From Miami to New York: The competition for Bitcoin adoption & business is blowing up

In my last article, I wrote about how Miami is leading the race for Bitcoin acceptance and adoption. Now, New York seems to plan seriously to re-join that race and take a share of the pie from Miami.

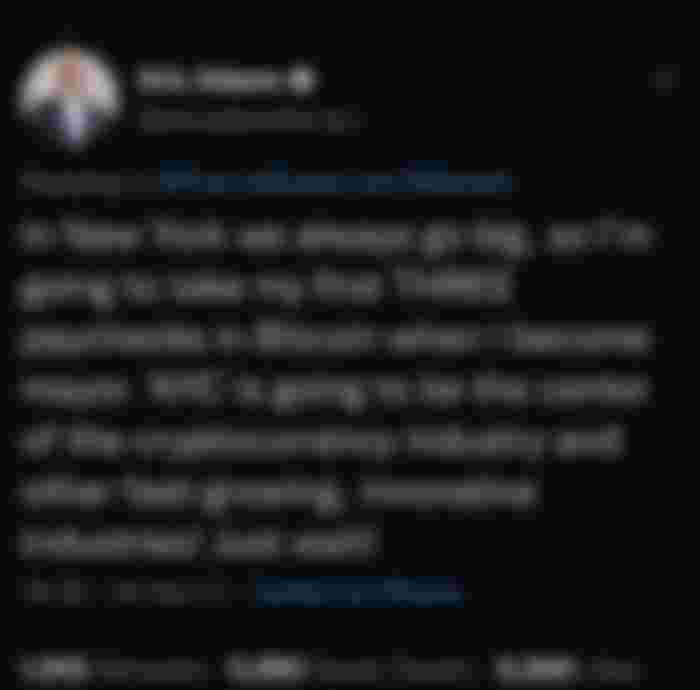

New York Mayor elect Eric Adams posted on Twitter that he will also take his salary in Bitcoin like Miami Mayor Francis Suarez had done a couple of days earlier. In a show of the brewing competition for a slice of the Bitcoin/Crypto pie he claimed that he will take not one (!), but three. Since the "Big Apple" is the most thriving economic hub in the US he also claimed that would try to lure crypto-businesses and industry back to city.

The race to lure the best of the crypto industry between Miami and New York is not that new. A prime example to this race is Blockchain.com that moved its offices from New York to Miami, citing the latter as offering better opportunities for tech investments and innovation.

Moreover, New York will follow into Miami's footstep by launching its own City Coin. The idea is to create a New York City coin after the success of MiamiCoin. CityCoins is a grass-root initiative that releases Crypto coins about respective cities based on the Stacks Protocol of Bitcoin. My estimation is that CityCoins projects will become even more popular in the future as more cities release their coin. People will purchase these tokens either an investment opportunity or to show support / allegiance to their cities.

It looks like the race between cities and mayors in the US will only intensify on who will position themselves better in attracting more investments and making their environments more crypto friendly. Think of it as the internet during the late 90s. Now cities, banks, and investors are looking to get the pole position in a new financial and technological paradigm led by Bitcoin that will shape the next decades.

Bitcoin Core adoption is logical, as it is the most well known token in the crypto-verse. What I find problematic though is a Bitcoin monopoly in these cases as there shouldn't be just one token being accepted by cities, institutions, banks, and businesses. This would give Bitcoin an unfair advantage to other tokens. In the sense of liberty and financial freedom, people should have the right to chose if they want to pay or get paid in crypto, and in which one from a list of accepted cryptocurrencies that have a solid reputation.

In the end of the day, why would someone chose to spend Bitcoin for paying for their daily groceries when it can be done faster, cheaper, and easier with Bitcoin Cash? Even the "Store of Value" and Digital Gold narrative clash with the idea of every-day use because you do not use Gold to pay for your morning coffee but you use Cash instead ;)

I am following both these guys on Twitter (Suarez and Adams). I like their positive attitude toward cryptocurrency adoption. I sure hope their predictions about digital currency are right!