sample is;

50% FlexUSD + 50% BCH = in one POOL

I have attached here an illustration of how liquidity pool looks like!

Supposed that Ana wants to invest her initial capital of 100$ in a pool of BCH-FLexUSD in benswap so she could farm a 70% APR reward of Eben.

She have to buy a 50$ worth of BCH and, 50$ worth of FlexUSD. (Assuming that she already separated the payment for the fees.)

Supposed that the Current Price per BCH when she decided to invest = 600$

So she got 50$/600$ BCH or 0.083333 BCH

In the pool exist;

0.083333 BCH + 50 FlexUSD = 100$

So what happens when the price increases?

And Ana already wants to pull out her investment?

Supposed that when that time comes the price of BCH, rises to 800$!

Her pooled 0.083333 BCH is now equivalent to = 0.083333BCH x 800$ = 66.6664$

And FlexUSD being stable stays at = 50$

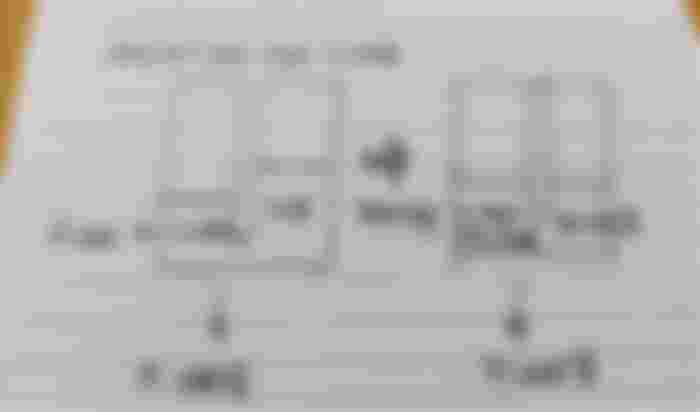

Since the pool needs to be balance (see image below), liquidity pools means 50% of both token in one pool. The value of the two will be added and distributed equally. Then,

66.6664$ + 50$ = 116.6664$

Distributing this equally becomes,

58.3332 BCH + 58.3332 FUSD = 116.6664

Being the price of bch is 800$ you will get approximately,58.3332/800 BCH or 0.0729165 BCH

So Ana would get,

0.0729 BCH and 58.3332 FlexUSD and her EBEN reward for farming.

In conclusion, Ana earned 16.6664$ for her initial investment and earn a reward. But if you would look closely Ana only earned the reward.

What if Ana buys a 100$ worth of bch and wait for the price to go up? She could have earned 32.99$. So best is to analyze if the one you are farming has a potential increase on the future, or more or less has a high APR reward.

Another thing is what will happen when the price of BCH drops to 500?

The image shows above is what would happen. If Ana would want to get her investment back, and the price drops to 500$ she will get a larger quantity of BCH and will reduce the value of her FlexUSD plus an Eben reward.

What would she need to get back her 100$ investment? Wait again for the 600$ value of BCH.

So the thing is it is okay and was great to farm using Liquidity Pool with a coin (with a good standing on market cap) and a stable coin. But of course it is good when the reward has a higher APR.

But when you stake both unstable coin, the risk is very high. Why? Because both the token can increase at the same time and decrease at the same time, or the other would increase the other would not.

If you want a more detailed explanation of lIquidity pool with both unstable coin, please comment down below and I will create another article for that. If anyone would be interested. Hehe!

And sorry for my sponsors for not writing these past few days! I have been so busy! Hehe I am currently working on my project and its a bit hectic! (Project as in work related stuff. I overthink everything! And it needs to be executed not perfect but closed enough!)

Once again, thanks for reading all the way to the end! Heart yah all! 🤟💕

Hope this helps!

Credits,

Lead image is created on Picsart! 🤟

Reference,

https://www.gemini.com/cryptopedia/what-is-a-liquidity-pool-crypto-market-liquidity

Very informative and detailed article. Well explained. Thank you Meyzee.