CPI Figures, Fed Rate Hikes and Your Crypto Portfolio

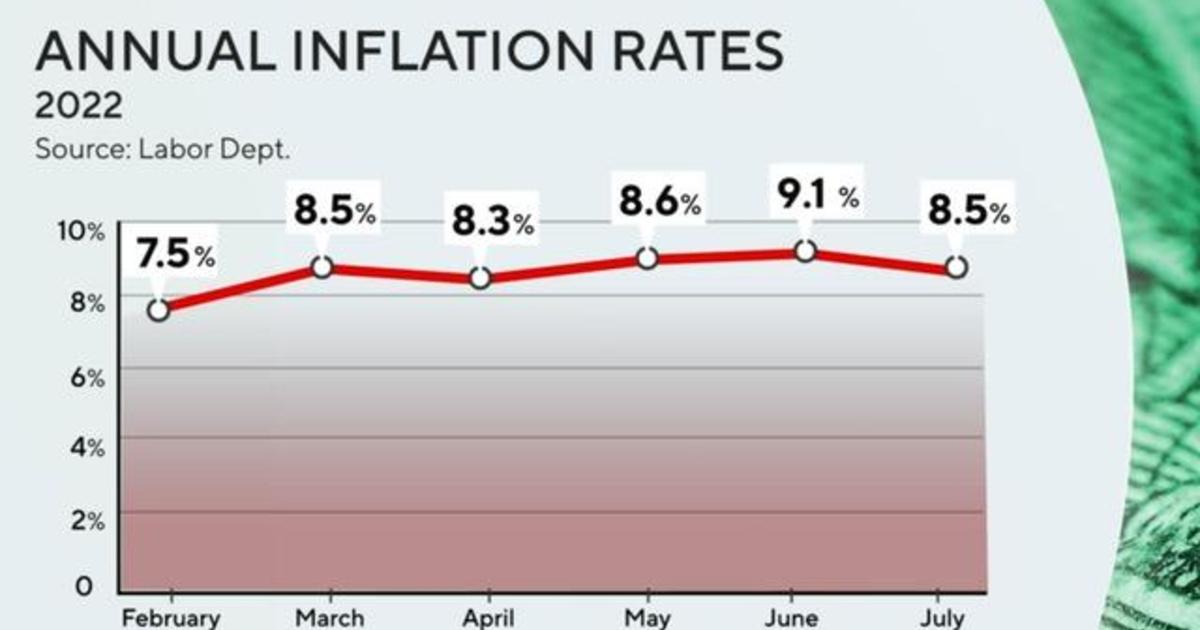

Finally, good news on the inflation front. Today's CPI Report showed inflation was flat month-over-month from June to July after rising for a number of months this year. Inflation in the US did rise 8.5% in July as compared to a year ago, however, this was below analyst expectations that were primarily coming in around 8.7% when averaging all the analyst estimates.

The majority of the decline came from a drop in energy prices which can be seen at the gas pump in the US. In fact, if you take out energy prices actually rose 0.4% for the month which equates to a 4.9% annual increase. Food prices, which are a significant portion of most American's expenses, rose 1.1% in July. Shelter, another major expense, rose at a 0.5% clip. Overall the news is good as it may signal that inflation peaked in June and is now on the decline.

What does this mean for interest rate hikes?

The Federal Reserves next meeting will take place on September 21 and that is when they will announce the next set of interest rate hikes. The Fed has maintained a "hawkish" stand looking to rise interest rates to help curb inflation, the lowering of the CPI (consumer price index) is generally seen as a good sign the agency will look further than just the overall numbers.

The Fed recognizes that energy prices tend to be very volatile, even month-over-month, a will most likely remove them when they look at inflation numbers. Energy prices do tend to impact almost every aspect of the economy, so reductions there cannot be overstated but the Fed is still likely to see another increase in July.

Given that the Fed won't meet until the third week of September, they will likely weigh August numbers higher as they will be more current and further demonstrate any trends in the index. Just going on current data, I would expect the Fed to raise interest rates by 50 basis points as opposed to 75 that I would have guessed before the latest numbers were released. That said, I would hold off any expectations until we have August CPI data and further jobs reports to digest.

What does this mean for your crypto portfolio?

Analyst expectations for an 8.7% increase were already factored into the market so given the numbers beat those expectations a quick rally was to be follow. Bitcoin (BTC) gained 2% while the higher flying Ethereum (ETH) gained 7% shortly after the CPI Report announcements. The news helped lift stocks to which cryptocurrencies are heavily correlated to.

In the short run, it was decent news and given a rally thanks in large part to a movement back to risk assets we could see a continued move upwards, albeit at a cautious pace given the murky picture surrounding the economy.

In the longer run, the real question is if the crypto market has already hit its bottom and that is a question nobody can answer for certain. We could be in the midst of an extended relief rally but with more lows to come as the US tries to pull out of a recession. Yes, I realize that many in the government are not calling it a recession, but for this old business graduate who happens to also have his MBA the definition for a recession was pretty straight forward back when I was in school - a fall in GDP for two consecutive quarters. Funny how the government keeps changing the definition of things like inflation and recessions. Well, not really...

The upcoming Ethereum merge has put positive momentum into the crypto world after a couple of quarter of relatively bad news on almost all fronts. Given the current momentum, it is when crypto prices move upwards despite bad news that should excite you and we have seen a little evidence of that as of late but more is needed to truly signal a market bottom.

Conclusion

Take todays CPI numbers in stride but also be thankful that they came in better than expected. It is always nice to see crypto prices going up, unless you happen to be buying that day.

What continues to trouble me is that cryptocurrencies should be more of a global digital monetary and technology play rather than being so US centric. The fact that crypto prices move in lockstep with US stock prices and opposite of US dollar movement that is troublesome. This is especially true for those of us in the US seeking greater diversification from our current assets and economy. Given stocks dependence on US economic news, cryptocurrencies are dependent on this news also and that is a shame.