Bitcoin Weekly (7/24/2023)

Bitcoin Weekly - Edition 69

Bitcoin (BTC) spent last week like it was just waiting for this week to happen. The largest cryptocurrency had a bit of a red candle as it prepared for the Federal Reserve Meeting to take place which just might knock Bitcoin out of the narrow trading range it has been stuck in for about a month with $30K flipping from support to resistance marks and back. It all has been a bit maddening for those who like some volatility in the markets but they could be in for a treat as we all search for some direction in the markets.

As the new week kicked off, Bitcoin fell below $20,500 to its lowest level since June 21 and looked to begin testing support closer to the $29K range.

The Federal Open Market Committee (FOMC) is scheduled to convene on Wednesday, aiming to determine how much they will increase benchmark interest rates. Expectations call for a quarter-basis-point rate hike with CME Group’s FedWatch Tool putting that figure at 99.8% chance of happening. With that much certainty, it is hard to see how much volatility will actually be injected into the markets since it is already factored into asset pricing. While the Fed did actually pause rates in their last meeting, the ten previous meetings told a different story with rate increases accompanying them each time and I expect that trend to resume this week like just about everyone else.

While the Fed's decision is the biggest looming piece of macroeconomic news slated to be released this week, it certainly won't be the only anticipated bit of data to chew on. We have a fifth of the S&P companies reporting earnings this week along with new economic data points being released after the Fed meeting including the Personal Consumption Expenditures (PCE) Index print and the second quarter Gross Domestic Product (GDP) figures in the United States. Other economic data that will be scrutinized include the consumer confidence data that will be released tomorrow and new home sales information on Wednesday. All in all, it is going to be a very busy week ahead so strap in and get ready for an interesting ride.

As for Bitcoin itself, we are now about nine months away from the next halving event and have a lot of BTC seemingly out of the supply chain. Looking on-chain with the help of Glassnode, well over half of the total supply hasn't been touched in over two years and almost 30% has been dormant for at least five years. That is a lot of supply sitting on the sidelines that should send Bitcoin surging when demand picks up.

Speaking of demand, we can expect things to tick up once those Bitcoin spot ETF funds start getting approved. Six companies have already had their applications approved for review by the Securities and Exchange Commission (SEC); BlackRock, Fidelity, Invesco, Bitwise, WisdomTree, and VanEck. Spot ETF funds would directly track the price of BTC without investors having to hold the coins directly. It should be noted that when the Bitcoin futures ETF was first approved in October 2021, the price of BTC soon after hit its all-time high.

With everything going on this week, it really is still all about the Federal Reserve. It isn't so much about the rate hike, that is pretty much a given. What would really be a positive jolt to the markets would be some positive comments made by Fed members after the meeting. It would be nice for them to finally acknowledge that inflation does appear to be much more under control now sitting at a manageable 3% versus over 9% this time last year based on June's figures. While I don't expect the Fed to be done with rates, I think we are close to the end. As such, a dream scenario would be for Fed officials to announce that they plan to halt future hikes after the next meeting.

We can all hope for this outcome anyway...

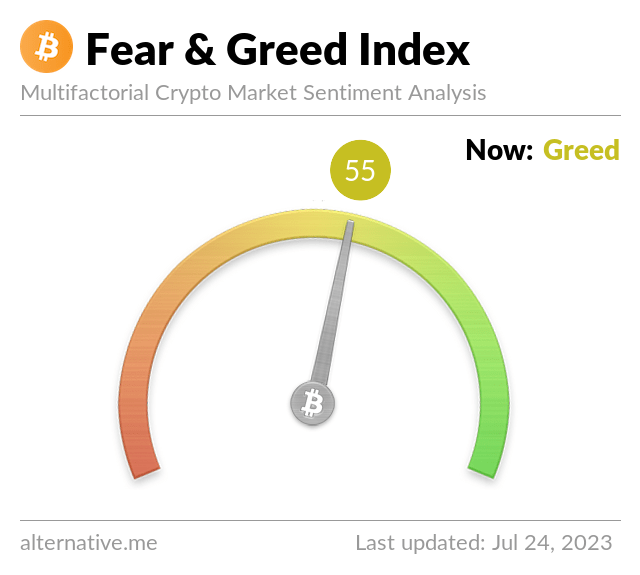

The Crypto Fear and Greed index highlighted below is 55, up a single point from where it stood last week and remaining in the "Greed" range.

Ten Must-Read Bitcoin Articles This Week

How Miners Are Preparing for the Next Bitcoin Halving (CoinDesk)

Bitcoin: Will short-term holders succumb to sell pressure soon (AMBCrypto)

'Struggling for clarity' in the spot bitcoin ETF pursuit (CNBC)

How Bitcoin Adoption Is Growing Against Weak Currencies (Bitcoin Magazine)

Bitcoin volatility dips to yearly lows as FOMC meeting looms (Blockworks)

Bitcoin Long-Term Holders Control 75% of Circulating Supply: Glassnode (CoinDesk)

Sleeping Bitcoin wallet stirs after 11 years, moving over $30M (Cointelegraph)

US SEC accepts six spot bitcoin ETF proposals for review (Reuters)

How Texas Became a Global Mecca for Bitcoin Mining (CoinDesk)

Bitcoin Price Statistics (as of 7/23/2023, weekly close)

Bitcoin Price = $30,085

Last Week = $30,235

Weekly High = $30,360

Weekly Low = $29,708

Market Cap = $565,251,627,985

Market Cap Dominance =46.627%

Trading Volume = $15,079,014,278

All-Time High = $69,044.67 on November 10, 2021

statistics provided by CoinGeckoBitcoin Fun Fact of the Week

Bitcoin operates on a foundation of public-key cryptography, wherein users possess a publicly accessible key viewable by all and a confidential key exclusive to their computing devices.

Bitcoin Mining Statistics

Miners = 5,321,099

Hashrate = 403.15 EH/s

Difficulty = 53.91T

Emission (24hr) = 843.8 BTC

Circulating Supply = 19.43M (92.6%)

statistics provided by MiningPoolStats

Crypto Fear & Greed Index

index provided by AlternativeWhat is Bitcoin?

Bitcoin (BTC) is a decentralized digital cryptocurrency. Bitcoin was invented by the person or persons under the pseudonym Satoshi Nakamoto as described in the Bitcoin Whitepaper released on October 31, 2008. The original cryptocurrency began trading in January of 2009 and could be transferred in a peer-to-peer fashion implemented using open-source software. The transactions are recorded and stored on a public ledger called a blockchain. Only 21 million Bitcoins will ever be minted with one million being owned by its creator(s).

For more on Bitcoin, please read What is Bitcoin? [A comprehensive Guide to Understanding Bitcoin] on Publish0x written by Mr.CryptoWiki

For information on the Bitcoin white paper, please read I Finally Read the Bitcoin Whitepaper on Publish0x written by CryptoMasterMiner

Find Bitcoin on Bitcoin.org, Reddit, Twitter, Instagram, Facebook

* Where to Buy and HODL Bitcoin (Referral Links) *

Coinbase (Get $10 in Bitcoin)

Crypto.com (Get $25 to sign up)

KuCoin (Lend out your Bitcoin)

* My Crypto Work *

Yield Farming - My Book on Amazon (paperback and eBook)

* Earn Free Crypto *

Publish0x - earn crypto for reading and writing articles

Presearch - earn crypto for searching on the internet

Torum - earn crypto on social media site with a crypto focus

Zirkles - stories that pay in crypto like Publish0x

PipeFlair - Faucet to earn MATIC and other cryptos

Fountain - earn BTC listening to Podcasts

Thank you for reading Bitcoin Weekly!

Resources

It was a very useful article. Good luck to you