Reviewing DeFi Yield: YFO's Yield Farming Optimizer and assessment of investment opportunities

Hello, Crypto Enthusiasts!

Hope you’ll enjoy reading the article I’ve written recently.

Bookmark our site, where you can always find the freshest DeFi rankings and reviews. Subscribe to our YouTube channel to watch useful tutorials and cool interviews.

Develop your DeFi project with the highly experienced Platinum Software Development Company!

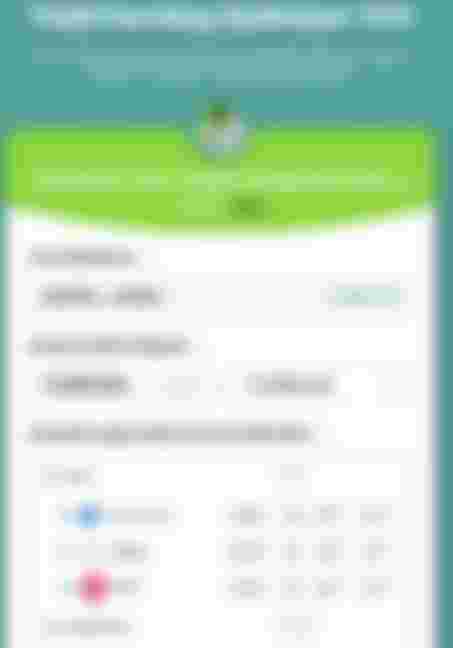

DeFi Yield is a DeFi aggregator platform that allows users to check the APY of more than 100 DeFi pools and over 20 DeFi platforms/protocols.

DeFi Yield also has a number of educational articles on DeFi and yield farming, as well as useful tools - impermament loss calculator, ETH gas tracker and Uniswap charts - which can make the life of a yield farmer easier.

DeFi Yield has developed a tool for assessing investment opportunities, calculating volatile losses in different scenarios. This is to help users decide whether to contribute to liquidity pools or simply hold their assets, anticipate possible opportunity costs, estimate the profit / loss (in US dollars or as a percentage) when staking into liquidity pools, assess the factors affecting their assets when using liquidity pools in Balancer, Uniswap, Curve and other platforms.

What is YFO?

YFO is a set of smart contracts that organize the intelligent routing of crypto assets to maximize the return that the market has to offer. Users send LP tokens to a smart contract and select individual preferences for using its capabilities. YFO tracks the pools with the highest APY and automatically moves funds to that product.

With YFO's Yield Farming Optimizer (currently undergoing beta-testing) users will be able to dynamically rebalance funds by continuously selling underlying crypto assets locally and maximizing on the yield available from yield-farming pools.

Initially designed to support Vaults on Yearn deposits, betting on Sushi, YAM, YFV, Based and others, it offers a generalized approach to plugging new yield farming protocols.

Also, the DeFi Yield team conducts their own research on different DeFi projects and protocols using different metrics such as: minting function, migration function, smart-contract owner, team reward, possible token locks, suspicious functions and scam probability, which produces a final verdict on the project.

Thank you for reading this article!

The article is written by Kristina Ivanova and Mr. Anton Dziatkovskiy, the co-founder and CEO of Platinum Software Development Company.

Go to QDEFIRATING.com to learn all about the best DeFi projects and keep up with the latest news from the crypto sphere.

Welcome to our YouTube channel, where you can watch numerous tutorials and interviews with crypto industry leaders.