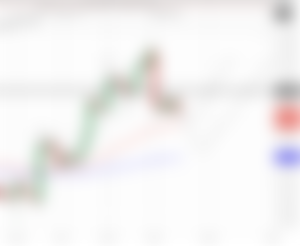

Ethereum fell on Monday, dropping to about the $1,650 level before bouncing but ultimately closing down about $100 on the day. This is a bearish hammer candle and one that may be an early indication of a bit of exhaustion around these levels with the bulls buying the dips but less so as the sellers take a bit more control. While ETH still finished the trading session higher than all but one of the most recent daily closes, we have to be weary of potential local tops that may lead to sustained corrections which are to be expected throughout different stages of a bull market.

(February 15, 2021 8:30 PM EST)

Outlook:

ETH had a bit of a pullback today that could likely be a corrective wave on a smaller scale, of which we currently do not measure because we focus on the longer game (short-term capital gains suck). That being said, I think today's dip was just that; a short-term pullback and a good opportunity to add to longs if so desired. As you can see in the chart above, ETH is in a very clearly defined uptrend and ascending triangle/wedge that is not only pointing to higher prices but is usually resolved with a decisively bullish breakout higher. We could see that as early as this week or later in February, but when it does come it could and probably will pierce through the $2,000 level and send ETH to $2,500 or even $3,000. ETH is now trailing behind BTC in the ETH/BTC chart quite a bit now compared to a few weeks ago when ETH put in its highest level around 0.046 but has since retraced more than half of that move. When ETH resumes its uptrend against BTC, we should see a corresponding appreciation in ETH's price which actually points to higher price targets than were previously forecast due to Bitcoin's rally to just under $50K.

The daily churning of bullish news and developments in the crypto space continues as ETH continues to evolve In the background amongst all the news flow noise. Today the ETH 2.0 deposit contract tops $5.5 billion staked in Ether. ETH and WETH are now settling more value than Bitcoin, including over $8 billion in Bitcoin itself. It’s also reported that Grayscale purchased over 50,000 ETH in the last 24 hours as institutional and individual investor demand continues to explode, adding to the supply shortage of Ether that has been known for a few weeks now. There continues to be a lot of concern around ETH network fees due to record usage of transactions, however, it is widely known that the ETH 2.0 network upgrade is specifically designed to address this and enable a generational scalability solution making the Internet of money transactions exponentially cheaper than they are today, and we are expecting the next phase of ETH 2.0 to roll out by end of year 2021.

As you can see in the ETH/BTC chart below, ETH has pierced the rising trendline I had drawn, effectively breaking the short-term trendline or otherwise decreasing the sharpness of its slope. That being said, that doesn't mean that ETH/BTC's uptrend is invalidated; rather, it could mean that Bitcoin's about to reassert its dominance in the overall crypto market pointing to a Bitcoin rally ahead, in which case the ETH/BTC ratio would likely suffer, at least earlier in the crypto bull market cycle. It could also mean that ETH/BTC might find support and a higher low at one of the important and dynamic moving averages such as the 50 Day EMA below around 0.0355. Finding support there would absolutely validate the sustainability of the uptrend, so that'll be a key area to watch.

Current Strategy:

HODL, buy the dips and earn ETH while we enjoy the ride. There's not much to do now other than sit back and let your investments grow. Otherwise, DCA on a weekly/biweekly basis, whatever you can afford if you so desire.

Support:

$1,500 - $1,400 (likely), then $1,200 (less likely), then $1,000 (concrete floor).

Resistance:

Immediate-term $2,000, then $2,500, then $3,000.

Please support the channel by "Tipping" this post below, or using either of these referral links below.