There are several ways to analisys a crypto for a trade not the project itself, but right now we're going to do the Mayer Multiple methodology.

What is a Mayer Multiple?

This methodology was first created by Trace Mayer as a way to analyse the price of Bitcoin in a historical context.

"The Mayer Multiple is the multiple of the current Bitcoin price over the 200-days moving average."

It is not an indicator that you should buy,sell or hold, it's just another way to complement your analisys and create more theorical basis to your decision.

Why is 2.4 the best indicator?

"Simulations performed by Trace Mayer determined that in the past, the best long-term results were achieved by accumulating Bitcoin whenever the Mayer Multiple was below 2.4. "

So whenever in the past 200 days the indiciator shows us this indicator below 2.4 it has a nice opportunity to buy, however as said before you must compare with other indicators to make a better decision.

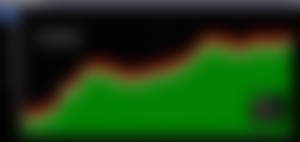

Now let's take a nice look at the current scenario.

So as you can you see whenever it reached above 2.4 (mark as read in graphic) it suffered a major correction in its price, so now we reach this mark again. Does it mean that it will undergo another one? There's no straight answer to this, however historically points to yes. But before suffering this correction it might go even higheras it shows on 2012, 2013 and 2014 for instance. The tendency is that it suffers a major correction in the following 4 weeks or today, and afterwards it might rise again!

Another way to see those graphics is through Mayer Multiple price bands

As you can see we're in the bullish extension and going to the overbought region, so if you're going to trade please be careful, don't leverage.

Sources:

https://digitalik.net/btc/mayer_bands