Is Crypto just one big Ponzi Scheme?

People who know little about crypto see it as "fake" and often describe it as some sort of "ponzi scheme". What if they are right? There is no doubt that some of the DeFi projects are built as ponzi's, just as I pointed out in my last article - Anatomy of a DeFi Ponzi Scheme. But what about crypto as a whole, is it all just one big ponzi scheme?

Earlier this week, Sam Bankman-Fried, founder of the massive exchange FTX, described yield farming as a ponzi scheme. Bankman-Fried said on a recent Bloomberg’s Odd Lots podcast. “Maybe for now actually ignore what it does or pretend it does literally nothing, pour another $300 million in the box and you get a psych and then it goes to infinity, then everyone makes money.”

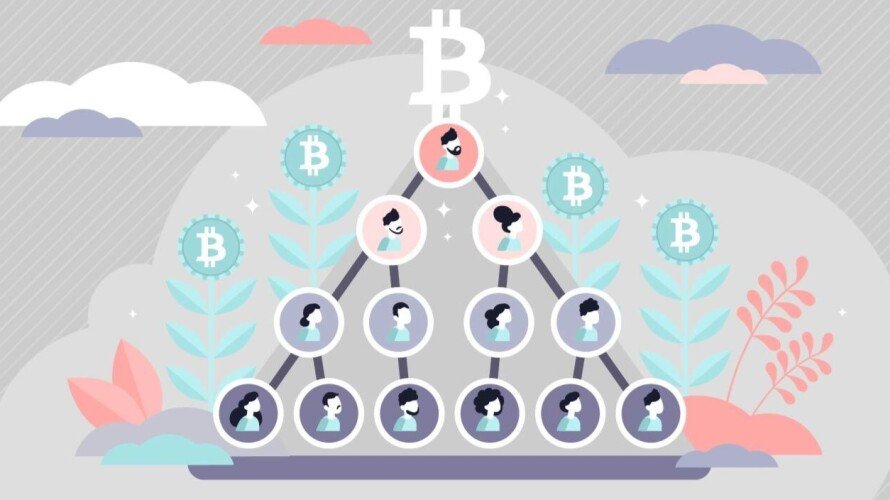

What is a ponzi scheme? A ponzi scheme is an investment that pays existing investors with funds collected from new investors. It was named after Charles Ponzi who committed fraud in the early 1920's when he promised investors a 50% return within a few months. Ponzi used capital from new investors to payout earlier investors, but today we know these schemes fail if not enough new investors are coming in to pay off those expecting their returns leading to an eventual collapse. Typically these fraudulent schemes offer high rates of return with little risk associated with the project, in other words the are "too good to be true".

Key elements of a ponzi scheme:

Benefit - the promise of an above average return or yield

Explanation - the believable story that explains how it all works

Credibility - the person(s) running the scheme appear credible

Pay Outs - early investors receive the payouts promised

Word Spreads - new investors join in after hearing about the success

Collapse - at some point the requested payouts exceed existing capital

Bernie Madoff ran the largest and most well known ponzi scheme in his hedge fund. He promised returns of about one percent per month and his customers believed they would be able to cash out both their initial investments and their returns whenever they wanted. Participants received statements showing the growth of their accounts and everything appeared fine until the financial collapse in 2008 when a large number of redemptions occurred at the same time and there wasn't enough money to cover the fund outflows. Estimated losses from this scheme range up to 50 billion US dollars.

The largest cryptocurrency, Bitcoin (BTC), may appear to be a ponzi from the outside. Investors buy bitcoin expecting or perhaps just hoping, that it will increase in price. Bitcoin has little to no utility so there is no source for profits for the coin to generate. Price increases come from new investors coming in and buying bitcoin driving up the price. That is starting to sound like a ponzi, however, bitcoin doesn't promise any sort of yield off the coin so investors know they can lose money if the price declines.

There are, of course, other factors in which bitcoin differs from a ponzi scheme. The point here is that it is easy to to take many things and compare them to ponzi schemes using the basics. Think about the stock market, if new money stops coming in the prices will fall while many of those holding stocks will sell to limit their losses. The entire thing starts to crash and almost any form of investment has this potential economically. Is every investment therefore a ponzi, of course not. And don't get me started on the social security system set up in the United States, that program certainly checks off a lot of the ponzi boxes.

So back to the original question - Is Crypto just one big Ponzi Scheme?

No. It is a lazy analysis by those who don't understand the industry. It is a complicated world, no doubt, and this is why the lazy opinions come out and throw out words like ponzi to dismiss something they fail to understand.

That stated, bad actors do exist in crypto just like everywhere else. There are also a number of protocols built on ponzinomics but these do not paint the picture for the entire industry.

You can spot ponzi scheme's given the many red flags often associated with them. Look for grandiose promises with little to no downside risk. Returns are typically steady without any correlation to down markets. The strategies behind these schemes are often very complicated and communicated poorly. In addition, investment documentation is often poor and removing funds is very difficult.

While I don't believe crypto is a ponzi scheme and this is certainly not financial advice, perhaps I am wrong. If so, the good news here is that you are very early in on crypto so you should benefit on behalf of all the suckers who get in late!!!

Nicely written! A Ponzi scheme always promises high returns with NO risk, but crypto is volatile due to market conditions, regulation challenges, and other market factors, giving investors an opportunity to earn high returns WITH high risk!