Notional Cash Pooling

Basel III, projected to come into effect before 2019, would have huge inferences on the notional cash pooling business, making it very difficult for banks to offer this service profitably. This is likely to make certain banks reassess the business. They would most likely either reprice their offering or exit from the business.

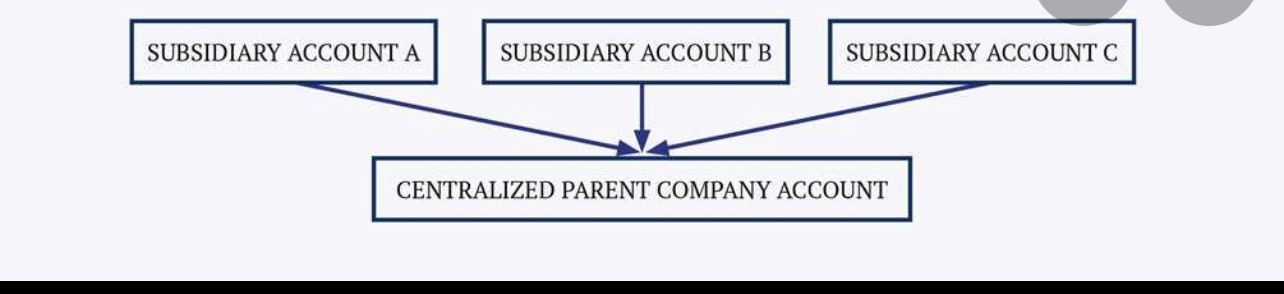

Notional cash pooling enables firms to oversee finances for the group from a specific account, offering corporate treasurers an appropriate, combined view of accounts that could be spread across several associated organizations, in various jurisdictions and currencies.

It is not permitted in the US. However, it is prominent in Europe and Asia as an effective method for huge multinational firms to manage their balance sheets at a group level. It permits the firms to balance their liabilities, including those of their affiliates against their assets.

At the same time, by ensuring the increased transparency that is required to protect the financial system, Basel III has created a requirement for banks to report all the assets and liabilities of their clients distinctly.

This would not have substantial inferences for physical cash pooling. However, as far as notional cash pooling is concerned, where there has been no physical transfer of funds between currencies, it places an additional burden on firms with extremely increased disclosures of their liabilities.

Where currencies are managed distinctly, but as a portion of a specific master account, the liabilities related with every currency position would have to be disclosed, and have an equity capital distribution set against them, usually ranging from 11% to 13%.

As far as banks providing notional cash pooling to clients are concerned (though they are comparatively few), this would most likely have implications for leverage as well as liquidity coverage ratios. The number of firms using this service is also comparatively modest, but the ones that do are among the banks' main clients.

Notional cash pooling for such clients could have a substantial impact on a bank's balance sheet. In several instances, the impact on leverage and the LCR would weaken the case for providing the service to distinct clients. It would mean that some banks could pull out of the business.

On the other hand, the regulation does not transform the fundamental requirement for firms to effectively manage their balance sheets.

Notional cash pooling would still be engaging for clients with extensive businesses, where the treasurer would like to have a holistic assessment of group finances. It ensures the firm need not manage FX positions in the market, which could be a substantial cost in itself.

It also eliminates the requirement for inter-company loans and provides the group treasurer much more control over cash inflows and cash outflows within the group.

It also offers significant operational flexibility. Cash pooling permits firms to function in new jurisdictions without establishing relationships with regional banks to deliver local currency.

Notional cash pooling is all about effectiveness: where a huge and varied group could require several treasurers globally, it allows the function to be efficiently centralized in a particular place, managed by a distinct treasurer.

Certain banks may exit the business since it would be difficult to earn a profit from it, continued demand ensures that the product itself would survive. Firms must be ready for an interruption. However, they should not be discouraged if their early discussions with banks do not proceed the way they wanted.

According to Arnaud Pichon, international desk supervisor at Société Générale, "The nature of the product means that while a client's business might have a significantly detrimental impact on one bank's balance sheet, it might have a much smaller impact, or even a positive impact, for another bank."

For e.g., a bank that has a significant amount of USF, but little GBP on its balance sheet could turn down a client having most of the cash in USD, but accept a client having most of the cash in GBP. A bank with reverse exposures could take the opposite view. Therefore, treasurers must communicate with as many banks as possible, to identify the bank with the best plan.

Cash management has usually been a complex business, and firms have tended to stay with their providers if they are satisfied with the service being offered. Shifting providers require substantial effort, so several firms would certainly prefer to maintain their existing relationships.

Despite this, firms must use the next two years to review their existing arrangements and determine whether they are viable. Even if their business is attractive to their bank at present, any transformation of conditions, such as a large acquisition, could greatly transform the feasibility of that relationship.

According to experts, at present, firms engaged in notional cash pooling require a backup plan. They must seek clarification from their banks whether the service would be repriced or terminated because often it would be one of the two.

Banks have been known to exit from the business in the past, indicating how disruptive this could be for their clients. Firms should not wait to receive information that the terms of service must change. Instead, they should be identifying a provider who is willing to offer the service at the best price.

The use of notional pooling is expected to increase in the future. It would provide firms with a better understanding of their financial position and therefore, they would be able to manage their money more efficiently.

Read Academy of Financial Trading reviews and testimonials on how AcademyFT has helped thousands of students achieve success in financial trading. Academy of Financial Trading is the leading online financial educator. To know more about how AcademyFT has helped it's 100,000 and more customers to trade the markets, follow on Facebook.