Hi everyone

Ok, so here's a rather unfortunate headline. ...

Seriously?! I didn't even know he had a TikTok account. It kind of makes sense though. We're dealing with a president who likes to take executive action through social media.

After Facebook and Twitter blocked his campaign accounts, he's gonna need some way to get his message out, along with his sweet, sweet dance moves.

Oh wait, no. Sorry. That headline should read "President Trump Issues Executive Order Against TikTok." And WeChat, too.

Looks like the U.S.-China trade war is in a new phase, the social media phase. By my count, that would make this phase four. Good thing we've already locked down phase one. Only three more phases to go, unless new phases come up in the meantime, of course.

Stimulating Jobs

Enough of that though, it's jobs day on Wall Street, and we got a whopper of a report this morning.

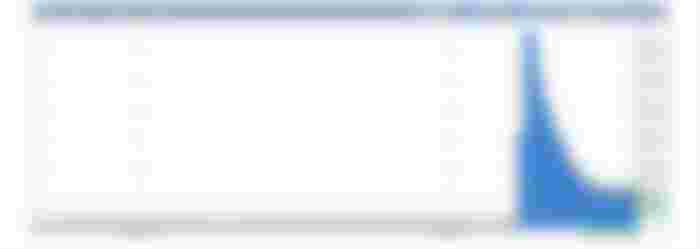

One question that we asked last month, and I still have not heard a reasonable explanation, is how the monthly jobs numbers seem to conflict with the weekly data we're receiving.

In this graph, we can see that about 1 million new Americans are filing for unemployment on a weekly basis. So how is it that 1.8 million jobs were added in July??

In any case, the jobs data only seems to be relevant to the markets these days in that it may have an impact on the amount of stimulus provided to the markets.

The Federal Reserve has already made it clear that they're putting their money printing on hold for the time being, and that it's up to the president and Congress to hash out some fiscal stimulus for the people.

Indeed, the hour for this is getting late. The provisions from the original CARES Act ran out a week ago, and yet it seems that talks between Republicans and Democrats are beginning to stall. They're just too far apart.

The Democrats want to throw about $3.5 trillion or more into the economy, whereas the Republicans are looking for something like $1.5 trillion or less. That's a really wide gap to cover.

The president has stated that if Congress doesn't get its act together, he will issue an executive order, hopefully without a dance this time. But jokes aside, there's really a very limited amount that Trump can accomplish with such an order.

The power of the purse belongs to Congress, and the U.S. Treasury can only override them in emergency cases.

So sure, the president can reallocate funds from the CARES Act, but as we mentioned above, it's already mostly gone anyway. What a mess.

Enter the Buck

With all that going on in the background, we do need to keep a sharp eye on the U.S. dollar. The slide over the last 10 weeks has been sharp, and it does look like the greenback is looking to form a bottom at these levels.

A quick glance at the chart might confirm that the technicals are in place for a bounce at this point. Here's the Dollar Index since mid-May. Check out the neat double-bottom formation, which often signals the end of a strong movement.

With that, if indeed this is the end of a trend, we can probably expect some retracements out there. Gold, silver, the Nasdaq, and even cryptocurrencies have all been riding this U.S. dollar weakness. Hang ten, everyone.

Personally, I've pulled back ever so slightly on my long positions and allocated a bit more to cash. Not that anything is certain, but the winds of change don't usually give any better indication, so if the trend does change I want to be ready for it.

Holding cash is never a very attractive prospect though, and even doubly so, in the face of these pandemic-skewed markets. Fortunately, the wild volatility we have experienced lately has produced some compelling opportunities, for example, sharply reduced oil prices.

So at least with some of those funds, I've managed to position for dollar strength in the form of short WTI Crude oil at an entry of $41.50.

Let's wish me, as well as any of you taking this trade, good luck and a fantastic weekend!

May your path be clear and the sunshine bright. May you know great love and your heart be light. May you share this message with all you know and bring great success to friend and foe.

Best regards