DeFi (Decentralize Finance) is a financial tools built upon Ethereum that provide Banking Service in New Era of digital/crypto space.

Traditionally money supply were controlled by group of financial institution i.e. Bank, to provide services in the form of tangible assets. As such, this banks were effectively run by large corporations that have only motive of profit and control of money supply and in turn, control world financial system.

Access of loan to the lower and middle class were always a hefty task and has to go through a lot of paperwork. Even approximately more or less 1 billion people aren't able to access basic banking service till today. But with the coming of defi or open financial system, it promised to bring all stakeholder together to the new modern digital banking using blockhain.

With the used of Defi products, all financial assets will come under one roof having access of financial service to everybody. Defi is an premissionless , open and interlocking financial tools/products. It means overlapping network of dapps (Applications in Crypto) and smart contracts (Type of contracts executed when certain conditions is met) which built on Ethereum. That is to say, uses of financial application such as borrowing, lending, trading, derivative, exchange, insurance etc.

Using defi tools/products anyone having access to internet can send, borrow, receive, lend, make contract, make payment, have trading and other financial services, to anyone on earth. As it is an open source and code is distributed across decentralized network, nobody would be able to prevent to access to services who want to use it.

Current Performance of Defi as of June 2020:

According to Delphi Digital's, very large number of tokens for popular apps in the DeFi space have been showing sign of great gains.

Also coming of Ethereum 2.0 will greatly impact on DeFi space as current Ethereum have the scalability issue (i.e. no. of transaction per second). With coming of Ethereum 2.0, it's scalability and staking performance will greatly improved. Also, issue of gas fees(transaction fees on Ethereum) and slow back times will have greatly improved.

Note: It is expected Ethereum will be launch in the next 3-4 months.

Future of Defi:

I will show it based on USD value and number of user that are currently using DeFi space.

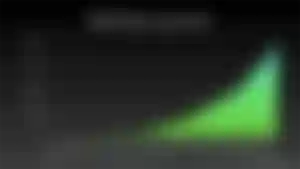

More projects being launched on DeFi space and as such, investment in DeFi tokens have been significantly increase over the years. Here is the graph according to DeFi Plus,

Next, as the valuation of Defi tokens increases over the time, the number of user that are using it also increases. All time high of 600,000 using DeFi space as of May 2020, according to Dune Analytics(Research Firm).

List of dAPPS that are most popular:

-

Kyber network has been widely accepted by the users as will below graph shows:

Note: It is fully centralized protocol.

-

Uniswap is 2nd most popular dApps as it is fully decentralized protocols with having function of automatic liquidity provision on Ethereum.

-

Compound has been gain attention recently due its functionality that allows users to earn interest on lending and borrow against the collateral function.

-

What about crypto collectibles?. Well, the largest source of platform for buying, selling and exchanging Collectibles is the OpenSea dApps.

Crypto Collectibles are kind of Art that makes them cryptographically unique in design and pattern. It has mapped on real life objects. Example: Pets, Avatars etc.

Even some crypto collectibles has high value than Bitcoin Price!!

As the adoption of blockchain technology and underlying benefit of it is noted, different government and regulator will have significant consideration of DeFi or Open Financial System.

If you wanted to know more on DeFi space, visit at www.difipulse.com , www.defiprime.com

Resources:

Image Source:

www.shutterstock.com (Royalty Free Images)

Banking has transformed, offering innovative solutions to meet the needs of modern customers. The rise of digital banking platforms allows for greater convenience and accessibility, all from the comfort of your home or on the go. With financial institutions like Spero Financial leading the way, customers experience top-tier services that prioritize user experience. Whether it's managing accounts or securing loans, the spero financial customer service team is available to assist with any concerns. For more details on their customer support, visit https://www.pissedconsumer.com/company/spero-financial/customer-service.html.