Since the concept of Bitcoin emerged in 2009, there has been a lot of discussion about the reasons for the existence of Bitcoin. The conflict of ideas about "what Bitcoin is" and "what should be" lasted for several years and led to the division of many communities. Hasufly and Nic Carter document many different ideas about Bitcoin in "Visions of Bitcoin." This article is a little different from the usual discussion on the subject: instead of looking at Bitcoin as a political, philosophical, or technical thing, we look at the history of the chain from top to bottom, and learn more about how Bitcoin is used over time.

Early exchange

Bitcoin was launched in January 2009, but it has caused little stir. Until July 2010, it had a mere 8, 000 transactions (excluding mining transactions mandated by the agreement). But in the next two weeks, bitcoin's trading volume exceeded the sum of its previous transactions.

A more nuanced indicator can also see the change: What is the accuracy of the amount sent? During the same period, the number of transactions that have specified precise amounts of bitcoin transfers has increased dramatically. events led to a sudden increase in bitcoin usage in July 2010. First, Slashdot, the popular tech news outlet, reported the release of Bitcoin 0.3. the price of Bitcoin rises in mid-2011, more and more spending is starting to use all available decimal places. What this tells us is that the first growth of Bitcoin was directly related to the emergence of MtGox, the first market to allow BTC to exchange dollars.

SatoshiDice

The next interesting growth point comes from SatoshiDice, which rose in April 2012. It allows users to send bitcoins to specific addresses, after which they can bet different odds on bitcoins to toss dice (for example, Send 1 BTC and you get 2 times the chance (48%). Its key innovation is the use of a provably fair protocol to show that it does not deceive users with a poor random number generator.

In the days after its launch, SatoshiDice grew to account for 40 percent of Bitcoin's daily activities.

SatoshiDice is a powerful argument for Bitcoin as a cheap and trusted payment network. Playing the same game through bank wire transfers is not only illegal, but also extremely slow. There are many reasons why SatoshiDice has gone from popularity to demise, some are regulatory (it has to ban American players), some are commercial because it has changed ownership many times, others are technical, because games increase transaction costs and make users less interested.

Use Bitcoin as a Collectible

Another way to understand how bitcoin is used is to look at the "non-use" of bitcoin. In 2011, Bitcointalk user Casascius began selling physical coins that can be entered into real bitcoins. With the passage of time, from 1 BTC copper coin to 1000 BTC pure gold coins, a variety of denominations and forms of currency constantly appear. Since the addresses in which the coins were born are publicly available, anyone can track the amount of money they hold. China (BTCC) has recently introduced a set of entity currencies that are supported directly by block rewards. Similarly, addresses are known to be traceable.

Combined with Casascius and BTCC coins, we can see that at least 50000 (2.5% of the total supply) have BTC physical currency so far. This often validates Bitcoin's settings as a store of value.

Finally

This analysis proves that "bitcoin is diversified". While Bitcoin's theories and visions are often portrayed as antagonistic, the data on the chain shows that they often co-exist. While SatoshiDice takes advantage of the cheap payments features of bitcoin, physical bitcoins are being created as well. use of bitcoin will no doubt evolve over time. The data on the chain gives people a deeper understanding of the use of Bitcoin as well as theoretical and philosophical discussions.

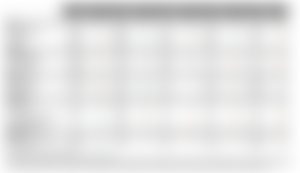

Summary indicators

On July 17, Cloudflare's failure briefly disrupted most of the Internet. Although most of the major encryption networks have not been damaged, the interruption has led to a slight drop in trading volume, possibly due to failures in some popular wallets. As a result, bitcoin (BTC) trading volume fell 5 per cent from a month earlier. But BTC transaction costs rose 54.5 per cent a week from a month earlier, meaning demand for block space is growing rapidly despite falling trading volumes. On July 17, the trading volume of Ethernet (ETH) also fell, but its trading volume still rose in the week-to-month ratio as a result of the sustained and rapid growth of decentralized financial (DeFi) applications.

Network Highlights

DeFi continues to push up the cost of ETH. The median transaction cost for ETH is close to $0.40, the highest since mid-2018. In most cases, the high cost represents a healthy sign, as it implies high demand for block space and creates more revenue for miners who want to secure cybersecurity.

But high fees can also make sending transactions very expensive, especially for types like games and collections that rely on large, low-cost transactions. In the last week, although the volume of transactions increased (at a seven-day average), the number of independent active ETH addresses decreased.

Another sign of DeFi's growth: ETH transactions on smart contracts are moving to record highs. For most of July, over 1 million ETH transfers per day (based on a 7-day average) were made.

Supply of DAI has increased by more than since July 17, possibly driven by the high demand for DAI in the DeFi ecosystem. For example, DAI currently offers an annual interest rate of 6.16% on Compound, which is about 4.5% higher than USDC or USDT.

Market Data Interpretation

It's been a relatively tired week for the market, but ChainLink is an exception. ChainLink continued to climb, pushing this week to a record $8.80. This is happening amid continued enthusiasm for shanzhai.

ChainLink's spot volume market share has also continued to grow and now stands at about 9% (on a rolling 7-day average).

Volatility continues to fall for all major assets, and long-term volatility trading continues to be overwhelmed. We reported this trend in June, as in most cases less than 20 days have been maintained below these levels. And we're on day 41.

END