Dear reader,

Before we go snowballing down the mountainside and delve into the Avalanche ecosystem, we need to come to agreement on one thing: consensus. Cryptocurrencies are assets that live upon their respective blockchains and these blockchains are meaningless if they cannot be trusted to carry out their core tasks. One of those tasks is to have the decentralised network of computers agree upon the content they are collectively working on. This is the process of reaching consensus.

For the first few decades of distributed computing, consensus was based upon the so-called Classical approach. In public permissionless systems, this approach is difficult to scale due to a number of factors such as the fact that all nodes need to “know” who the validators are at any one point in time. In such a consensus model, the network ends up agreeing on the decision with absolute certainty.

Satoshi Nakamoto livened things up in 2008 when he/she/they released the Bitcoin whitepaper, in which they laid out the groundwork for a novel consensus mechanism which has since come to be known as Nakamoto consensus. For Bitcoin to succeed, proof-of-work needed to scale and for that to happen a more forgiving consensus mechanism was required. The trick that Satoshi used was to allow for a minute possibility of error to be included in the decision making process. While this may sound risky, it’s worthwhile to note that the chance of error is infinitely small and also decreases exponentially over time as the blockchain increases in length.

Various iterations of this consensus mechanism have since graced the charts of the cryptocurrency landscape but by and large these remain linked to Nakamoto consensus.

The Pokémon moment

In early 2018, a pseudonymous group called Team Rocket contacted a Cornell University computer science professor called Emin Gün Sirer. Sirer was no stranger to the world of cryptocurrencies, having already enjoyed an illustrious career in the nascent sector. He was well known in the Ethereum community; in 2016 he famously tried to warn of certain security flaws in The DAO’s smart contract (the hacking of which ultimately lead to the split between Ethereum and Ethereum Classic).

Team Rocket caught his attention as they claimed to have come up with a new consensus mechanism that offered the best of both Classical and Nakamoto consensus models.

It may be interesting to note at this point that Satoshi is the name given to Ash Ketchum in the Japanese version of the popular cartoon series Pokémon. Team Rocket also just happens to be the name of a criminal organisation in the Pokémon franchise. Coincidence? I’ll let you decide, dear reader.

After working discreetly with Sirer over the course of several months, Team Rocket launched the initial “Snowflake to Avalanche: A Novel Metastable Consensus Protocol Family for Cryptocurrencies” whitepaper on May 16, 2018. The document itself was posted to the IPFS (InterPlanetary File System) so any crypto enthusiasts out there can relive a piece of blockchain history by visiting this link.

Sirer himself let the cat out the bag a day later by first tweeting and then speaking about it during Token Summit 2018 (skip to 17 mins to see Sirer’s speech).

Sirer then went on to found Ava Labs, a Brooklyn based research and development company, that worked in tandem with Team Rocket to publish an updated whitepaper in 2019 entitled “Scalable and Probabilistic Leaderless BFT Consensus through Metastability”. A link to the document can be found here.

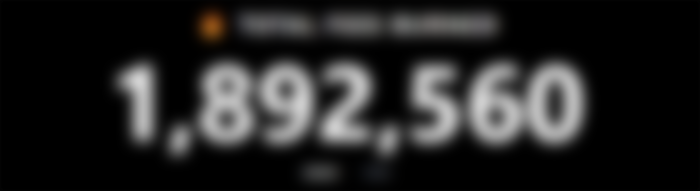

fter some further development and 3 rounds of presales for the ecosystem’s native coin $AVAX, the protocol’s mainnet launched in September 2020 and has seen tremendous growth since. At the time of writing there are over 3 million unique addresses on Avalanche’s smart contract chain.

Current metrics show that even though we are in a bear market, DeFi participants have chosen to keep approximately 3 billion dollars’ worth of value locked into the Avalanche ecosystem:

So what's special about Avalanche?

Ava Labs came to market with an ambitious goal in mind: digitize all the world’s assets. In order to do this they created a blockchain technology aligned for the activities of the financial sector. The platform, underpinned by its three-pronged primary network, allows for the creation of custom blockchain networks called subnets. Speed is also a key factor in this ecosystem, so much so that they claim to have the fastest smart contract system as measured by time to finality (sub 2 seconds as per their latest comparison chart).

That’s the elevator pitch. Now let’s dig into the tech.

Consensus

We learnt briefly about Classical and Nakamoto consensus approaches. The Avalanche ecosystem is built upon the Avalanche Consensus Protocol. As we saw above, consensus is a complex topic so for the sake of your sanity (and mine!) let’s go with a high level understanding.

In a network of validator nodes, each validator has the task to decide whether a transaction is good or bad. The nodes gossip between themselves and over time a dominant decision obtains a majority. Even in situations where the network seems to be split down the middle, a tipping point will always occur, paving the way to consensus. The key ingredient in this consensus recipe is metastability.

Consensus is one of the most complex areas of computer science so I suggest those willing to dig deeper into Avalanche’s backbone consult the aforementioned whitepapers or the documents section of the Avalanche website.

To put the 3 consensus models into perspective, here is a handy comparison chart:

Architecture

Avalanche has a unique infrastructure consisting of 3 blockchains that make up the Primary Network. Avalanche’s marketing department is pushing hard to demonstrate the benefits of its subnet possibilities but before we see what all the fuss is about we need to first understand the 3 core elements that make up the Primary Network.

The Primary Network secures 3 built-in blockchains:

X-Chain (Exchange Chain)

This is where tokens are issued and traded. According to the Avalanche website: “The X-Chain acts as a decentralized platform for creating and trading digital smart assets, a representation of a real-world resource (e.g., equity, bonds) with a set of rules that govern its behaviour, like ‘can’t be traded until tomorrow’ or ‘can only be sent to US citizens.’”

Unlike blockchains such as Bitcoin and Ethereum, the X-Chain progresses on a non-linear DAG (Directed Acyclic Graph) model, similar to how Fantom operates. Simply put, transaction blocks are interlinked but not in uniform series. This enables parallel processing of transactions, reducing bottleneck issues as seen on other blockchains.

This chain can reach speeds of up to 4500 tps (transactions per second).

P-Chain (Platform Chain)

The P-Chain plays a critical role in the scaling and security of Avalanche. According to the Avalanche website: “The P-Chain is the metadata blockchain on Avalanche and coordinates validators, keeps track of active Subnets, and enables the creation of new Subnets. The P-Chain implements the Snowman consensus protocol. The P-Chain API allows clients to create Subnets, add validators to Subnets, and create blockchains.”

This is the environment in which validators stake their $AVAX to secure the network.

This P-Chain can reach speeds of up to 1500 tps, although the speed of the individual subnets is dependent on their own settings.

C-Chain (Contract Chain)

This chain acts as an environment for smart contracts, allowing for the deployment of dApps (decentralised applications) for activities such as DeFi and NFTs. According to the Avalanche website: “The C-Chain allows for the creation smart contracts using the C-Chain’s API. The C-Chain is an instance of the Ethereum Virtual Machine powered by Avalanche.”

Even though it is EVM compatible, by using a different consensus protocol to Ethereum, this chain can also reach speeds of up to 1500 tps.

Subnets

Without getting too much into the nitty gritty, the concept of Avalanche subnets is similar to how Ethereum, Polkadot and Cosmos plan to scale out their respective ecosystems. Separate blockchains have the capability to do their own thing but “report” back to the main chain. Avalanche offers the subnet creators an immense amount of flexibility in their creation.

Finance specific applications could limit the use of their chains to cater for regulatory issues, such as: geographical location, restriction based on licenses, KYC and AML standards, etc. On the other hand, less valuable activity such as NFT trading and online gaming could benefit immensely from custom built subnets.

These two very different sectors, both heavily reliant on speed and data availability, look set to benefit from this custom architecture. At the time of writing, two gaming projects have deployed subnets on Avalanche: Crabada and DeFi Kingdoms.

The more I think about this, the more absurd it seems to me that we currently use monolithic blockchains for both DeFi and NFTs simultaneously. Volatile market swings with all the liquidation drama they bring coinciding with saturated NFT drops seems to bring about a highly impractical use of block space. Spikes in gas fees have clearly shown this inefficiency time and time again.

Proof of Stake

Avalanche operates on a proprietary proof-of-stake protocol. Validators need to maintain a stake of at least 2000 $AVAX. For those of you wishing to contribute to a pool, the minimum amount is 25 $AVAX. There is a minimum lockup period of 2 weeks after which you can release the coins. The coins can be staked for a maximum period of 1 year at a time. Contrary to several other PoS blockchains, Avalanche validators don’t run the risk of having their $AVAX slashed (confiscated) for misbehaving. Instead they are penalised by not receiving rewards.

Transaction fees paid in $AVAX are burned, meaning that validators are remunerated for their efforts through staking rewards. The staking rewards decrease over time, similar to how Bitcoin emissions slowly taper off over a period spanning several decades. A key difference with the $AVAX staking reward rate however is that this has the capability to be changed through governance voting by the token holders.

Validators are rewarded for their speed and uptime. In the gossip style consensus mechanism, nodes are constantly queried until the network comes to agreement upon the current transactions being processed. Validators with a higher amount of $AVAX under their control will be queried more frequently.

A brief history of $AVAX speculation

The 2021 crypto bull run was a lucrative time for early investors of $AVAX as it reached a peak price of $146.22 on November 21, 2021. This rapid move into triple digit territory was in large part fuelled by two catalysts: Avalanche Rush and Wonderland. Whereas the $180m Rush incentive program was an organised initiative aiming to bring developers and protocols into the ecosystem, the rapid rise of Wonderland (a DeFi 2.0 rebasing protocol inspired by Olympus DAO) was a much more sudden and chaotic sequence of events.

Wonderland offered an intricate stablecoin yielding mechanism linking Terra’s UST and Abracadabra’s MIM (Magic Internet Money) in their Degenbox strategy. Through a series of liquidations followed by the eventual exposure of their pseudonymous Treasury Manager 0xSifu as being Omar Dhanani, aka Michael Patryn, co-founder of QuadrigaCX, confidence in Wonderland fell, causing an exodus of market participants back to other blockchain ecosystems. That’s a whole other can of beans that we won’t be opening today but suffice it to say that it spooked a lot of investors and both Wonderland and Avalanche’s prices have been struggling to reclaim those higher highs ever since.

More recently, Avalanche launched Multiverse, another multimillion incentive program. Other interesting developments include the updating of the Avalanche Bridge to allow support for BTC in Avalanche DeFi and the announcements of a promising new wallet called Core.

Tokenomics

So you’ve learnt all about Avalanche and want to bet the farm. Hold your horses! It’s always a good idea to investigate the tokenomics before diving in the deep end. Let’s start by taking a look at where things began:

Avalanche held an initial seed round at $0.33 per coin. At today’s price of $24.55 that’s a 74x gain.

Next up we had 2 private sales. One at $0.50 and one at $0.85. Today’s price yields gains of 49x and 28x respectively. The difference between the two sales is that the $0.85 coins were immediately liquid, so one can presume that a fair amount of those were sold for juicy profits towards the end of 2021.

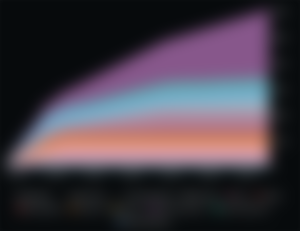

There was a considerable amount of coins allocated to various entities such as the foundation, team, strategic partners, etc., from the initial pre-mine. This graph of the liquid supply curve demonstrates this rather clearly:

There is a max supply of 720 million $AVAX. The coin itself is used for staking and for paying transaction fees on the main chains. In subnets however, $AVAX is not necessarily required for transaction fees. Although one could be concerned that the lack of requirement of $AVAX could have a negative price impact, it is worthwhile remembering that any validators wishing to support a subnet must always hold a minimum of 2000 $AVAX.

Still can't make up your mind?

Can’t blame you. There are so many alternative layer 1 blockchains each competing for their own chunks out of the Ethereum pie. The closer we get to Ethereum’s transition to proof-of-stake, the harder it becomes for these Eth Killers to differentiate themselves.

The team has also developed a reputation for missing deadlines and has even gone so far as to remove the roadmap from their website.

Finally, we didn’t yet mention the shenanigans of the Terra ecosystem implosion earlier this year. While the material number of $AVAX coins sold to LFG (Luna Foundation Guard) are not significant enough to dent the price in the long term, the razor sharp attention of regulators will have been brought towards the Avalanche ecosystem considering their unfortunate link to the Terra fiasco.

Please note however, that all this information provided today, both the positive and negative, should not be taken as financial advice. The decision to invest in a cryptocurrency is yours and yours alone to make and should always be supported by due diligence and solid research.

Getting started

If you’re coming from a centralised exchange you can usually chose to send to either the X-Chain or the C-Chain. Usually it makes sense to send your assets directly to the C-Chain as that’s where the majority of the activity occurs.

If your assets are already on a crypto network, then you’ll want to make your way over to the Avalanche Bridge. More detailed support can be found here. If you’re bridging more than $75 over from Ethereum then the bridge even provides you with a little airdrop of $AVAX to help you on your way.

As far as wallets go, users that are already familiar with other EVM compatible chains should have no problems here as Metamask is a perfectly good option for the C-Chain. If you want to explore deeper into the depths of the Primary Network you’ll need to get acquainted with the Avalanche Wallet. Avalanche does have a new wallet in the works however, Core. This will be offered as both a browser extension and mobile wallet that will enable users to navigate the entire ecosystem (dApps, subnets, and internal chains), as well as to natively bridge and swap assets.

So what to do with your time? Until more subnets begin rolling out, you’ll likely be participating on the C-Chain which is already home to several interesting projects such as:

Finally, you’re always in need of a good block explorer when navigating a crypto network and my personal recommendation is Avascan. Avascan offers a good all-round view of the entire ecosystem, including the various subnets. You could try others, such as Snowtrace (for the C-Chain) which is very similar to Etherscan.

Closing thoughts

You could be forgiven for thinking that a cryptocurrency ecosystem named after snow would thrive in the midst of a crypto winter but alas, Avalanche is suffering heavily just like every other layer 1 blockchain ecosystem out there.

Although the chain’s unique architecture was set up with the needs of financial institutions in mind, the most obvious and present use case at the moment is gaming. The successful deployment of both Crabada and Defi Kingdoms to their own subnets is proof of this. According to their website, there are several other games launching soon. Should Avalanche be able to convince the wider gaming community to set up shop in their own niche subnets, this could just be the right catalyst to spark a new and exciting narrative driven rally.

See you on the slopes,

JaseDMF

Original content, copyright © JaseDMF 2022. First published on Medium.

Cover image by Daniel Frank on Pexels (modified)

Let’s connect:

Twitter | Medium | Publish0x | Read.cash | Noise.cash | Hive

Disclaimer: some URLs may include affiliate links. These don’t cost you any money, nor do they alter your web browsing experience. They do however help yours truly keep the heating on in the winter!

Where to next?