We hear a lot about the supply chain issues. There is no doubt that the economy was nuked in early 2020 due to the lockdowns from COVID. At the same time, the supply chains were completely disrupted as companies, globally, shut down operations. In short, nothing was moving very fast.

With people locked up at home, they decided to do a bit of shopping. This could be done online and people had money. Since services were closed off, people were able to concentrate their purchases to IT and durable goods. These sectors did very well and the products that were available were quickly scoffed up.

This created a problem. When retailers when to refill the orders, they were told to just wait. Delivery times exploded as items were very slow to be replaced. Even after economies started to open up, the process was very slow.

Here we sit 18 months later and the global supply chains are still disrupted. Or are they?

Perhaps what the financial media and the talking heads on television are telling us is not quite accurate.

Shipping

It is best to find out about the movement of products by looking at shipping. After all, most of what is produced and delivered globally happens on the open seas. Thus, monitoring what is going on there is vital.

For this, we turn to the Baltic Dry Index. This is consider the benchmark as to what is taking place within the shipping realm. We are getting some rather interesting data coming from there.

Before going into the chart, here is what Wikipedia said about the BDI:

The Baltic Dry Index (BDI) is issued daily by the London-based Baltic Exchange. The BDI is a composite of the Capesize, Panamax and Supramax Timecharter Averages. It is reported around the world as a proxy for dry bulk shipping stocks as well as a general shipping market bellwether.

Now let us take a look at what things look like:

Going back to the start, we see how the chart lays out. Not surprisingly, last year, prices shot up. This was often discussed as the cost of shipping skyrocketed. Companies were paying a lot more per container due to the increased demand. After all, since things were locked down, after they reopened, customers wanted products. Whatever came off the factory lines was immediately shipped out. There was a shortage of everything.

This continues to this day. We are told how there is still demand out there and the consumer is strong. However, the BDI is issuing a warning on this idea.

Here is a close up of the last year. Notice how things turned of late.

We saw a 48% drop in the index over the last month. It has registered 11 straight down days.

Does this make any sense? If there is a major supply chain shortage of containers along with consumers screaming for product, why are the shipping rates suddenly plummeting?

Supply and demand says that if the later is strong, prices will be increasing, not decreasing.

Yet they are falling off a cliff.

How can that be?

Demand Not As Strong As Made Out

The answer to this is that demand is not what people are claiming. In fact, one of the main indicators of consumer expectations is coming in rather poor.

We are seeing the numbers drifting down each month in the University of Michigan Consumer Sentiment Survey. This is not a heathy sign for the economy.

Here is the summary of the latest results:

As we can see, both the Month-over-Month (MoM) and Year-over-Year (YoY) are both reading negative. What we are seeing is the consumers are not buying into this idea that things are so great. For an economy like the United States, which is made up of 70% consumption, that is going to have a massive impact.

This could be leading to the sudden drop in the cost of shipping. If people are starting to turn away from purchasing, then the entire system pulls a reversal from last year. Instead of the suppliers cutting off the shipping, it is the demand side that freezes it.

Of course, considering the decline in China's GDP from the second to third quarter, this also lines up. When the world's largest exporter has a major decline, it is time to start asking questions.

There is no way with data like this that we can conclude anything is going well. There are major issues forming, something that the media is omitting from their narrative.

In fact, in some categories it is to a level we have not seen in 40 years.

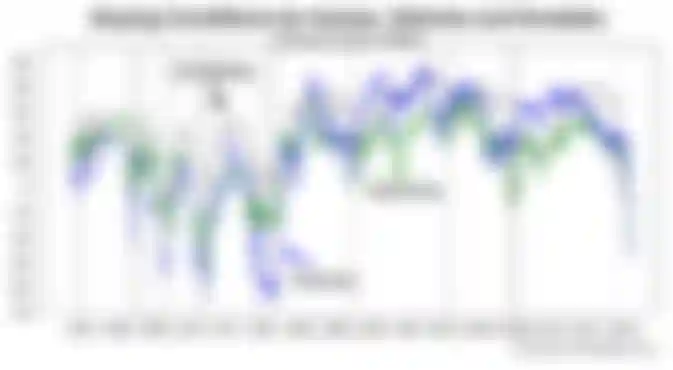

This is the sentiment results for durable goods, vehicles, and real estate. Notice how it is much worse than either the Great Recession or the aftermath of the DotCom bubble.

Sorry but there is no way to conclude that people are going to be rushing out and spending a lot of money in this areas. This is something that is hard to overcome.

It looks like there is a major demand issue starting to line up. We can expect this to hit the numbers for companies going forward. This does not bode well for the economy.

I believe demand is waning because people who made purchases are waiting as myriad ships sit at ports unloaded due to the flu hoax. This is being deliberately done. That's my opinion. Why demand more when you can't receive what you already bought?