Daily crypto news alerts for 13th January, 2021

🗞Price Analysis: Bitcoin Cash for 12/01/2021

After Bitcoin, the world's largest cryptocurrency, stabilized above the $36,000 mark, the broader altcoin market managed to cut its losses after yesterday's crash. Altcoins like Bitcoin Cash and DigiByte were looking to move higher on the charts as buyers sought to gain control of the market, but on the other hand, BAT was on track to recover as altcoins were blinking green and looking at the $0.265 resistance level.

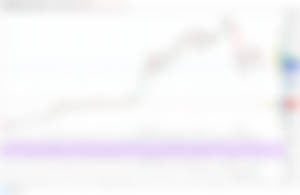

BCH/USD

Bitcoin Cash managed to recover the $500 mark after bulls stepped in and cut some of the losses that occurred yesterday. At press time, BCH was trading at $496.34, down 3.5% in the past 24 hours. The price was also far from the local high of $654.32, which was optimistic as evidence suggested that momentum could shift towards bulls in the short term.

Stochastic RSI moved north of the ceded territory. If the index continues to head towards overbought areas, the price could immediately drop to $551.16.

In addition, On Balance Volume has shown that an increase in the number of buyers can drive the price of a cryptocurrency.

______________________________

🗞Bitcoin related: Did we learned anything about Whales in the past 48 hours

After a significant period of volatility at the time of writing, Bitcoin has finally condensed around the $35,000 mark. This was a relief for many, especially as the price of the cryptocurrency has dropped from $41,000 to $32,000 in the last 48 hours. While some investors feared the worst, no further excerpts were seen on the charts as Bitcoin has rebounded in the past 12 hours.

Given that the short-term period of Bitcoin trading has been followed by uncertainty in the press, Glassnode has identified a number of key factors that could indicate an important role in the future.

😮Bitcoin NVT Premium Still Below 2019 Levels

The bitcoin NVT ratio, or online value / conversion rate, is the key to determining whether the bitcoin price is overvalued or undervalued. Based on Glassnode's results, NVT's premium is below the limits reached in 2019 and mostly in January 2018. What does this mean? Well, that means the visit is far from overheating and, as Willie Wu suggests, the bullish capital flow in the market remains strong after a major dip.

Indeed, short-term investment flows taking place on local exchanges remain optimistic as investors are actively buying at this all-time high.

💪Are the whales really active?

To test the interest of the whales, we have observed their movements over the past 24 hours and some confirmations have been made. According to the above figure, after a reduction from USD 41,000 over a period of approx. 13 193 BTC have been accumulated. $35,000 and another 1,017 BTC were collected for $32,600.

While these databases are not very large, it's worth noting that whales continue to be active despite bearish pressure.

🤔Bitcoin recovery and withdrawal probability 40%

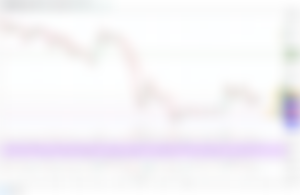

BTC/USD

Although the market remains optimistic, it is interesting to expect a 40% discount on such a visit. While that may not be the case in the next few weeks, the eventual drop to $25,200 is not surprising.

Ahead of 2021, cryptocurrency stocks increased by another ~ 25% when pressed, indicating the positive nature of the bitcoin market. The recent conclusion is normal in accordance with the market structure, otherwise the contraction would have occurred later and would have been even greater in the coming weeks.

______________________________

🗞This is how the CEO of MicroStrategy intends to get more companies to buy Bitcoin

Ever since business intelligence firm MicroStrategy invested $425 million from its coffers in bitcoin last year, the company and its CEO have been praised for supposedly implementing massive adoption of BTC.

The beginning of the bitcoin fortune allowed MicroStrategy to take advantage of market conditions and increase the value of its BTC assets. At a time when bitcoin was approaching $13,000, MicroStrategy reportedly made $100 million in two months after buying bitcoins. These numbers were compared to the $78 million that MicroStrategy has earned over the last 3.5 years of its actual operations.

In addition, the “top reserve of the Treasury” has increased the company's overall market visibility, said Michael Saylor, CEO of MicroStrategy.

Saylor announced that the company's new program will provide an overview of ways to "integrate the Bitcoin monetary system and the benefits of different approaches."

Together with Ross Stephen, founder, CEO of Stoneridge and other industry leaders, Michael Saylor will discuss the integration of bitcoin into Treasury reserves. The presentation will also include the inclusion of the asset on the balance sheets of public and private companies. Legal, regulatory and audit issues are also on the agenda.

The company is set to become the first publicly traded company to invest significant treasury assets in Bitcoin, or so the company claims. MicroStrategy, on the other hand, has 70,470 BTC worth over $1596 billion in its reserves. This makes it the largest property owner on the list of other companies investing in BTC, according to the Bitcoin Treasury.

However, in November 2020, Real Vision economist, co-founder and CEO Raul Pal didn't think MicroStrategy was going to use Bitcoin. I spoke to podcaster Peter McCormack and said to Pal:

I think Michael [Sailor] will not be leading the introduction of companies into space because he really speaks the language of bitcoin, not the language of corporate cashiers, and this is about to happen.

However, Saylor has always talked about why more companies need to invest in leading assets. In fact, the CEO even suggested that billionaire Elon Musk could turn Tesla's balance sheet into bitcoin. Saylor told Musk that other S&P 500 companies would follow suit if he took over the digital asset.

______________________________

🗞Prices Analysis: Bitcoin, Ethereum, Ripple for 01/13/2021

Buyers were unable to recover above average prices yesterday. Will the moving average continue to contain the recovery momentum?

BTC / USD

Yesterday morning, buyers continued to try to restore the BTC price, and in the morning they tested the hourly EMA55, but failed to gain a foothold above the average price level.

The pair returned to the area of weak support at 32600.00 USD tonight. The sales volumes are still low, so there is a possibility that the pair will recover from this level above the POC line (34007.78 USD) and again rest against the resistance of the hourly moving average EMA55.

If the level of average prices continues to hold back the recovery dynamics, then until the weekend the pair will move sideways along the Point Of Control indicator line (34007.78 USD).

ETH / USD

Yesterday, during the day, buyers tried to overcome the resistance of the hourly EMA55 twice, but both times the ETH price rolled back to the support at 1000.00 USD. Ether trades were held at medium volumes, and if this trend continues today, the sideways movement will continue.

If the bears intensify the onslaught and push the support of 890.00 USD, then the pair will roll back to the green trend line (800.00 USD area).

XRP / USD

Sales volumes were low yesterday and the XRP price was able to test the upper border of the 0.310 USD side channel. As we expected, the pair remained in consolidation, narrowing the range to the two-hour EMA55.

If today the bears push the support of 0.260 USD, the pair will roll back to the equilibrium price in the area of the POC line (0.228 USD).