I've been trading cryptocurrencies a quite sometime now and it should be normal for every new traders to lose a small amount, but if you are losing so much money in trading because you don't have a proper and enough knowledge, you should stop it now and do more research.

Binance Exchange is one of the most famous crypto exchanges at this time and has some unique features with lower trading fees compared to other exchanging platforms.

Binance has lots of trading accounts inside the platform and the most used, famous yet the most risky to trade is in the Binance Futures Trading Account.

Futures Trading is like the Stock option trading where you will bet or guess a price of cryptocurrency if it will either go up or it will go down.

Trading in Futures account can give traders a lot of excitement because there is a big possibility that you can gain a very huge amount of money in just a short time, but can also put traders in a very risky situation of losing their money in just a short time too.

But if you want to minimize the risk in losing money in Future Trading, you should learn the best way to maximize and secure your profit and at the same time minimize the possibility of losing your money by using the Trailing Stop Loss feature in your Future account.

What is Trailing Stop Loss and How Does It Work?

Trailing Stop Loss is an advance type of a stop order that you can set at a certain amount or percentage away from the current market price of the cryptocurrency you better on. If you want to be in a long position, you need to place your trailing stop loss below the market price that you have or want to enter. But if you want to make a short position, you should put the trailing stop loss above the market price.

Using the Trailing Stop Loss can protect your profit or gains simply by enabling your active trades to stay open and to continue having profit as long the price of the cryptocurrency is going the way of what you have wanted it to.

Example of Setting a Trailing Stop Loss.

Let's assume that you bought Bitcoin Cash (BCH) at a price of 400$ with a 10x leverage and you set your Trailing Stop Loss at 5%.

Now, if the price of BCH goes down to $380, which means -5% from the price of BCH that you bought it, then your stop loss will be hit and activated, so your trades will automatically close and you will have a $20 loss.

But if the price of Bitcoin Cash (BCH) will go up and reach $440, then the Trailing Stop Loss will change to $418. How?

Let's do the math:

5% is your Trailing Stop Loss percentage.

$440 is the current market price of Bitcoin Cash (BCH).

Solution:

440 * 0.05 = 22.

440 - 22 = 418.

418 is now your new Trailing Stop Loss limit.

But if Bitcoin Cash will go down again and reaches $418, it means your $418 Trailing Stop Loss will be hit and activated, and it will automatically closed your trade.

But if the price of Bitcoin Cash will continue to go pump and go higher, your Trailing Stop Loss will also increase and it will always be -5% below the current market price of Bitcoin Cash.

How to set a Trailing Stop Loss in Binance App?

Firstly, you need to have a Binance account. Then simply go to the Future tab.

Click the Limit function and go down to see the Trailing Stop function.

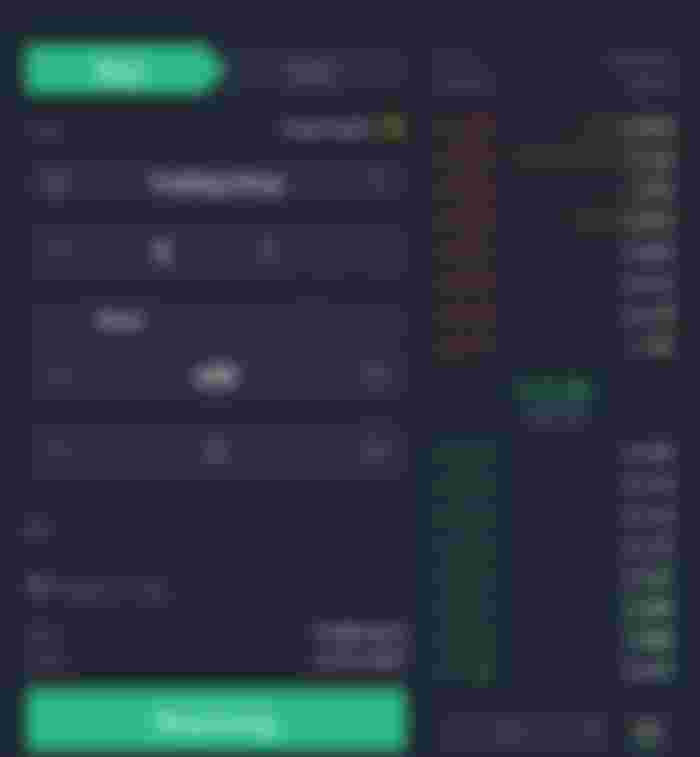

And as you can see below, 5 indicates the percentage as my Trailing Stop Loss limit, 400 is price of BCH I want to buy it and last 1 shows how much BCH I want to buy.

After setting that, you can now buy/long BCH and start your trades.

As of now, the Trailing Stop Loss feature in Binance is only applicable in the Future account. And I'm hoping that someday, we can also use it in our Spot Trading Account.

Note: Trading cryptocurrencies comes with a lot of risks. Trade with your own caution and trade only the amount you can afford to gamble.

Thanks God I found this. I've been looking for an article about trailing stop loss so I will know how to use it. Thank you!