Bitcoin(BTC) or Bitcoin Cash(BCH)

Let's keep it simple by starting with Satoshi Nakamoto's title of Bitcoin, as used in the white paper. He described it as -

"Bitcoin: A Peer-to-Peer Electronic Cash System"

I am sure there are plenty of articles written about Bitcoin Cash , or other content which points to it. And it all stands to reason given that this platform is a real use case of BCH. So why not?

Every writer brings a new insight, something different from the previous one, a new perspective, a new way of explaining. It's a good way to keep adding more quality content on BCH especially for the newbies and for other users who are trying to understand and get their way through this. And as an ode to BCH, I have decided to write one too. I hope it brings some value and clarity in understanding BCH. However, it is understandable to have doubts as we all have different levels of understanding based on our previous knowledge and our diverse backgrounds. Please don't hesitate to hit me up with your questions. I will try my best to explain and don't worry if your question appears stupid to you, we all have learnt our way through asking the exact stupid questions.

If you don't know what a blockchain is, and terms like PoW, scalability, block size, hash algorithm all haunt you, then don't fret. Lucky for both of us, we have found each other. I will try explaining in a simplified manner with minimal use of those technical words. And for some of the those complicated terms, I will try to break those down for you in a much basic form for easy understanding.

A blockchain is nothing but a ledger, and what is a ledger, a diary of sorts or simply an account book which records all the transactions, incoming and outgoing. You probably wondering, that's way simple. How can it be that? It is exactly that, where transactions are recorded. We are talking of digital transactions, so these are recorded on a data block, and then as you keep adding more and more blocks of data, it forms a chain, and there you have it, a blockchain, or a chain of data blocks. Simple so far.

In traditional setup, accountants used to record entries in the physical ledgers. The physical ledger could however, be damaged, stolen, burnt just like other physical records besides other possibilities which would erase all the previous record of transactions (unless you had been smart enough to copy it). Right! So we did have a problem with the conventional system and that's where digital ledgers filled the gap. But soon it was realised that any of the existing public ledgers were but centralised under the control of select few which meant there was no guarantee of it being authentic or free from any sort of interference. That led to distributed ledgers or distributed systems. Internet was what made that possible. Distributed systems are simply, systems with distributed copies over different computers, also called nodes, which make it difficult for the data to be manipulated. For the date to be manipulated, each of the copies needs to be manipulated which is definitely more difficult than manipulating one copy.

Now back to Blockchain.

Blockchain is, but a ledger, a record of transactions which is distributed and hence called a distributed system. For it to work, the information needs to be same and synchronised all across the distribution points, and it needs a specific order. One cannot spend money that has not been received, nor can one spend money that is already spent. This order is the fundamental requirement which is based on the occurrence of a transaction and every node of the blockchain needs to have the same copy. Even if blockchain was not a ledger and a data log of some sort, it would still need that order and an identical copy of the blockchain. One order mismatch, and it's a different blockchain. So, the importance of the order is paramount. I won't go into the further specifics of it, not in this article at least.

Now, If we were dealing with just two or three users involving only a few transactions at once, record keeping would have been so much easier but when it comes to millions and billions of people and transactions, imagine the kind of speed that is needed to execute all of these in given time. Consider this for an example, You walk in to a grocery store and there are twenty people ahead of you at the billing counter. You will have to wait for the cashier to bill those twenty ahead of you before you get your turn. So it has taken you that long to get the transaction initiated. Now, if everyone is paying with the cash vis-a-vis card, you can expect the wait to be even longer. But what if, it was the other way around and paying by card was slower than paying by cash. Do you still think people would use credit card over cash, considering time to be the only factor. I wouldn't for it would mean more time for my transaction. Now, use the same analogy to understand how transactions would happen on Bitcoin. The transaction speed on bitcoin is just 7 transactions per second which means with hundreds of thousands of users, the waiting time will be insanely longer, just like the queue at the counter, only way more.

Would you want that? Would businesses want that? or Would they prefer something like a Visa which can do about 1700 transactions per second (tps) achieving roughly 150 million per day.

One of the major constraints for any business to progress is scalability, which means it should be able to deliver the growing demand. For blockchain, it would mean more and faster transactions. If we are to think of blockchain to step into our traditional infrastructure, the speed of executing these transactions has to be faster. Time is always of essence and no one wants to wait, not when it comes to money.

Comparing the transactions stats of Visa with that of Bitcoin, which processes about 7 per second, do you understand the problem here. It's like moving back into the time, which isn't going to work for anyone. Waiting for a transaction for several minutes before the confirmation comes in would be ludicrous. Imagine twenty people waiting at the grocery cash counter in El Salvador for their Bitcoin transaction to come through. Looks like a long wait to me.

For the sake of this article, I won't dwell upon decentralisation and security aspect and only focus on the scalability part of it. Let's go back in time when BCH and BTC were one. I hope you knew that already.

The problem of scalability needed a solution, which could either be achieved by making the data smaller in each block which meant more data in a data block or it could be done by increasing the size of the data block, again more data in a data block. Traditional Bitcoin block size is 1 Mb while that of BCH is 32 MB. So there, you got the answer, and it was second option which was chosen for BCH.

Think of it like a river which was flowing downslope until it hit a wall in its path (scalability), the water started flowing towards either sides of the wall disintegrating into two tributaries. That's how bitcoin forked into BTC and BCH.

Back to the scalability solution, 2017 was it when it happened. The companies and miners who were the primary stakeholders decided to increase the computing power of bitcoin through a technology called segregated witness, or Segwit. This came as a soft fork, which meant the river was still one and still not divided yet, with some change to the data block. The transactions which are added to the data block in the blockchain need to be verified in order for them to be a part of the blockchain.

The solution happened to the first one, where the amount of data which needed verification, was reduced in the block. Basically, the signature data was removed from the data block which translated to lesser data needing verification, and the signature data was attached as an extended block. Signature data was roughly 65 percent of the data processed in each block, so the shift stood a good reason. And that's why the name segregated witness. Cool, right! There was also a subsequent proposal to double the block size which came to be known as Segwit2x. However, that proposal failed and was never implemented.

Much around the same time, there were other individuals who believed in Satoshi's Bitcoin than what was to become of Bitcoin. They believed SegWit2x was only a short term solution which would not address the core issue of scalability because at some point, data block size would still be an issue. They also felt that it was a deviation from Satoshi's roadmap. Segwit2x was anything but transparent and was against the core principle of decentralization.

So, some miners and developers decided to stand for it and came out a hard fork, known as BCH which had its own specifications. The most important distinction was the side of the block which was increased to 8 MB and later to 32 MB.

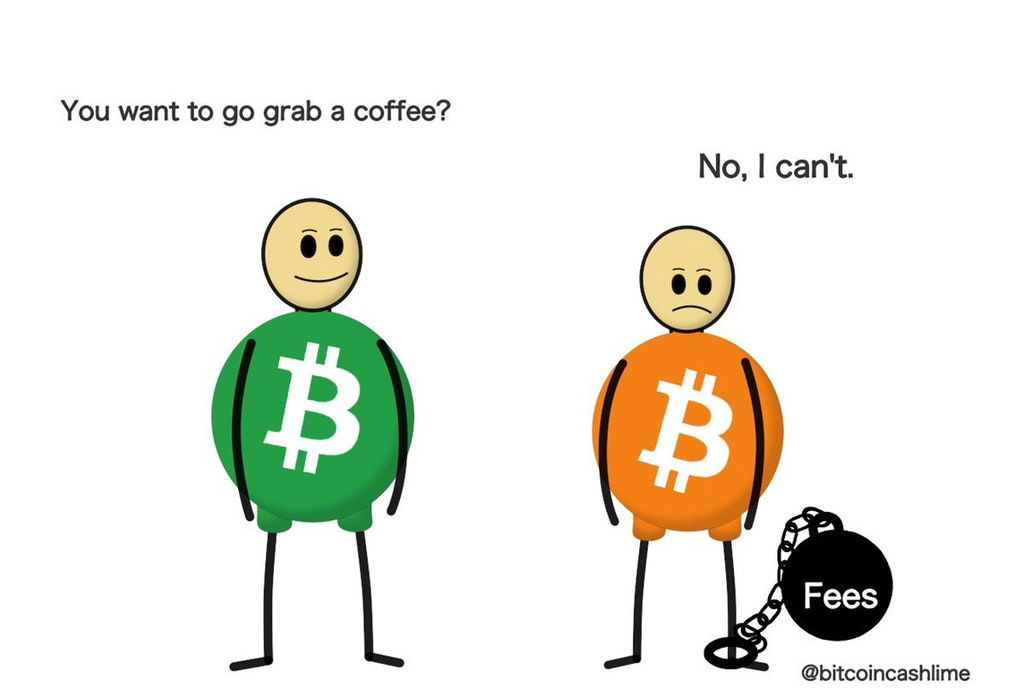

Thus, unachievable was achieved and a solution was provided with faster transactions, translating to short wait times and low transaction fees. The other side of the story is a bit of a sad one, where the crypto world is yet to see and accept it for what it truly is. A major part of that comes from uninformed users who think of BCH as a copycat of BTC, which is far from truth, anything but better tbh. The market confidence and the adoption is also lower but that stands to reason, given it is much younger compared to BTC.

Read.cash and Noise.cash are important use cases and drivers for BCH adoption. They have created an ecosystem to support BCH. For rest of the crypto community to lean towards BCH and see more of its adoption, education, research and development will go a long way.

BCH could have been a perfect contender to El Salvador's crypto adoption, in fact still can as far as the retail is concerned. Countries in Africa and South America which are open to change and crypto adoption can be the perfect drivers for BCH's adoption. Individuals like @RogerVer and @MarcDeMesel are doing the bit, but unless it has support from rest of the community, it won't see that impetus. It means we will have to contribute in ways, by making investments, educating, writing, creating more and interesting content for others to recognise it. If the community grows, BCH grows and we all grow together.

Final Thoughts

Bitcoin and BCH can both exist and will exist as separate blockchains adding value to the crypto space. BTC with its limited scalability and higher transaction fees will never find an acceptance as a money moving machine. BCH tick marks that exact spot and is a suitable contender to step up. With some tweaks and changes, it can be a much better alternative than other blockchains which are trying to find a purpose or creating one. BTC can continue to be a store of value just like gold which no one uses (other than jewellery) except for investment. No one goes flashing the gold coins. BCH fits that space quite perfectly.

Now back to the Satoshi's white paper,

Is Bitcoin still a Peer-to-Peer Electronic Cash System, I doubt and not with the existing set up. Is BCH a Peer-to-Peer Electronic Cash System, most certainly.

Thank you for your time.

Socials

For price updates, check Coinmarketcap or download the app on Apple/ Google

Join CMC on Telegram(G), Telegram(EN), Twitter, Reddit, Instagram, Facebook or subscribe to newsletter

My crypto Watchlist on #Coinmarketcap

good idea to explain