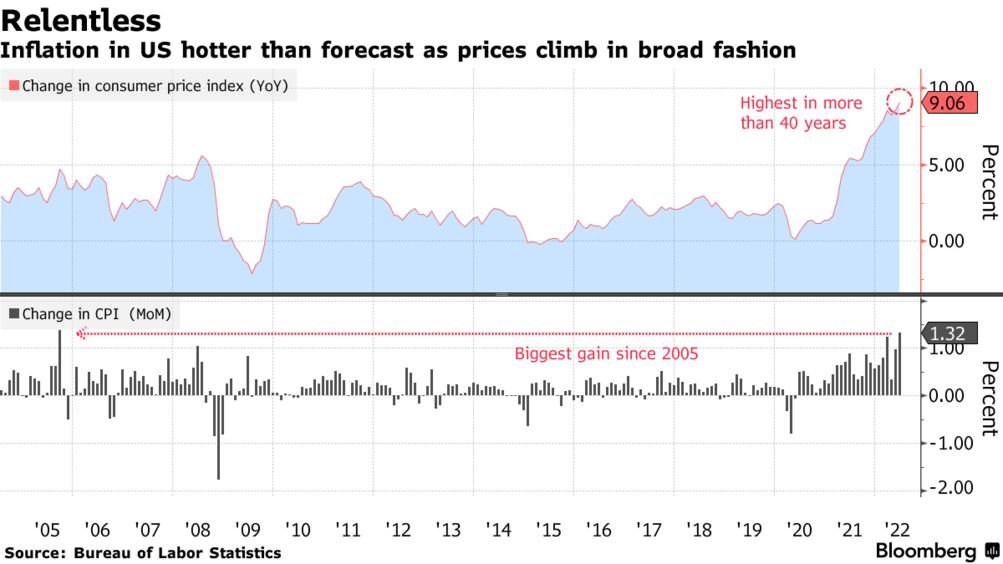

June US Inflation Highest Since 1981

The US Consumer Price Index (CPI) rose 9.1% from a year ago (and up 1.3% from May), the highest level in over 40 years in a report released today by the US Bureau of Labor Statistics. Prices are rising driven by gas, food and rent increasing squeezing Americans paychecks even further and pressuring the Federal Reserve (FED) to try to counteract the inflation. The rise was faster than expected, never a good sign for investments including stocks and high-risk categories like cryptocurrencies. Stocks and crypto, as one might expect, both fell quickly but investors saw a buying opportunity and put an end to the carnage with Bitcoin (BTC) falling to near $19,000.

Yields on US bonds rose to 3.1% which is a sign that investors expect the FED to raise rates even more aggressively. That being said, the government agency that determines interest rates is caught between a rock and a hard place as it feels the pressure to raise rates to offset inflation but also has to keep an eye on the overall economy which looks as if a recession is looming and higher rates will only push the economy into more woes.

So what is the FED to do? Well this writer, for one, would suggest limiting the amount they want to raise rates keeping an eye on both opposing forces. Since there is a lag on the CPI numbers, those living in the US have seen a drop in gas prices recently which have a major impact on everything that needs shipping. This should mean an easing of the inflation rate for July which would be a welcomed relief and a possible signal that inflation peaked in June.

Indeed, the yield on the ten-year treasury bills dropped slightly which is an indication that investors expect interest rates to drop over the long-term. This is likely caused by the expectation that inflation has peaked and the FED will now have to turn some of their attention to an impending recession.

The US government is also likely to try to pass new legislation over the next few months that will help strengthen the supply chain, especially in the technology section focused on semiconductors which are a key component to so many products sold in the country today. An improved supply chain will also help reduce price pressures on everything from electronics to automobiles.

The US is not suffering along as the International Monetary Fund (IMF) is recognizing similar issues throughout the globe with many countries including Germany, France, Spain and others also seeing near record level inflation. The continuation of the war in Ukraine is further exacerbating the global supply chain issues and putting a damper on the worldwide economy still trying to emerge from the Covid-19 pandemic. The European Central Bank is looking to increase interest rates itself, something it hasn't done in more than a decade. The Euro is now trading one-for-one with the US Dollar and the ECB only has so much time to increase rates before a recession on the continent limits it's abilities to combat inflation.

Digging into the report you can find detailed year-over-year price increases by every major category traced in the CPI:

All items 9.1%

Food 10.4%

Food at home 12.2%

Cereals and bakery products 13.8%

Meats, poultry, fish, and eggs 11.7%

Dairy and related products 13.5%

Fruits and vegetables 8.1%

Nonalcoholic beverages and beverage materials 11.9%

Other food at home 14.4%

Food away from home 7.7%

Full service meals and snacks 8.9%

Limited service meals and snacks 7.4%

Energy 41.6%

Energy commodities 60.6%

Fuel oil 98.5%

Gasoline (all types) 59.9%

Energy services 19.4%

Electricity 13.7%

Natural gas (piped) 38.4%

All items less food and energy 5.9%

Commodities less food and energy commodities 7.2%

Apparel 5.2%

New vehicles 11.4%

Used cars and trucks 7.1%

Medical care commodities 3.2%

Alcoholic beverages 4.0%

Tobacco and smoking products 7.9%

Services less energy services 5.5%

Shelter 5.6%

Rent of primary residence 5.8%

Owners' equivalent rent of residences 5.5%

Medical care services 4.8%

Physicians' services 1.0%

Hospital services 3.9%

Transportation services 8.8%

Motor vehicle maintenance and repair 7.9%

Motor vehicle insurance 6.0%

Airline fare 34.1%

As you can see the energy categories soared which in part drive most other areas of the economy. Hopefully a decline here in the month of July will change the inflation rate for the better moving forward.