Is the era of pumped-up exchange volumes over?

Until the end of 2017 trading volumes were playing a major role in our TA. Volumes were indicating interest in a coin by investors and it could have been a sign for a possible rally of an altcoin. Volumes were also useful for determining the interest in Bitcoin reflecting certain sentiment and determining trading attitudes.

By the end of 2017 hundreds of new exchanges appeared and all of the sudden we started watching completely unknown exchanges featuring at the top of trading volumes on coinmarketcap, with a huge difference from the established exchanges.

Coinbase, Kraken, Bitstamp, and Binance cumulative volumes were lagging behind Bitforex or Digifinex alone. Hundreds of exchanges were providing fake volumes on coinmarketcap making the whole market look like a huge joke.

By the end of 2018, it was obvious to everyone that almost every exchange was wash-trading to pump up its volumes. Traders new something going on as in certain exchange orders of 500 BTC were filled in seconds. Still, the hard facts were the volumes in 2018 which in total reached hundreds of billions of dollars on a daily basis.

Coinsquare is a Canadian exchange which after an investigation by the Ontario Securities Commission admitted wash trading more than 90% of its volumes for more than a year. The wash-trading manipulation reached volumes of 5,5Billions in total for this period. The exchange CEO Cole Diamond and President Virgile Rostand are stepping down and will be forced to pay fines of more than 1,5 million.

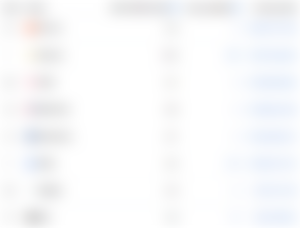

I can't imagine the fines all these random exchanges in the list below will pay if anyone ever cares to investigate them:

Besides a few exchanges that might not wash trade 90% of their daily volumes, there are quite a lot of extreme cases and new ones appear once in a while. I haven't ever heard of ZG.com, IDCM, PayBito, or EXX. They can even have 0 real trading volumes and think they can trap traders and squeeze a few thousand USD with fees. I have used Ethereflyer and their daily volumes can't be more than a couple of thousand. Also, I highly doubt that Sistemkoin has 1 billion USD in volume.

This screenshot shows the current top exchanges by volume as they are indexed on Coinmarketcap and there are hundreds more swapping between the top positions. If any of these exchanges become regulated on a country where laws work they would be shut down immediately.

These fake volumes and the manipulation they include are the main reason for serious investors not wanting to participate in these markets. Since 90% of trades are fake why would any reasonable investor trust this market and invest any funds at all?

We need to wonder why is this allowed and how has this helped? Fake volumes are obvious from miles away and just make everyone think that the whole market is a big scam. Either this is fixed or the two-year bear will be prolonged.

Header Image Source

Reposted on Uptrennd & Publish0x