I had a promise to write an article about trading indicators, but it's been so many days and I have not yet done any. So, I decided to write, because I know some of my fellow here is waiting for this. Sorry, it took so long because I don't know what to prioritize anymore lol.

Trading is a very complex matter to understand because you have to learn the indicators for you to have a good entry and exit of your trades. Understanding indicators will help you to determine how the market behave in the next although the market is unpredictable, Technical Analysis (TA) and Fundamental Analysis (FA) will likely guide you to have a better trade outcome. Both TA and FA is very complicated to understand, TA is focused on reading the charts using the indicators while FA will focus on the fundamental aspects of the coin. On TA it also includes reading candlesticks, it's really hard if you only know 😆

So, I will write first about trading indicators which are the MA, EMA (which is under MA), BOLL, MACD, RSI, KDJ and VOL. These are the indicators that are present on the Binance trading platform, and maybe so in other trading platform.

MA (Moving Average)

Moving Average is very easy and popular used by the majority of traders on their Technical Analysis (TA). It uses previous price data and average/ smooth out of price, an average is calculated over a specific period. Some traders used MA to find trend direction for entry and exit because it cuts the noise from the market and smoother out the price to understand its trend.

There are types of Moving Average;

Simple Moving Average (SMA)-

It calculates the average price given over the period. It can be used to find trends. Most traders use a combination of moving average, which suits them. Some use 50, 100, or 200-period moving average for 4H and 1D TF (Time Frame) for trend directions. Some traders using Moving average crossovers to enter and exit the trade when the price bounces from the MA line. Knowing the bigger TF trend if it's bullish or bearish while entry and exit in smaller TF will have some good trades.

Exponential Moving Average (EMA)

This is widely used for some traders than SMA as it gives more weightage to the most recent price by using the most recent data of price. It gives many more entries than SMA with the trend direction it can catch many more swings. Crossover is applicable too.

Smoothed Moving Average (SMMA)-

This indicator is just an additional to EMA & SMA which gives equal weightage to the current price as the previous prices take all available price data into account. Using the three indicators SMA, EMA & SMMA will give traders potential entries as it is a lagged indicator based on the last price.

Golden Crossover - When a short period MA (Moving Average or EMA, or SMMA) cracks above then long period MA is known as Golden Crossover. Traders see it as a long term uptrend or bullish momentum.

Death Crossover - It is just the opposite of Golden Crossover which indicates a long-term downtrend or bearish momentum.

Bollinger Band (BOLL)

It is a volatility band that is usually based on the standard deviation. The band expands or deflate with the increases and decreases of the volatility. The price is wrapped with three SMA (Simple Moving Average) that is known as the Upper band, Middle band, and Lower band. Traders used their strategy trade style with default BB (Bollinger Band) with a value of 20 in its indicator.

Relative Strength Indicator (RSI)

It is an oscillator momentum used by many technical traders in discovering the speed and changes in price movements. RSI is a leading indicator that has fixed oscillating rage from 0-100. RSI below 30 is considered oversold

and if it is above 70 it is considered overbought.

Using the RSI indicator is somehow not a good strategy it needs to have confirmation along with the other indicators. Sometimes traders only used it to find divergence and find a possible good entry.

What is RSI Divergence?

Relative Strength Index (RSI) Divergence is used in price action traders for the entry and exit trades. RSI Divergence is created when the RSI line diverges the momentum of the market or it opposes the price respecting to RSI.

Bullish Divergence

It occurs when the price is continuing the lowest low respecting to RSI making a Higher high, then it's probably Bullish Divergence. But sometimes it has some false divergence especially when the market swings. As you can see in the photo the price is making lower low but the RSI indicator is going down.

Bearish Divergence

It occurs when the price is making Higher High respecting to RSI that is lower low is called Bearish Divergence.

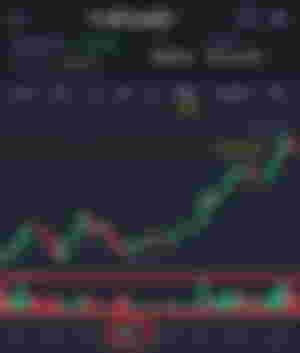

Moving Average Convergence Divergence (MACD)

It is a momentum indicator being used by technical traders which calculates the interconnection between two EMA (Exponential Moving Average). In MACD there is fast EMA with the length of 12, slow EMA with the length of 26, and a single line of length 9 is the default in general.

How to use MACD?

Traders usually used its crossover with the entry and exit of their trade position. When the MACD line (yellow) crossover with the Signal line (purple) above the histogram then it's a buy signal, but when the Signal line (purple) crosses the MACD line (yellow) below the histogram then it's a sell signal.

KDJ Indicator

It is a technical indicator being used to analyze and predict changes in stock trends and price patterns in an asset being traded. KDJ is otherwise known to be a random index. This indicator is practically or commonly used in market trend analysis or short-term stock.

KDJ is derived from Stochastic Oscillator Indicator but it has different because it has an extra line called the J line. The values of %K and %D line shows the security is overbought (over 80) or oversold (below 20). When %K crossing %D is the moments for selling or buying. The J line is representing the divergence of the %D value from the %K. The value of J can reach beyond 0-100 for %K and %D lines on the chart.

Volume (VOL)

Volume is the number of units being traded in the market during a given time. Measuring the number of individual units on an asset that changes hands during that period. Each of the transactions involved a buyer and a seller. When they reached an agreement at a specific price, the transaction is recorded by the exchanger facilitator. This data is used to calculate the trading volume.

Traders look after to use the volume indicator attempting to gain a better understanding of the strength of the given trend. If the volatility in price is supported by high trading volume, it is said that the price movement is more valid. On the contrary, if the price movement is supported by low trading volume it indicates the weakness of the underlying trend.

When buying volume is huge then it would mean bullish momentum, otherwise when selling volume is huge then it would bring bearish trends.

If you really want to learn how to use those indicators there are a lot of videos on YouTube, for you to learn more and how to execute more of it in your trades. Thank you for reading, I hope you learn something! @Eybyoung

Lead Image from Unsplash

Source: Crypto VIP Signals ™

PS. I hope the bot will be friendly again to me 😔

So confusing to look at 🤣🤣🤣 i need to check back your articles with jane about trading and indicators😁