Technical Analysis

Technical analysis is the study of statistical patterns derived from historical price and volume data in order to spot trading opportunities. Technical analysts use market movement patterns, trading signals, and other analytical methods to assess an asset's strength and weakness.

Any security with historical trading data, such as cryptocurrencies, forex, commodities, and stocks, will benefit from technical analysis.

What makes Technical Analysis so effective?

A price and volume map depicts all of the market participants' previous decisions (buying and selling). This knowledge would have two effects on potential participant decisions:

Psychological: Your past actions have an impact on how you handle future circumstances. Many traders, for example, concentrate on the price at which they purchased an asset, and if that price falls, they want to sell when it hits break-even.

Reflexive: Some traders recognize common trends and chart patterns and act on them (buying or selling). If a large enough number of people follow the same approach, these chart trends are expected to follow the expected result, and the trend will most likely be continued as more people join the trend.

Types of Trends

An asset is in an uptrend when it is making higher highs and lower lows.

Downtrend: When an asset is in a downtrend, it makes lower highs and lower lows.

Sideways trend: When an asset trades in a horizontal channel, it is said to be in a sideways trend.

Traders will also use the words "Bearish" and "Bullish" to describe a pattern. Bullish refers to the bull striking upwards with its head, causing prices to rise, and bearish refers to the bear striking downward with its paws, causing prices to fall.

Resistance and Supports

Since price movements are not linear, the price will encounter opposition as it rises and help as it falls.

Resistance: A stage at which an uptrend is likely to pause or restart, indicating a seller's focus.

Support: A stage where a downtrend is likely to pause or recover as a result of a concentration of buyers.

When a resistance level is broken, it also turns into a support level, and vice versa.

Help is frequently used as an entry point and resistance is frequently used as an exit point in technical research. The price will go through support/resistance without stopping in the case of strong patterns.

Advanced Technical Analysis Tools

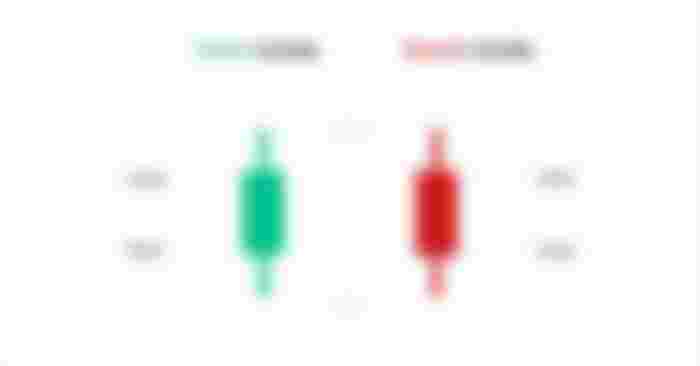

OHLC Charts

Candlesticks are the bars that appear on these graphs. The relationship between the day's high, low, opening, and closing prices determines the shape of a candlestick.

The close of a bullish candle (which can be green or white) is higher than the opening.

The close is below the opening on a bearish candle (which can be red or black).

Candlestick charting is based on a rice price monitoring technique developed in Japan in the 1700s, but it can be used to trade any liquid financial asset. Candlesticks may be studied on their own (simple patterns), but they are most often used in groups (Complex patterns). Candlestick charting is used to assess the current market trend.

Simple Moving Average

The stock's closing price averaged over a given number of periods.

Bollinger Bands

Bollinger Bands display a graphical band (the envelope) in the center with a simple moving average. The variance is expressed by the width of the envelope.

The rate at which the price of an asset will rise or fall is referred to as volatility. Higher volatility indicates that the asset's value will fluctuate rapidly over a wider range of values.

MACD

Convergence of Moving Averages Divergence (or MACD) is a trend-following measure that combines two moving averages:

A moving average that is only used for a limited period of time.

A moving average that has been calculated over a long period of time.

These two moving averages are combined to determine the current trend and whether or not there has been a shift in momentum.

Thanks for sharing your views, my views are quite different on these.