Technology is often promoted as though it will make life better and easier. As an IT professional, many of my colleagues speak highly of great cost savings that computer solutions bring. This seems to be true on a small scale, but if you are like me, you wonder if modern life, full of the high-tech marvels, is as labour-free as promised. To me, it seems the more we innovate, the busier we become. This seems counter-intuitive. Technology does bring a sense of accomplishment and potentially reduces waste. But it seems to also seems to bring sad circumstances, like loss of jobs to automation (e.g. supermarket self-checkout) and contemporary consumerism with associated environmental impact.

Reposted @ https://dunconomics.blog/the-addictive-cost-of-technology/

This page is now available as a video here: https://youtu.be/zOqJrUv0XEQ

This article has a wide target audience. If you are disgusted by modern disposable technological trends and you often think about leaving the rat race to raise grass-fed cows, read on. You may be surprised to learn how the current top-down economic system is causing this unsustainable madness and how to solve it. Or, if you are a business owner who lives comfortably in a high-rise penthouse, continue reading to hear how much of your wealth is being stolen. Or maybe you are a decade away from retirement but you struggle to keep up with these new computer contraptions at work. You wonder why things can’t be like the good old days of pen and paper.

What follows is a broad lay perspective on what I think is a profound tragedy regarding the relationship between economics and technology. I live in Australia but all concepts are applicable to any nation. I’ll try to be brief with the following economics primer. Try to stay awake, so the main point makes sense.

If you keep up with the news, you probably hear that most governments try to regulate inflation at 2-3%(1). The term “inflation” is commonly used in its utility meaning – the rising cost of living. It means your money will not buy as much stuff and things will generally cost more over time. For example, a loaf of bread may have cost $3 last year compared to $3.10 today. But if you get paid more, this should not be a big deal, right? That’s the idea.

To calculate the cost of living, real product and service prices are recorded and indexed. The most common index is the Consumer Price Index (CPI). This is what is mostly quoted in the news. Governments gather thousands of consumer prices and compare them with previous periods.

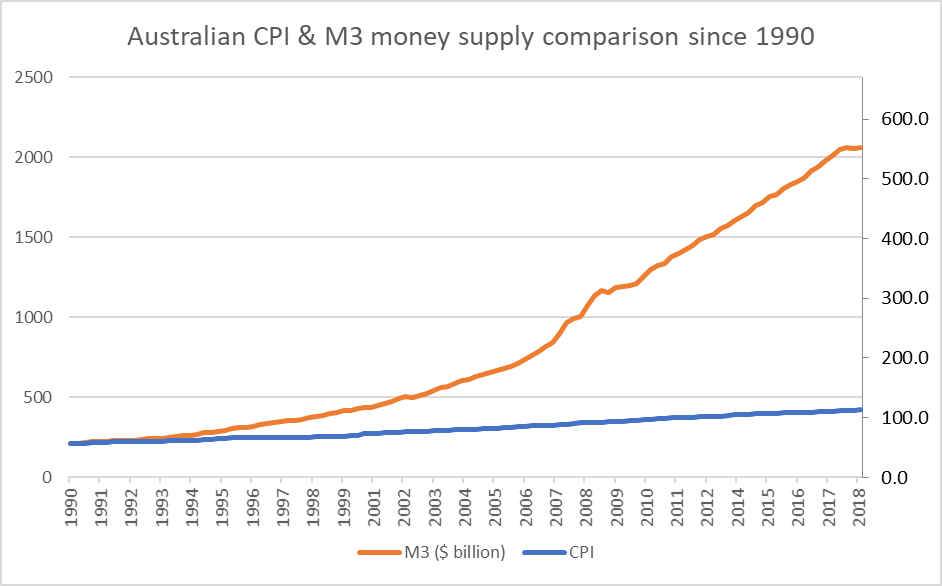

Governments can encourage these prices by manipulating an economy with a central bank. While the term “bank” is accurate, in the context of this article, you only need to think of it as the entity that creates the national currency (AKA money). The main way the central bank increases the cost of living, is by continuing to print the currency (now-a-days this is mostly done digitally but is conceptually the same). This bank is the issuer so they can make as much as they want. By printing more dollars, yen or euro, the currency is not as rare and therefore becomes less valuable. This is the literal meaning of “inflation” in economic terms. Money is valuable because it is rare. The more money that is available, the less valuable it will become. See M3 money supply diagram below(2).

Much economic study aims to predict this relationship between money supply and the rising cost of living. This is because the relationship is organic and somewhat unpredictable. Economists must consider how fast people are spending (velocity) and even what people feel something is worth from a historical context. This is why real prices are used to calculate CPI.

“What people today call inflation is not inflation, i.e., the increase in the quality of money and money substitues, but the general rise in commodity prices and wage rates which is the inevitable consequence of inflation.” – economist Ludwig Von Mises (1974) – ‘Planning for freedom, and twelve other essays and addresses’.

Lets summerise this axiom as:

Creating money increases the cost of living

Before I send you to sleep, now it gets interesting.

One day the following thought struck me. Printing money increases the cost of living while technology integrators, such as myself, are reducing the cost of living by helping businesses cut costs. Potentially, they could cancel each other out.

To clarify: When costs are rising, businesses will often reduce costs by using technology(3). IT professionals and engineers are among other occupations which frequently aim to save businesses money. For example:

Installing a computer software package allows a small business to spend less money on bookkeeping fees. A hired accountant now spends half the time as invoices can now be sent via email.

An automotive manufacturer installs a robot welder which increases the speed of production. Even this example results in decreased costs because there is less labour required per vehicle.

A food producer decides to use a new preservative for transportation. This allows the food to be shipped further to gain customers and reduce expiring food.

In theory, on a national scale, these technological changes would have a “deflationary” impact on the cost of living. In essence, technology is pushing the cost of living down. Let’s summarise this axiom as:

Technology decreases the cost of living

In previous decades, with less technology available, manufacturers were required to hire many workers. Go to the source

Sometimes process improvements only have a positive impact such as changing a manufacturing procedure to produce more with fewer resources. On the other hand, the food producer above may discover that their preservatives are potentially harmful and render food less nutritious(4). Overall, I propose this, at best increases dependence on technology and at worst leads to a gradual lower quality of products. When the central bank inflates the currency, encouraging price increases, the market is absorbing much of the cost through technology.(5)

The diagram below may help describe this hidden cost of inflation. Seen below is a comparison between CPI (the cost of living) and money supply. It seems logical that an increase in money would proportionally increase the cost of living. But as shown in the diagram, the cost of living is measuring far lower than the accelerating inflation. Our current dependence on technology explains this discrepancy.(6)

Simply stated,

Technology is absorbing much of the cost of inflation

“…you can sell a lower quality good or service at the same price and there’s plenty of evidence to suggest that’s been happening in Australia the US and other places where they’ve been inflating the money supply. And that becomes a moral dimension too – you know you’re essentially ripping people off” – Darren Brady Nelson , Chief Economist, LibertyWorks. 2017 Australian Senate Inquiry testimony.

Dependency on tech is perpetuated when Central banks continue to use the CPI in monetary policy decisions(7)(8). When technology reduces costs for a population, a central bank will usually inflate the currency (via money “printing” or interest rate changes) compounding the problem.

Let’s think about our three characters. First the organic-loving hippy.

Organic farming has a specific definition but perhaps it can be summarised by a general rejection of technology for food production. If we didn’t have accelerating inflation, I suspect more people would favor organic farming. Sure, many would still opt for our current conventional food suppliers (especially those escaping poverty), but with a lower cost of living, families would have more left-over wealth which could be used for more expensive food options. This is in contrast with the current sad reality that consuming a purely organic diet is generally available only to the wealthy. Putting the debate of organic benefit aside, consumers should be free to choose this option given it was once the only option (before the Industrial Revolution). So, if one wants to see a greener world, they should be advocating to free our second hypothetical character, the business owner, from the shackles of modern central bank inflation. If the entrepreneur doesn’t have to worry about a perpetual increase in costs, they will have less reason to reduce quality or implement technology as band-aid fixes.

As another example, imagine how cheaper labour, caused by a lower cost of living, would encourage waste recyclers to compete with big mining multinationals selling metals and other raw materials. With less dependence on technology, we can see that there would be less need to “get with the times”. More emphasis on experience and labour. Less on change and improvement which is good news for our hypothetical retiree.

A free market:

A market with inflation

“Inflation, being a fraudulent invasion of property, could not take place on the free market.” – economist Murrary Rothbard, ‘What Has Government Done to Our Money?’ p.48

To remove inflation there are a few options:

Disclaimer: the following is not financial advice. Seek a qualified financial adviser for financial advice.

For thousands of years, gold has served as money and continues to be used in the finance industry. Precious metals such as gold and silver have a natural low inflation rate and cannot be easily manipulated. The key distinction is that it must be physically mined. Governments are forced to tax the normal way. Unfortunately, in many countries, gold/silver cannot be used as legal tender. Trading in precious metals may sound primitive but remember people would not have to carry around heavy coin bags. Banks could still provide Internet banking and overnight settlements as our current system(9). In some countries like Australia, governments still mint (create coins) in gold and silver. So, this system is already in place available for the population to trade in it(10).

Another option is for governments to issue precious metals for currency. This was once a common practice but unfortunately, in most instances, the coins were de-valued using techniques such as mixing in other metals. This is no coincidence. Just like any business or individual, if a government can find a way to spend more than it makes, with no consequence, the temptation is too great to resist.

Recently cryptocurrencies such as Bitcoin have been making news headlines. These currencies are completely virtual, existing only in a computer database. What makes them special, is that they are decentralised in that a copy of the database is duplicated into a community of computers that no single entity can easily manipulate(11). This is why they appeal to many investors because, in theory, their investment will not devalue in the long run. Most of these digital currencies have a commitment of little or no inflation.

Lastly, we could repeal legal tender laws and other laws to allow the businesses and individuals to choose (e.g. capital gains tax). Multiple competing currencies may arise for specific purposes. For example, cryptocurrency for international trade and precious metals for local communities. Businesses don’t really want inflation so freedom of choice would help (well except for the banks, inflation props up their assets).

Observe, there is no need for more regulation. Rather more freedom in choice of money.

Inflation causes more reliance on technology and makes manual labour less competitive. With stable money, technology would be less about survival and more about helping people.

I encourage you to ponder this economic theory as you buy your groceries or use computers at work. Realising this should help remove guilt for using technology yet help you understand and empathise with those struggling to keep up with it. Technology frequently saves lives and helps people escape poverty so we should be grateful for it. Tech is not inherently evil, but as we can see, external manipulation of money is the chief cause of gloomy situations of which technology and business is often centre stage. To bring about lasting positive change, we should look to the real cause: monetary inflation.

Restructuring national economic policy is a monumental task. My hope is that this essay can increase awareness and discussion. Feel free to help by sharing.

Further research

https://www.cnbc.com/video/2015/12/03/technology-to-blame-for-deflation-pro.html CNBC: Technology to blame for deflation: Pro

Fractional Reserve Banking vs Full Reserve Banking | How Do They Work? by EconClips

Money Creation | How does it work? by EconClips

Senate Inquiry – 2017 Testimony – Money and Banking by economist Darren Brady Nelson

Austrian economics

This essay is licensed under a Creative Commons Attribution 4.0 Internation License (http://creativecommons.org/licenses/by/4.0/).

Reserve Bank of Australia is currently (2018) targeting a typical 2-3%. https://www.rba.gov.au/monetary-policy/inflation-target.html

Surprisingly, measuring literal inflation (how much money there is) is also a hard question. For example, should money generated from credit cards and loans be included? I have used M3 money supply because it is most relevant to the cost of living. Central banks encourage M3 to inflate via fractional reserve banking. This method allows commercial banks to create money with credit (keeping only a fraction and lending the rest). So, if the central bank is the initiator, it is not necessarily the sole contributor to inflation. This is a complex topic but the key take-way is that most governments mandate their currency as the only legal tender which means commercial banks can inflate without fear the population rejecting an increasingly less valuable currency.

Technology and process improvement can here on be used interchangeably. Process improvement is a more accurate umbrella term but I’m using “technology” because it means more to people.

For example, conventional food refining processes reducing nutrition: https://academic.oup.com/ajcn/article/70/3/459s/4714924#

On first glance, it may seem as though technology isn’t about lowering cost but it almost always is. For example, think about an expensive smartphone. It is true that a cheap “dumb” phone will cost less initially but a modern smartphone has additional value like providing news, Internet access and email. A user doesn’t need to buy a newspaper, find a computer or get to the post office which saves time and hence cost.

Note that CPI is an arbitrary number, interested only in difference. The above index graph is only comparing the difference since the late 50s (the earliest available data). But the picture doesn’t look any better if we reset the index to money in 1990:

Reserve Bank of Australia https://www.rba.gov.au/monetary-policy/inflation-target.html

It should be noted ‘quality change’ is often considered in CPI calculations (i.e. Australian Bureau of Statistics http://www.abs.gov.au/ausstats/abs@.nsf/Latestproducts/6461.0Main%20Features92017?opendocument&tabname=Summary&prodno=6461.0&issue=2017&num=&view=). But think about the challenge of the thousands of technology improvements particularly in a modern world. Every business manager from a small business to a Fortune 500 multinational, makes cost-saving decisions frequently. Many would impact quality which may be unnoticed by consumers. This is a monumental task to calculate these cost savings. The governmental Australian Bureau of Statistics (responsible for calculating CPI in Australia) says, “For some types of quality change, it is doubtful if any accurate measure of the change can be calculated. For example, in the case of services, consider changes in medical operating procedures (e.g. keyhole surgery) that involve less pain and a speedier recovery, or educational services making a greater use of computers. In these cases, generally no quality adjustments are applied.” Realise that this statement is only relevant for changes in quality noticed by customers and other improvements are essentially ignored and hence wasted effort in the long run.

Real-time settlements are now gaining popularity with most currency being digital which would are not really possible with physical assets.

In Australia, the Perth Mint still produces gold and silver coins as legal tender. Although, you wouldn’t want to give up your 1oz silver (worth about $20) for its $1 minted value. I am not sure if it would be legal to agree on its real market value.

If someone spent millions of dollars on powerful computers, they might be able to become the majority of the computer network and do some damage. But if this happened, people would simply stop using the currency. With the value plummeting, the computer owner would be helping his investment to fail. No one would do this because the cost will always out way the benefit.

you provide technology of addictive cost very well