What efforts have been made by projects in the Scroll ecosystem in order not to fall behind?

Scroll, a project highly praised by Vitalik Buterin, has always been the focus of market attention. Since its Mainnet launch on October 17, Scroll’s popularity has been rising steadily. As of writing, the number of Scroll wallet addresses has exceeded 570,000, cross-chain ETH has exceeded 122,000, the number of cross-chain transactions has been 44,000, and TVL has reached 26.4 million.

These numbers are outstanding. Everyone stays for a few seconds to carefully check the information about Scroll, and information about Scroll is mentioned and publicized naturally because all parties want to take advantage of Scroll's wind to attract more users. However, the competition is extremely fierce. How to stand out among many projects and attract users' attention is the matter.

These numbers are outstanding. Everyone stays for a few seconds to carefully check the information about Scroll, and information about Scroll is mentioned and publicized naturally because all parties want to take advantage of Scroll's wind to attract more users. However, the competition is extremely fierce. How to stand out among many projects and attract users' attention is the matter.

Find brand connections

The relevance of marketing content to hot topics matters a lot to the marketing effects. Projects need to establish a strong connection with Scroll. The most direct link to Scroll’s Mainnet launch is to join Scroll’s ecosystem.

Since October 17, many projects have announced support for the Scroll’s Mainnet, including

LayerZero and NFTScan are online on Scroll Mainnet

Orbiter supports the cross-chain of USDC and USDT on Scroll Mainnet

The list goes on…

Moreover, as a star project on the zk series L2 track, Scroll also needs to prove its ecological diversity: Scroll’s official website lists various projects that already support its Mainnet, which is an excellent advertisement for itself.

The author checked the sources of incoming traffic on Similarweb and found that the traffic effect through Scroll is obvious:

As mentioned above, many projects achieve the purpose of marketing by supporting Scroll. However, as a popular player in the market, Scroll had more than 100 application deployments as early as the Testnet period. After the Mainnet was launched, ecological projects emerged.

Announcing support for the Mainnet is considered a conventional marketing tool, but after that, how do projects try their best to get a share of the pie?

Traffic carnival brought by bundling and grouping

Web2's co-branded marketing activities are emerging one after another, and the use of bundling and grouping methods of marketing is also common in the Web world. There are so many projects supporting the Scroll ecosystem. In order to achieve good results in a marketing campaign, many projects choose to "bundle/group" to gain more traffic. At present, the best platform is the Web3 growth platform with large user bases, such as Galxe, TaskOn, and QuestN.

Through grouping, you can increase event budgets and share traffic, and at the same time, you can exchange for better resources with the Web3 growth platform and increase brand exposure. Moreover, the web3 growth platform itself also attaches great importance to growth. Facing the popularity of Scroll, they will also take the initiative to provide more support and allocate resources to related activities. In the traffic competition of Scroll, TaskOn took the lead in uniting multiple ecological projects. Galxe and QuestN followed closely and also united with multiple projects to launch the Scroll ecological co-branding activities. Currently, the joint activities of Scroll ecological projects are displayed on the homepages of these platforms as follows:

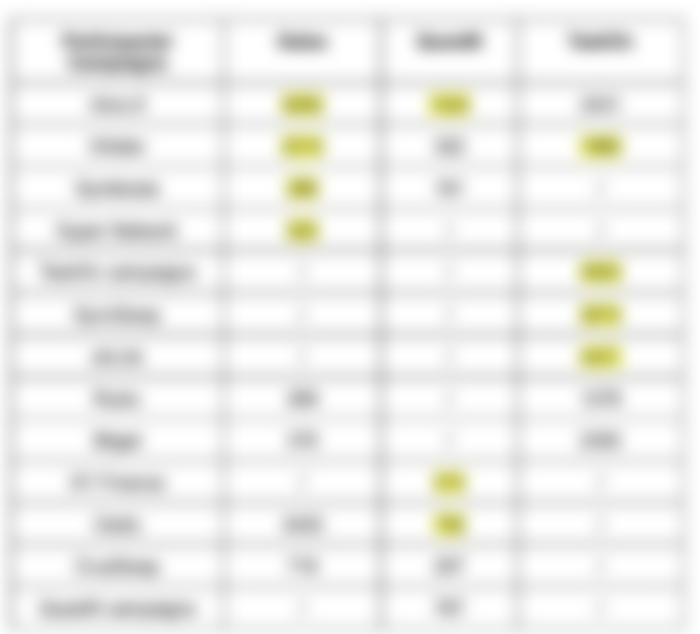

Here, the author counts some participation data of projects in the Scroll ecosystem in the campaigns in Galxe, QuestN, and TaskOn. The yellow items in the table are in the first display positions:

It can be seen that there is a clear gap in the number of participants among different project activities in Galxe and QuestN. The number of participants in different activities of TaskOn is relatively average. The resource location in QuestN has a greater impact on the campaign conversion rate. When the resource location in TaskOn is in the front, the campaign conversion rate is high and the number of participants is not very different.

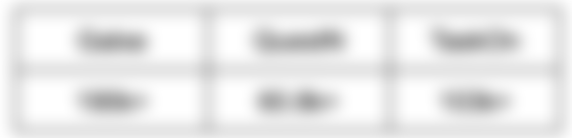

There is also a clear difference in the social media exposure of the campaign. As of this writing, Galxe, which has more than 1M social media fans, has far more exposure than the other two platforms:

The author noticed that because of the good response to this wave of Scroll joint activities, 15 more projects have formed a group to join TaskOn to start the second round of Scroll activities.

How many other projects are gearing up to compete in this battle for traffic? Let's wait and see.

Stand out by complying with the demand

Observing the campaign data above, we can find that rhino.fi has the highest number of participants on each platform because of their creativity in the campaign design. In order to get real users, campaigns often add on-chain tasks, and rhino.fi is no exception. However, rhino.fi observed the market demand and complied with the demand. Currently, most users need to transfer assets to the Mainnet. rhino.fi’s Bridge Free reduces user fees to attract more users to experience the product, differentiating itself from other projects.

The competition is fierce. But there are more and more opportunities for the traffic increase. It’s time to prepare in advance and take advantage of the momentum to set sail.